I only have 4 companies in portfolio

Here is an analysis of what the companies in my portfolio have in common—the core elements of my investment strategy.

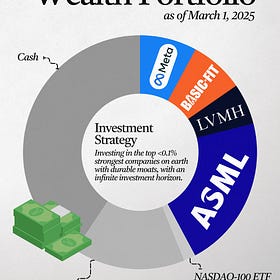

As of this moment, my portfolio consists of only four listed companies. In this article, I analyze what these companies have in common—which highlights the core elements of my investment strategy.

As of March 7, 2025, I hold the following companies in portfolio:

ASML (ticker: ASML 0.00%↑ )

LVMH (ticker: $MC.PA, however, I am invested in the holding company of the family Arnault; Christian Dior ($CDI.PA)).

Meta (ticker: META 0.00%↑ )

Basic-Fit (ticker: $BFIT.AS)

Despite that ASML, LVMH, Meta and Basic-Fit operate in very different industries, they all share several interdisciplinary commonalities that speak to broader trends in the world we live in today.

Each company is a leader in its industry or niche. ASML dominates in semiconductor equipment with its groundbreaking lithography systems—it holds a 100% monopoly with its EUV machines—while LVMH sets the standard in luxury goods with a portfolio of world-renowned brands.

Meta—as of this moment my second largest position—has reshaped digital communication through its social media platforms, and might contribute toward a future in which everyone can use AI to improve their lives. My fourth position, Basic-Fit, is a prominent player in the European fitness market.

All these 4 companies invest—and have invested—in IP; research, development, and technology. ASML pushes the boundaries of Moore’s law by precision engineering, Meta continually evolves its digital ecosystem, LVMH innovates in product design and brand storytelling, and Basic-Fit leverages technology and its brand awareness for scalable, accessible fitness solutions—fostering its European size.

In addition, all four companies operate globally or in multiple countries. Whether it’s shaping consumer tastes in luxury fashion, driving digital communication patterns, advancing semiconductor technology, or promoting a healthier lifestyle, each company influences its respective sphere on a larger scale.

Moreover, they are all integral to different facets of the world’s modern economy—high-tech manufacturing or the facilitation of creativity, digital connectivity, and health & wellness. Their success is tied to larger economic and secular trends—rising the demand for their products and services.

Their operations mirror contemporary societal shifts. Meta exemplifies the digital social revolution; LVMH reflects evolving notions of luxury and status; ASML underpins the technological advancements powering the digital and AI age; and Basic-Fit taps into the increasing emphasis on personal well-being and fitness.

Each company has demonstrated a strong ability to adapt to rapid technological shifts, evolving consumer behaviors, and global market dynamics. For example, Basic-Fit survived the COVID-19 period, during which it was forced to close its clubs, while LVMH managed to grow its organic revenue despite challenging market conditions in China last year—where competitors like Gucci (Kering) and Burberry faced real deteriorations. My companies’ resilience and strategic foresight enable them to remain competitive even during economic uncertainties or disruptive market events.

Their continued success rests on robust competitive moats—whether through proprietary technology, strong brand equity, network effects, or scalable business models—that help secure long-term growth while fostering their profit margins, ROI(I)C, and FCF, the key drivers of long-term shareholder returns.

Over the next few years, I will expand my portfolio by approximately 4 to 8 more stocks—my goal is to hold an average of 8 to 12 companies in the future, and hold them as long as possible. I will treat these companies like mountains—trusting in their strength to continue compounding their power over the coming decades.

On this Substack, massivemoats.com, and on social media (X, LinkedIn, Instagram), I will condense my research of quality- and moat-investing, as well as my analyses of the top <0,1% strongest companies worldwide, into articles and deep dives for others to read.

Along the way, I will keep you updated regarding the development of my portfolio and its performances.

Portfolio Update March 1, 2025

My journey toward building a portfolio of 8-12 high-quality, strong-moat companies continued to progress over the past month. Notably, I sold my position in Just Eat Takeaway — Prosus intends to acquire the company for €20.30 per share — and increased my stakes in Meta and Basic-Fit. Below is a bri…

I am curious to hear your thoughts on ASML, LVMH, Meta and Basic-Fit. How many of these four do you hold in your portfolio?

Best regards,

Eelze Pieters

Founder of Massive Moats

Disclaimer: The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.

Time to up your holding in LVMH. It’s going to be a hard 12-18 months but they are too big to fail. I’ve been buying the dip.

Basic-Fit has a moderate MOAT primarily due to economies of scale and brand recognition, but it lacks strong barriers to entry. Its dominance depends on continuous expansion and cost efficiency rather than an unshakable competitive advantage. If your investment strategy is to look for companys with a ‘Heavy Moat’ take a look at Visa - Mastercard, S&P Global - Moody’s, and also a Company like Linde. These have real strong MOAT.