Welcome to the May 2025 portfolio update. In this article, I will highlight the key developments in my portfolio over the past month.

Performance

In May, my total assets increased by +7.1%, driven by positive market sentiment and strong momentum from the companies in my portfolio. Meta Platforms, Amazon, and ASML rose by +12.1%, +8.3%, and +10.2% month-over-month (in EUR), respectively. (I added to my ASML position and initiated a new position in Amazon in early to mid-April.)

Transactions

In May, I made two transactions: I sold my entire position in Basic-Fit to fund a new investment in 3i Group (Action). My rationale behind this decision is detailed later in this article, build on the articles (notes) I shared in the last past few weeks here on Substack and social media (LinkedIn, X).

I also made a recurring contribution to an ETF tracking the Nasdaq 100 Index.

As the value of my investments rose faster than the absolute increase in my cash position, the latter decreased from 20% on May 1, 2025 to 19% on June 1, 2025, as a percentage of my total capital.

Portfolio

Below, I will walk you through the current status of my portfolio.

As of June 1, 2025, my capital allocation is as follows:

- 26% in ASML ASML 0.00%↑ ;

- 19% in cash;

- 15% in equity of own businesses;

- 14% in Meta Platforms META 0.00%↑ ;

- 10% in 3i Group $III.L;

- 9% in Amazon AMZN 0.00%↑ ;

- 6% in Christian Dior $CDI.PA;

- 2% in Nasdaq 100 ETF QQQ 0.00%↑ and other holdings.

Basic-Fit —> 3i Group

In May, I sold a stock in its entirety for the second time this year. After exiting Just Eat Takeaway (JET) in February, I fully divested my position in Basic-Fit last month. Unlike JET, this decision was not triggered by a takeover bid. Rather, I made the move because (1) I saw more attractive opportunities elsewhere [i.e., 3i Group] and (2) I believe Basic-Fit is gradually shifting from a long-term quality play, based on compounding and a positive slope of its moat, to more of a value play. More on that below.

I initiated my position in Basic-Fit in March 2024 and gradually increased it to approximately 8% of the portfolio. The total cost of the position amounted to €10,946. On May 15, I sold my 500 shares at €22 each, resulting in a profit of €53, or +0.48%. This figure excludes premiums received from written options.

The proceeds from this sale were used to purchase 250 shares of 3i Group at a total cost of €11,751. I believe this portfolio shift has enhanced its overall quality.

Naturally, I could have held onto my Basic-Fit position and simply added 3i Group as a new holding. However, I chose to sell Basic-Fit simultaneously for several reasons:

My focus is on investing in the best companies in the world. In my view, Basic-Fit does not fit into that category: the company has revised its short-term strategy—it plans to significantly slow its pace of club openings in the coming years. For long-term shareholder value creation, a clear path of organic revenue growth is essential. While I see that potential accelerating at 3i Group (via Action), it appears to be diminishing at Basic-Fit—particularly when considering the absolute number of new Action store openings per year.

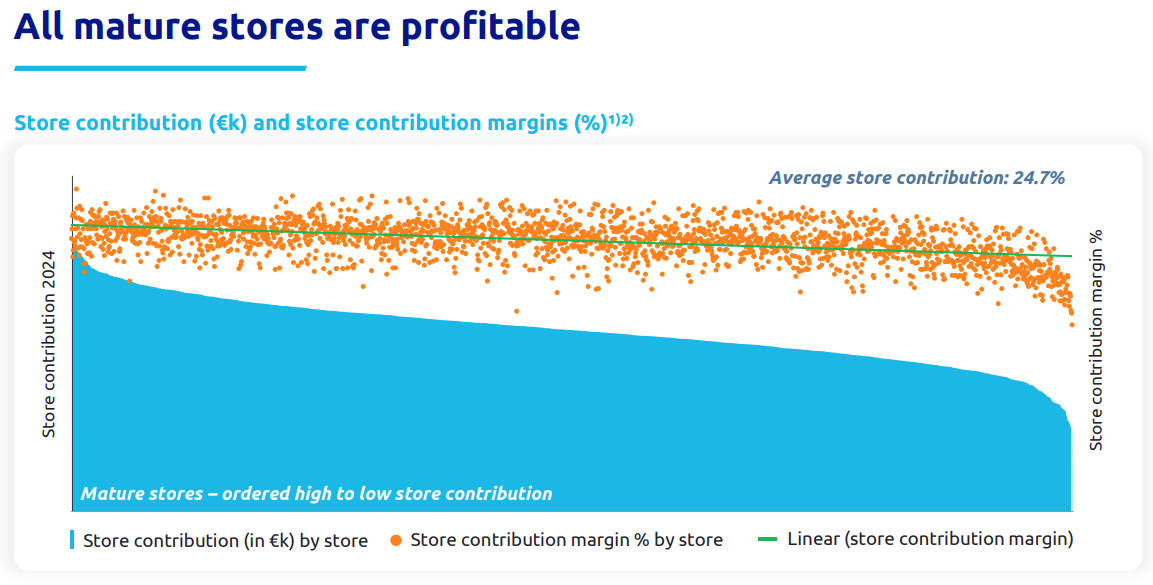

Basic-Fit also lacks a certain level of transparency, particularly regarding the profitability of specific regions/cohorts. This stands in sharp contrast to 3i Group, which informs its shareholders about the profitability of every store (i.e., it reports that EVERY mature Action store is profitable, see graph below).

In addition, regarding Basic-Fit, I find the company’s reported 30% ROIC somewhat opaque. Although I was aware of this when expanding my position, it increasingly gives me pause.

Based on my calculations, Basic-Fit generated €141 million in FCF before expansion in FY2024. With a market capitalization of €1.525 billion, this implies a yield of 9.2%. Including net debt of €938 million as of December 31, 2024, the enterprise value (EV) totals €2.4 billion. On this basis, the pre-expansion FCF yield is 5.7%.

While a certain level of debt can be beneficial if returns exceed the cost of capital (i.e., ROIC > WACC)—which historically has been the case for Basic-Fit on an average basis—the company is now prioritizing FCF generation, in part to meet its potential financial obligations in the summer of 2026. However, in my view, this shift comes at the expense of long-term shareholder value creation.

Because, if the company truly believes there is ample white-space potential, why not fully capitalize on it—especially for a business that claims to be long-term oriented? Why leave that space to potential competitors? Because why does the company repurchase €40 million worth of shares instead of using that capital to open new clubs? Could there be something deeper beneath the surface—such as newly opened clubs underperforming relative to the expectations shared with its shareholder based on the claimed 30% ROIC? In my view, this suggests that by allocating €40 million to share buybacks, the company believes the current market valuation of its club base offers a higher return than opening new locations. If this is the case, it delivers a higher return for shareholders in the short term. However, my focus is on long-term value creation, riding along the waves with high-trust, capable management, capitalizing on the secular growth trends in their sector. Therefore, Basic-Fit no longer meets the criteria for inclusion in my portfolio.

Conclusion

Based on 3i Group’s market valuation, I estimate the FCF yield (before expansion) for Action at around 2.3% relative to its estimated market cap. Including an estimated net debt of €6.3 billion as of March 31, this implies an enterprise value of around €72.5 billion, putting the FCF yield at approximately 2.1% on its FY2024’s earnings.

From a valuation perspective, Basic-Fit does indeed offer a higher yield on its EV (5.7%). However, when factoring in multiple qualitative factors, Action clearly stands out in my view: it continues to invest in expanding its footprint, based on a very high ROI, while Basic-Fit is scaling back growth. I also find Action’s growth potential, given its current size, both more interesting and more realistic compared to Basic-Fit and its long-term targets.

Closing remarks

In June, I’ll continue to share my research with you on the world’s strongest companies and will provide insights into the theory behind quality investing.

Happy investing,

Eelze Pieters

Founder of Massive Moats

Disclaimer: NFA / E&OE. The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.

I also hold ASML, great company!! I see you're talking about Action and Basic-fit are you a Dutch investors ? or at least an European investor ?