Following the market close on July 17, 2025, Netflix released its financial results for the second quarter of 2025. This article provides an overview of the key highlights and an analysis of the company's performance and strategic developments. We begin with a summary of the key financial figures.

Key Figures

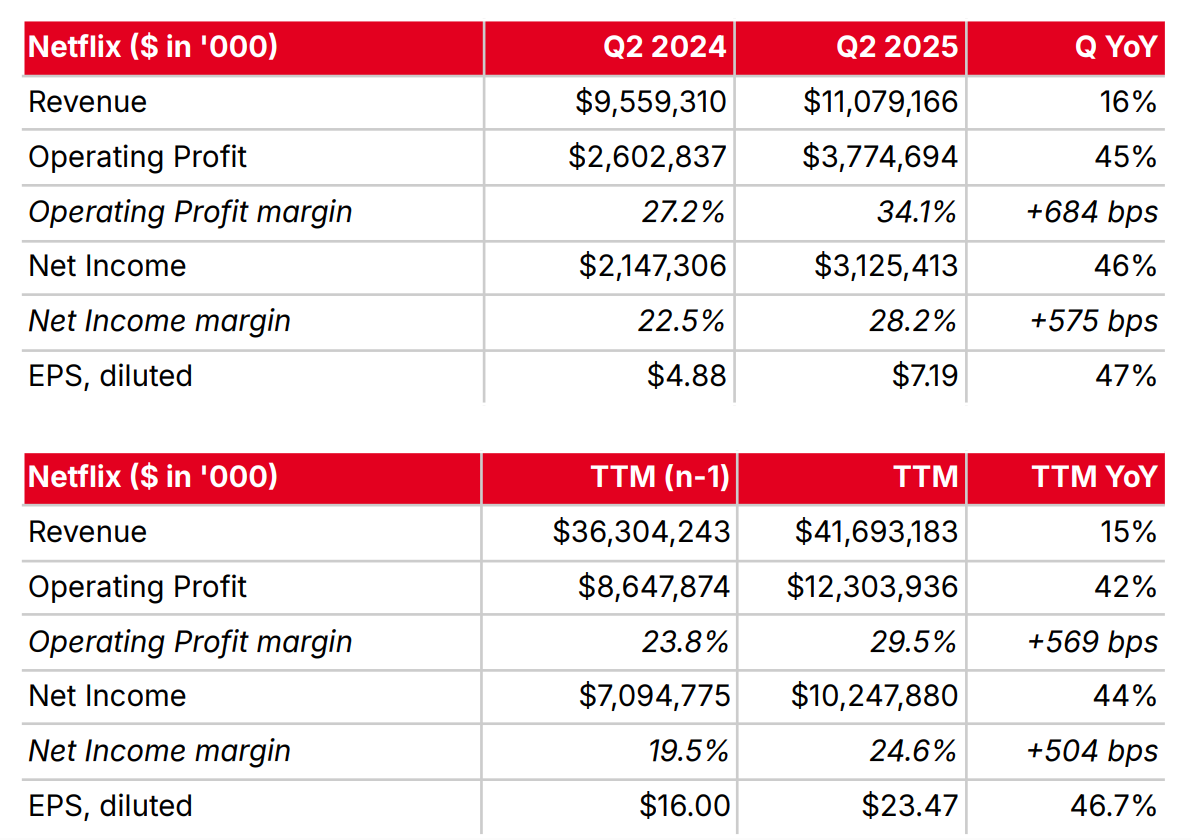

Netflix's performance over the trailing twelve months (TTM) demonstrates significant progress across key metrics:

Revenue growth: 15% year-over-year (YoY) increase to $41.7 billion (TTM).

Operating Income growth: 42% YoY increase to $12.3 billion (TTM).

Net Income growth: 44% YoY increase to $10.2 billion (TTM).

Diluted EPS: $23.47 (TTM), representing a 47% YoY increase.

Member engagement: 95 billion hours in H1 2025 watched, a 1% YoY increase.

Financial Performance

In absolute terms, Netflix's revenue expanded by $5.4 billion over the past 12 months. A substantial portion of this incremental revenue translated directly into operating income; operating income increased by $3.7 billion over the last four quarters. This translates to an impressive operating leverage of $0.68 in additional operating income for every dollar of revenue growth. Over the TTM period ending Q2 2024, this efficiency metric stood at 72% of revenue growth. However, analyzing Q2 2025 in isolation reveals an even stronger performance with a 77% conversion rate, compared to 57% in Q2 2024.

Netflix attributed its 16% YoY revenue growth in Q2 2025 (17% on a foreign exchange-neutral basis) to a synergistic combination of subscriber additions, strategic price increases, and expanding advertising revenues.

This robust performance resulted in a 569 basis point expansion of the operating profit margin to 29.5% on a TTM basis. This margin accretion is a direct consequence of operating income increasing by 42% on a 15% revenue growth over the same period.

For Q3 2025, Netflix anticipates 17% revenue growth, driven by continued subscriber expansion, pricing power, and higher advertising contributions. Furthermore, the company has revised its full-year 2025 revenue guidance upwards, from an initial range of $43.5–$44.5 billion to $44.8–$45.2 billion. This revised outlook implies an expected YoY revenue growth of 15–16%. Based on these projections, Netflix forecasts a full-year 2025 operating margin of 29.5% and a free cash flow generation of $8–$8.5 billion.

Content Performance

Squid Game Season 3 has demonstrated strong viewership, attracting 122 million viewers as of July 13th, just weeks after its release. Netflix reports this season as currently the sixth largest series season in the company's history. Concurrently, social media sentiment indicates some critical reception. The IMDb score for Season 3, at 7.6, is lower than Season 1 (8.0) but aligns closely with Season 2 (7.5).

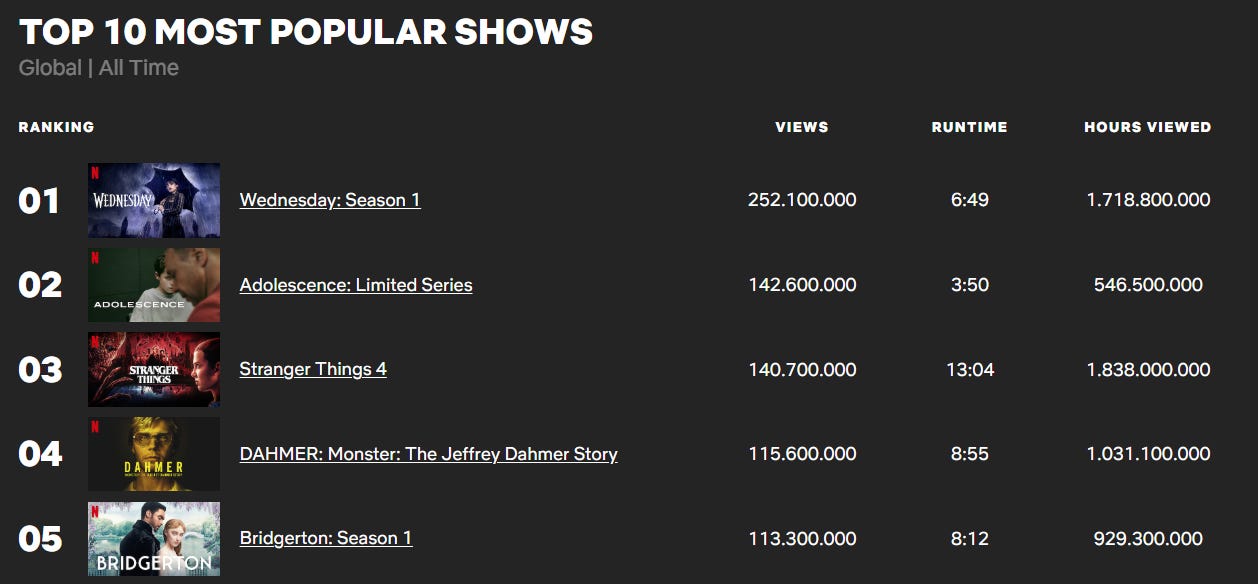

Netflix's Adolescence (IMDb: 8.2), released at the end of Q1 2025, has emerged as the second most-watched English-language series of all time on the platform, registering 142 million views (Netflix, 2025). Concurrently, the top 10 non-English language series are led by all three seasons of Squid Game, collectively accounting for over 4.3 billion hours viewed (Netflix, 2025).

With some of Netflix's historically most successful series coming to an end, the company will need to identify and develop new flagship content. Nevertheless, it maintains a robust pipeline of promising productions. Upcoming titles include Bridgerton (IMDb: 7.4), One Piece (IMDb: 8.3), Avatar: The Last Airbender (IMDb: 7.2), The Gentlemen (IMDb: 8.0), Four Seasons (IMDb: 7.2), Running Point (IMDb: 7.3), Beef (IMDb: 8.0), Three Body Problem (IMMB: 7.5), Love is Blind (IMDb: 6.2), Outer Banks (IMDb: 7.5), and the highly anticipated fifth and final season of Stranger Things (IMDb: 8.6). This season finale of Stranger Things will be released in three parts: four episodes on November 26th, three episodes on December 25th, and the series finale on December 31st.

Netflix is also adopting a staggered release strategy for other prominent series, such as The Sandman. For its second season (S1 IMDb: 8.0), the first six episodes were released on July 3rd, followed by five episodes on July 24th, with an anticipated bonus episode on July 31st.

It is notable that older titles continue to drive substantial engagement. Nearly 50% of Netflix Originals' viewing hours were attributable to content released in 2023 or prior years, exemplified by series such as Ozark (IMDb: 8.4). Among my personal preferences, Dark (IMDb: 8.7) ranks as the top Netflix Original. Black Mirror (IMDb: 8.7) also features prominently in my selection of premier Netflix Original series, although I tend to view its episodes as distinct, standalone films.

Furthermore, Netflix is strategically intensifying its investment in local content production through its "local for local" strategy. As an example, the company committed over €1 billion to content production in Spain for the period 2025–2028 (Netflix, 2025), underscoring its commitment to be regionally tailored as well.

Competitive Landscape

In the first half of 2025, Netflix subscribers consumed over 95 billion hours of content on the platform, representing a 1% YoY increase. However, accounting for subscriber growth, this implies a decrease in viewing hours per subscriber. Greg Peters, Netflix's Co-CEO, noted that "owner household engagement" has remained stable over the past 2.5 years but expressed the company's desire to increase it. Peters anticipates an improvement in this metric during the second half of 2025.

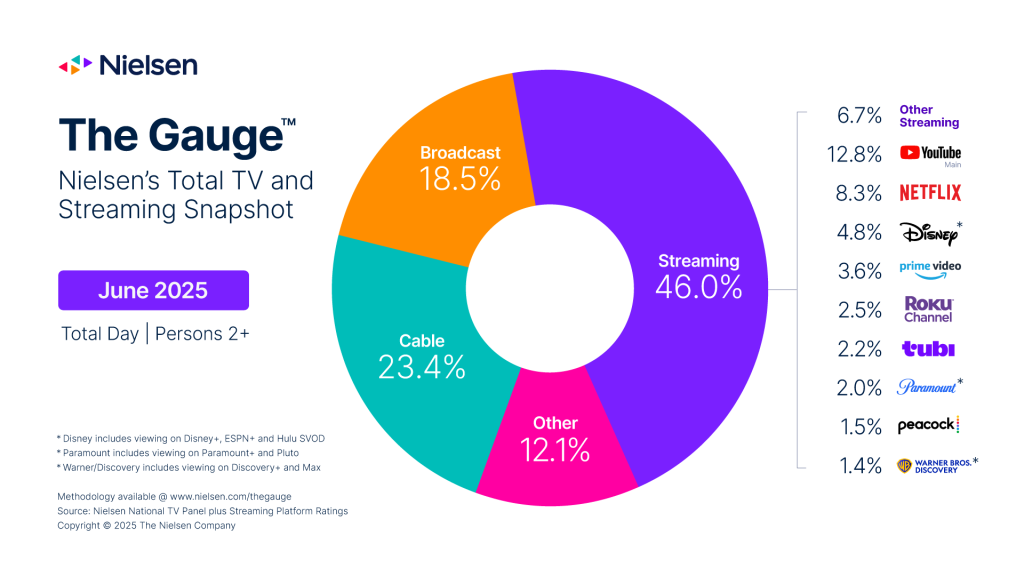

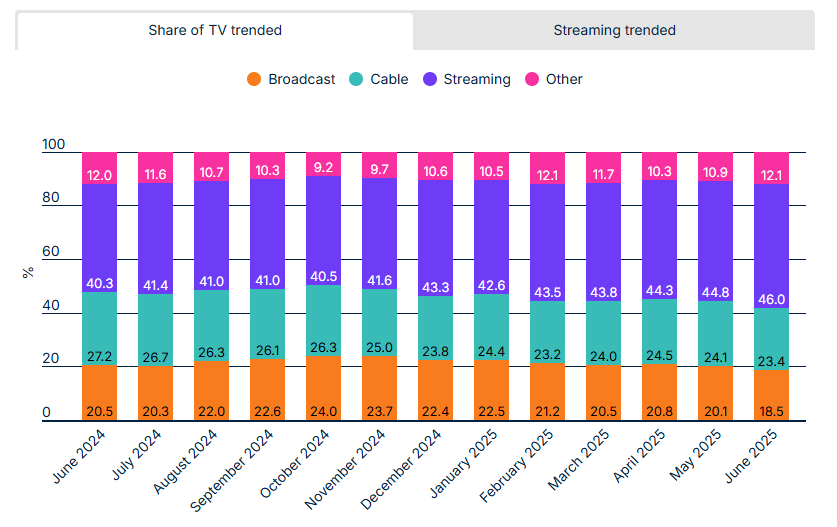

The accompanying diagram from Nielsen (2025) estimates the market share of streaming within total TV and streaming consumption at 46.0%, a notable increase from 40.3% in June 2024.

The graph below illustrates this progression over the last 12 months, demonstrating a gradual increase in streaming's overall share.

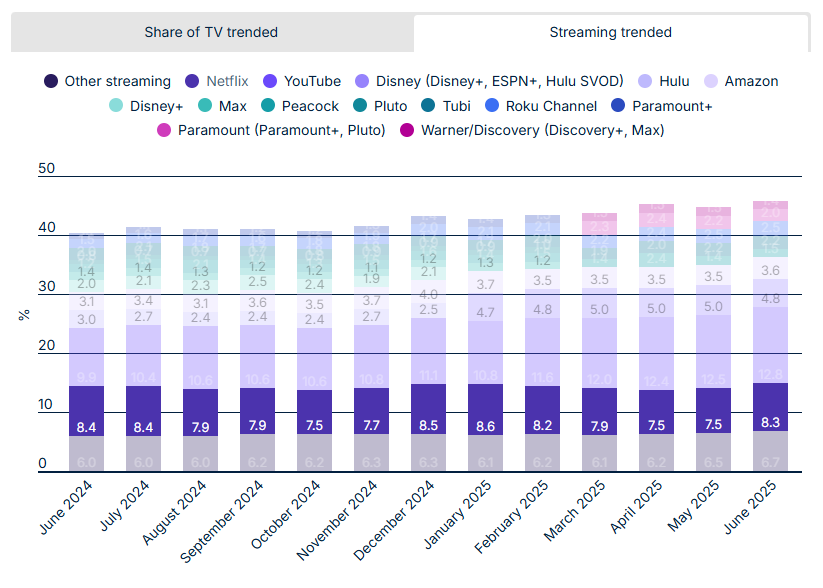

Subsequently, the chart below presents Netflix's estimated market share, which has fluctuated between 7.5% and 8.5% over the past 12 months. Among streaming platforms, only YouTube holds a larger share, with its estimated market share increasing from 10% to nearly 13% over the last year.

When asked by Steve Cahall of Wells Fargo about Netflix management’s opportunity to bring notable YouTube creators and their content exclusively to Netflix, Co-CEO Ted Sarandos stated that the company seeks to partner with the best content creators, regardless of where they come from. He added, however, that not all content appearing on YouTube is suitable for Netflix.

As an example, Netflix entered into a collaboration with Ms. Rachel earlier this year (Fortune, 2025), with her content accumulating 53 million views on Netflix during the first half of 2025. Netflix has had varied success with content creator collaborations in the past. The broader trend of content-producing companies approaching individual content creators is accelerating; for instance, Amazon produced a series with MrBeast (Jimmy Donaldson) in 2024 titled Beast Games (The Verge, 2024).

Sarandos affirmed that Netflix's long-term objective is to grow its market share, driven by the secular shift of the remaining traditional TV consumption, which is expected to further migrate towards streaming. Netflix aims to achieve this by continuously enhancing its services.

“It is our objective to sustain healthy revenue growth, reinvest in the business to improve on all aspects of the service, and that includes growing content spend, strengthening and expanding the entertainment offering, and to drive that positive flywheel of growth by adding value to our members, and all the while growing engagement revenue and profit around the world.”

— Ted Sarandos, Co-CEO of Netflix, Q2 2025 Earnings Call

Peters further elaborated that 80% of the total TV consumption market is currently facilitated by entities other than Netflix and YouTube. He stated, "a huge opportunity for which we are competing, aggressively, and we aim to grow our share." Sarandos concluded by emphasizing, "The vast majority of our money and attention is focused on that 80%."

Beyond the ongoing shift from cable and broadcast to streaming, and the competitive dynamics within the streaming segment itself, I anticipate that Netflix will face increasing competition from social media platforms in the coming years. Social media platforms such as Facebook and Instagram continue to shift from pure social networks into prominent entertainment venues, effectively competing for the same time of consumers.

The emergence of increasingly sophisticated artificial intelligence (AI) models will empower the world to transform creative ideas into moving images at an unprecedented scale. Soon, anyone will be able to generate mini-series set in self-created fictional worlds, with a simple text prompt serving as the foundation for an AI-simulated video sequence. Thanks to accessible content creator platforms like Instagram and YouTube, these creations can be easily shared and subsequently monetized.

Netflix itself foresees AI enabling the creation of better content:

“We remain convinced that AI represents an incredible opportunity to help creators make films and series better, not just cheaper.”

— Ted Sarandos, Co-CEO of Netflix, Q2 2025 Earnings Call

Gaming and Live Events

Netflix is also strategically investing in gaming, with titles such as Thronglets (from the Black Mirror franchise) and Squid Game: Unleashed, as well as live events, including boxing matches and NFL games. Sarandos highlighted that sports represent only a sub-component within the live segment, focused on big events, provided they are economically viable. Currently, live content accounts for a small portion of Netflix's total viewing hours, approximately 200 million hours.

Through gaming, the company aims to expand its offerings within the Netflix ecosystem. Partnerships with entities like Grand Theft Auto and, more recently, a deal with Roblox, are intended to contribute to this objective. Peters observes nascent positive effects of gaming on Netflix's overall performance and indicated that the company will continue to increase investments in this area, albeit in a disciplined manner. The focus remains on ensuring a positive impact on Netflix's aggregate results without premature overcommitment.

Conclusion

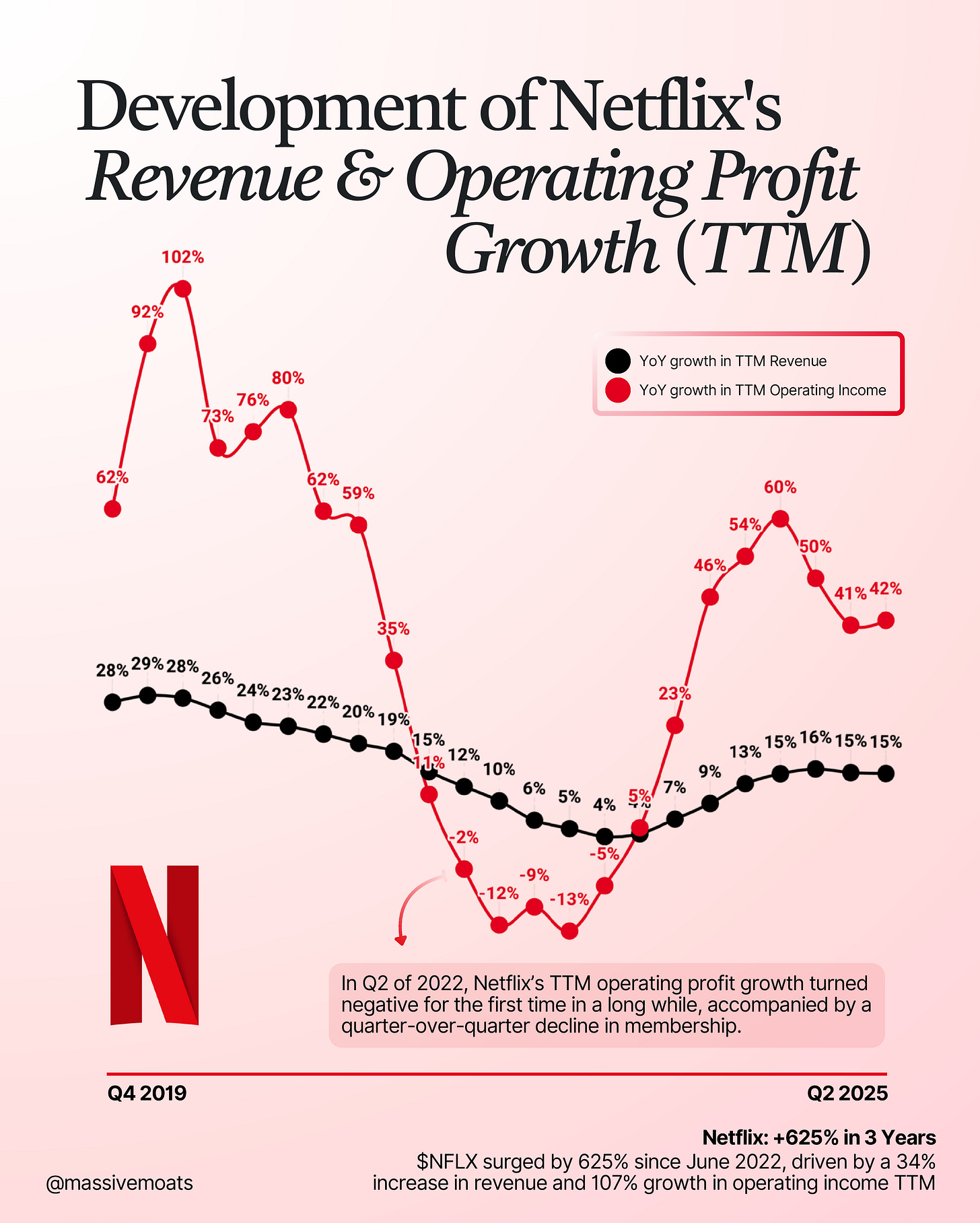

In Q2 2022, investors reacted sharply when Netflix reported its first negative operating income growth in a considerable period, coupled with a quarter-over-quarter decline in subscribers. As of early this year, Netflix no longer discloses subscriber figures. Consequently, investors must now assess the company's progress based on KPIs such as revenue growth and margin expansion.

Reviewing Netflix's performance over the past three years reveals significant progress: revenue has grown by 34% and operating income has surged by 107% during this period. However, considering more recent developments, we observe that the company's growth acceleration is stabilizing. In my view, this is a logical progression for a company that has already achieved substantial scale.

What is a fair price for Netflix? A complex question, which heavily depends on future pricing power and secular tailwinds of the company. Despite the strong secular trend from cable and broadcast towards streaming, I anticipate increasing competition for Netflix in the broader entertainment landscape.

I expect AI-driven video content to develop significantly in the coming years, potentially leading to substantially lower production costs while simultaneously enabling higher quality. This applies not only to major film studios but also to individual content creators. Furthermore, I foresee a significant reduction in the barrier to entry for content creation on a global level.

Nevertheless, I assess Netflix's opportunities over the next few years as very strong. The company is strategically expanding its content offerings with games and live events, and continues to produce high-quality films and series through its own studio. The future appears promising for Netflix, a sentiment also reflected in the company's robust share price appreciation over recent years.

I have not included a valuation analysis at this time, as I intend to further investigate Netflix's potential and its increasing profitability. To be continued.

Disclaimer: NFA / E&OE. The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.