Netflix Q1 2025 Financial Results

Financials

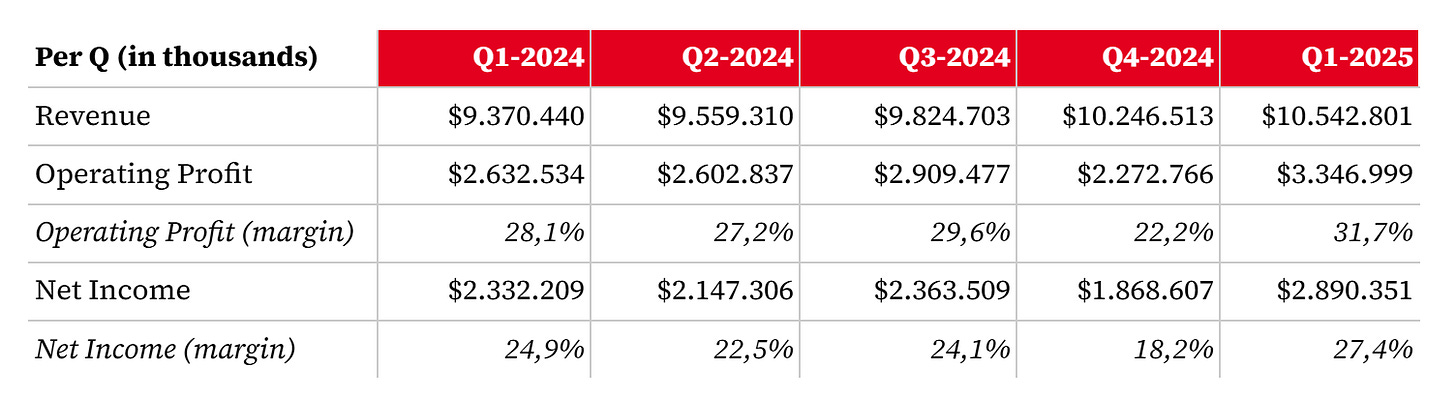

In Q1 2025, Netflix reported revenue of $10.5 billion, a 12.5% increase from $9.4 billion in Q1 2024. The company achieved an operating profit of $3.3 billion, with an operating margin of 31.7%, compared to $2.6 billion and a 28.1% margin in Q1 2024. This represents a 27.1% increase in operating profit and a 3.7 percentage point improvement in margin.

Over the trailing twelve months (TTM) from Q2 2024 to Q1 2025, Netflix generated $40.2 billion in revenue and $11.1 billion in operating profit, yielding a 27.7% margin. In the prior TTM period (Q2 2023 to Q1 2024), revenue was $34.9 billion with an operating profit of $7.9 billion (22.5% margin). This reflects a 15.0% year-over-year (YoY) revenue growth and a 41.4% increase in operating profit, with a 5.2 percentage point margin improvement.

Net income for Q1 2025 was $2.9 billion (TTM: $9.3 billion), up 23.9% from $2.3 billion in Q1 2024 (TTM: $6.4 billion, +44% YoY). Diluted earnings per share (EPS) for the TTM period reached $21.16, a 46.8% improvement from $14.41 in the prior year.

Members

Q1 2025 marked the first quarter in which Netflix ceased reporting membership numbers. As of December 31, 2024, the company had 301.6 million global members. Netflix plans to provide updates only at significant membership milestones. In FY2024, membership grew by over 41 million, a 15.9% YoY increase.

Outlook

For Q2 2025, Netflix projects 15% revenue growth (17% on a foreign exchange-neutral basis) and an operating margin of 33%, a 6 percentage point improvement from Q2 2024’s 27.2%. For full-year 2025, Netflix anticipates revenue between $43.5 billion and $44.5 billion, with an operating margin of 29%.

The final season of Squid Game, Netflix’s most popular series to date, is set to premiere on June 27, 2025. Netflix is expanding the franchise with updates to its game Squid Game: Unleashed and spinoffs like Squid Game: The Experience, hosting physical events in major global cities. The franchises of Netflix’ Originals offer significant opportunities for additional monetization in the future, through for example spinoffs, events, and games, with Netflix viewing the gaming market as a high-growth area.

Netflix Ads Suite

In early Q2 2025, Netflix launched its Ads Suite, an in-house first-party ad tech platform, in the United States to monetize its extensive distribution network.

Follow The Money

In Q1 2025, Netflix generated $2.7 billion in operating cash flow (adjusted for stock-based compensation). As of March 31, 2025, the company held $8.4 billion in cash, cash equivalents, and short-term investments, with long-term debt at $14 billion.

Reflection & Deep Dive

Having followed Netflix’s developments for some time, I drafted a valuation analysis of the company last year. Recent performance suggests my earlier projections for long-term operating and net profitability may have been (very) conservative. I plan to revise these estimates by conducting a deep dive into Netflix. In addition to being a potential portfolio candidate, Netflix—with its many transformations since its inception—offers valuable insights for investors, entrepreneurs, and executives in dynamic organizations.

Eelze Pieters

April 18, 2025

Financial Supplements

Disclaimer: NFA / E&OE. The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.