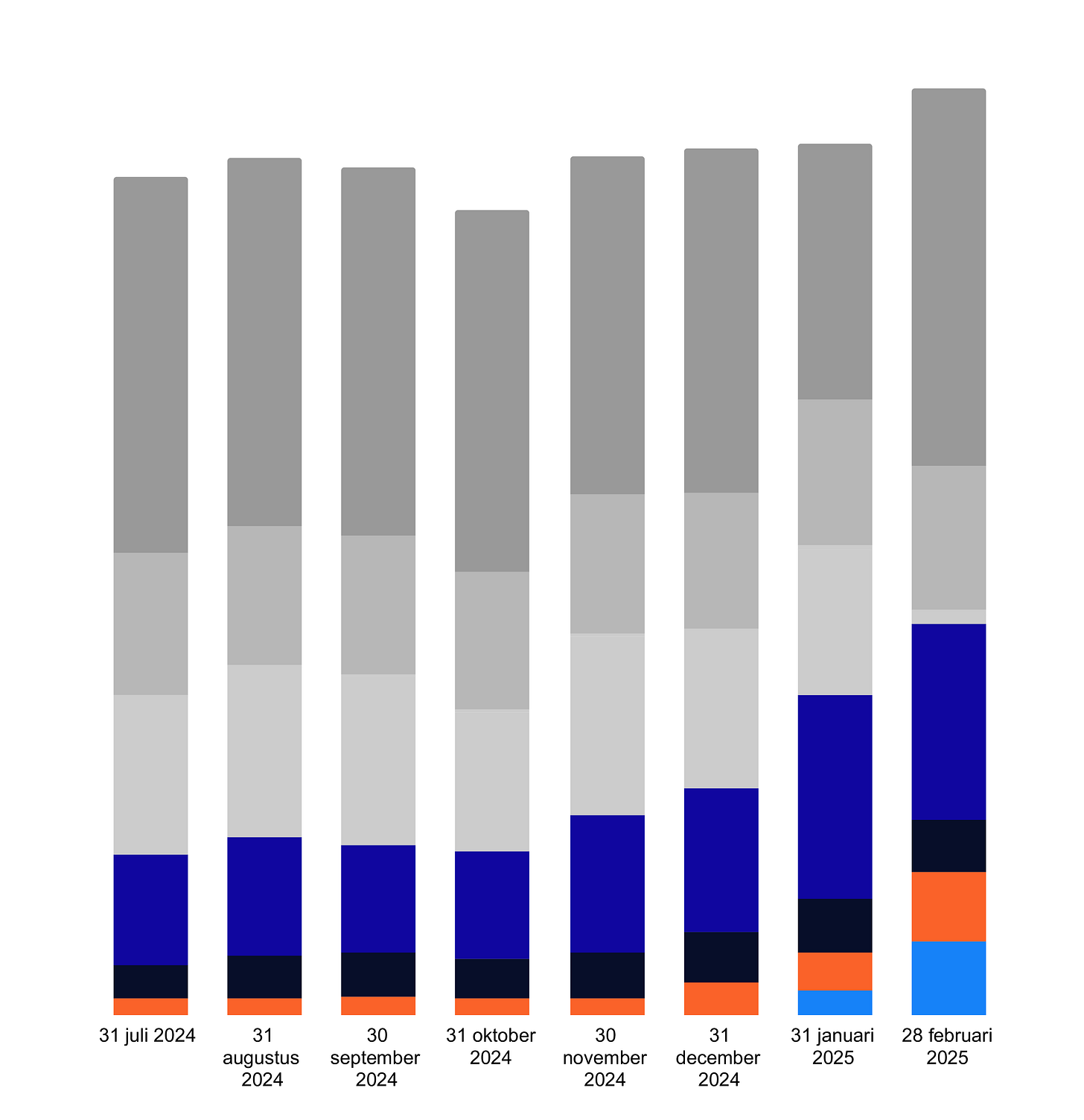

My journey toward building a portfolio of 8-12 high-quality, strong-moat companies continued to progress over the past month. Notably, I sold my position in Just Eat Takeaway — Prosus intends to acquire the company for €20.30 per share — and increased my stakes in Meta and Basic-Fit. Below is a brief overview of my investment thesis for each holding (ranked from largest to smallest percentage weighting):

ASML

With my position in ASML, I aim to capitalize on global investments in the semiconductor sector over the coming decades. Worldwide, significant investments are already being made in artificial intelligence (AI), driving demand for advanced chips to enhance the computational power of technology companies. Hyperscalers such as Microsoft, Alphabet, Amazon, and Meta are heavily investing in their AI capabilities. In a world where AI innovations are advancing rapidly, I view ASML as one of the few ways to position myself now for the profits that AI-driven advancements will generate in the decades ahead.

Meta Platforms

My primary catalysts for Meta center on the continued development of its existing platforms and capturing secular revenue growth driven by an increasingly digitized world. These factors, combined with Meta’s pricing power, serve as key drivers for sustained revenue and profit growth. Meta currently trades at a multiple of 22x its operating cash flow (adjusted for stock-based compensation). In the past fiscal year, the company increased its OCF (net of SBC) by 31% year-over-year.

LVMH

My investment rationale for LVMH is to tap into the growing demand for creativity and self-expression in an increasingly digital world. As AI brings greater uniformity, LVMH stands out with its core values of creativity, quality, innovation, and craftsmanship, making it a strong addition to my portfolio. With capable management and effective capital allocation (including M&A), I expect LVMH to further solidify its position in the luxury and masstige segments, especially as competitors like Burberry and Kering continue to see their brand strength erode.

Basic-Fit

With Basic-Fit, I am targeting the rising penetration rate of gym-going Europeans — a robust secular trend I foresee persisting over the coming decades — alongside the company’s ongoing expansion across Europe. As of September 30, 2024, Basic-Fit operated 1,570 clubs, making it by far the largest fitness operator in Europe. Its business model is built around the value-for-money concept.

NASDAQ-100

Additionally, each month I allocate a small amount to an ETF tracking the NASDAQ-100 Index, using DCA to build a position for the future while also trying to be inspired by promising new entrants in this index.

41% cash position

Following the sale of TKWY, my cash position has increased further (now ~41%). Which companies with strong moats would you recommend I research for potential inclusion in my portfolio?

Disclaimer: The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.

Mastercard together with Visa, Microsoft and S&P global with Moody’s.

Thats if you are talking about the top 1%, with the strongest MOATS. Great additions to youre portfolio

Wise!