ASML announced its Q2 2025 financial results this morning at 7:00 AM CET. This article provides a high-level overview and my personal interpretation of the reported figures. (Disclaimer: This content does not constitute financial advice. As of July 16, 2025, I held a long position in $ASML.AS.)

Key Points

✅ €32.2 billion in TTM revenue, representing a 26% YoY increase.

✅ €11.2 billion in TTM operating profit, up 44% YoY.

✅ €24.03 in EPS, with a dividend of €1.60 payable in August.

✅ €1.4 billion in share repurchases executed in Q2 2025.

✅ Net Bookings of €5.5 billion (Q1 2025: €3.9 billion).

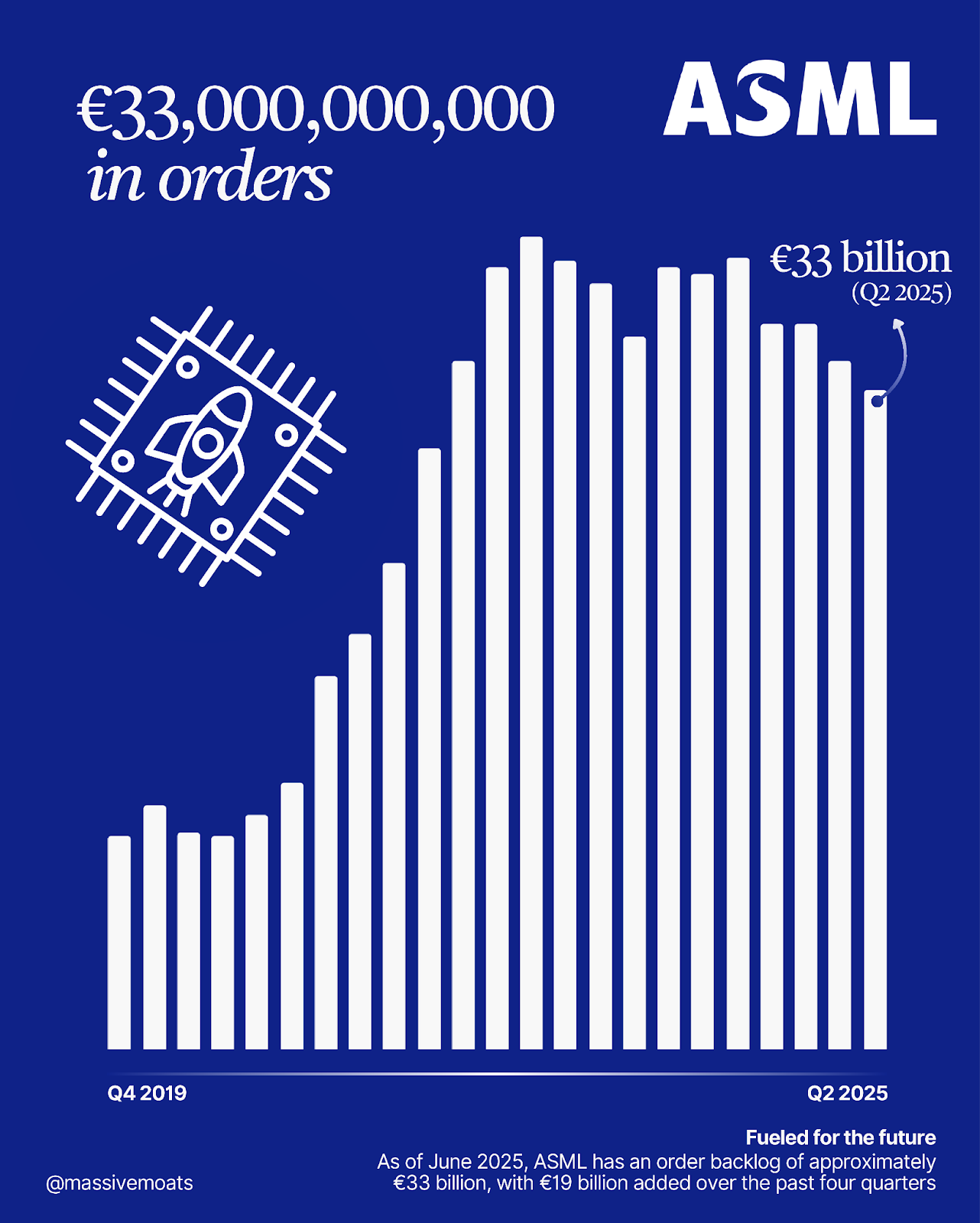

✅ Order Backlog of approximately €33 billion.

✅ 2025 Outlook reaffirmed.

❓ 2026 Growth cannot yet be confirmed.

✅ 2030 Outlook reaffirmed.

Financial Performance

For Q2 2025, ASML reported revenue of €7.7 billion, including the sale of one High-NA tool. Over the past four quarters, ASML's trailing twelve-month (TTM) revenue reached €32.2 billion, marking a 26% increase YoY. The revenue trend over the past five years (quarterly, TTM) is illustrated in the graph below.

Of the €32.2 billion in TTM revenue, €24.4 billion was derived from net system sales (+24% YoY), attributed to the delivery of 76 lithography systems. The remaining €7.8 billion came from net service and field option sales (+36% YoY).

ASML's gross profit margin for Q2 2025 stood at 53.7%, exceeding the company's guided range of 50–53%. Net profit for the quarter amounted to €2.3 billion, bringing the net profit over the past four quarters to €9.4 billion—a 40% increase compared to €6.7 billion TTM in Q2 2024. Earnings Per Share (EPS) for the past twelve months was €24.03, also a 40% increase relative to €17.14 in the same period last year.

Net Bookings

In Q2 2025, ASML secured total net bookings of €5.5 billion, which included €2.3 billion in EUV orders. The company's order backlog currently stands at approximately €33 billion. This figure accounts for a €1.4 billion write-off related to the cancellation of orders from China, as Chinese customers were, in this quarter, required to make a choice regarding their existing orders following the 2024 export controls.

Outlook

Looking ahead to Q3 2025, ASML anticipates revenue between €7.4 billion and €7.9 billion, with approximately €2 billion expected from installed base management. The gross profit margin for Q3 is projected to be between 50% and 52%.

Roger Dassen, ASML's CFO, confirmed an expectation of 15% revenue growth for 2025 compared to 2024, with revenue recognition weighted towards the fourth quarter. Based on 2024 revenue of €28.3 billion, this translates to an anticipated 2025 revenue of approximately €32.5 billion, falling precisely within the previously communicated guidance range of €30–€35 billion.

ASML's management reiterated its 2030 outlook, projecting revenue of €44–€60 billion for that year with a gross profit margin between 56–60%.

Regarding 2026, Christophe Fouquet, CEO of ASML, provided the following commentary:

“Going into 2026, there the fundamentals of our AI customers remain strong and we are still preparing for growth. However, as we discussed last time, the level of uncertainty is increasing, mostly due to macroeconomic and geopolitical consideration. And that includes, of course, tariffs.”

— Christophe Fouquet, CEO ASML

In ASML’s Q2 2025 press release, the following quote was included:

“Looking at 2026, we see that our AI customers' fundamentals remain strong. At the same time, we continue to see increasing uncertainty driven by macro-economic and geopolitical developments. Therefore, while we still prepare for growth in 2026, we cannot confirm it at this stage.”

— ASML press release Q2 2025

The final sentence in particular appears to be the primary driver for many investors and journalists today. This is evident from ASML's stock price reaction, currently down 10% at the time of writing, and media headlines collectively fixated on "uncertainty about future growth."

It is worth noting that much of today’s reporting in the media selectively focuses on the latter part of the above quote, often failing to mention that management has reaffirmed its FY2025 and FY2030 targets.

My preference, however, is to look beyond the short-term perspectives that seem to dominate financial markets today. I aim to shape a nuanced interpretation of ASML's figures and communication. Long-term investors, in my view, will recognize that ASML's future prospects remain robust.

Today, ASML's management repeatedly emphasized that the fundamentals of its customer base remain strong and that the company continues to strategically position itself for growth. Management's acknowledgment of ongoing market uncertainties, particularly concerning the lack of definitive tariff policies, is, in my opinion, appropriate. ASML has observed a higher degree of customer uncertainty compared to 90 days ago. I believe ASML has made a fair decision by reflecting these developments in its commentary on the uncertainty surrounding year-over-year growth for the upcoming fiscal year. This more conservative stance on 2026, relative to the beginning of the year, is both fair and indicative of sound corporate governance.

ASML Going Foreward

With that in mind, let us take a closer look at where ASML stands today.

Hereby it is important to acknowledge ASML's significant growth over recent years. The company has demonstrated impressive advancements across its workforce, physical expansion in the Eindhoven region and internationally, and the consequential increases in its revenues, profits, and value of its order book. The development of ASML's backlog since Q4 2019 is illustrated in the chart below.

ASML's order backlog peaked around the end of 2022, reaching €40.4 billion as of December 31, 2022. This substantial backlog was driven by ASML's capacity constraints and a rapidly expanding order book, fueled by a bullwhip effect in the post-COVID period when market uncertainties—which were also present at that time—quickly evaporated as the global economy reopened. Today, however, we find ourselves once again in a period of uncertainty.

The normalization that occurred throughout 2023 and 2024 is, to some extent, continuing into 2025: ASML's net system sales have outpaced incoming orders in recent quarters, resulting in a visible reduction in the backlog's size.

Furthermore, 77% of ASML's TTM revenue is derived from system sales, making the company more sensitive to potential global uncertainties for a significant portion of its top line. The remaining 23% of revenue comes from service and field option sales, an area where ASML enjoys high gross profit margins. With a growing installed base of machines worldwide, this highly profitable revenue stream is steadily increasing. EUV machines also contribute to service revenue as they move beyond their warranty periods.

Given this, ASML appears highly susceptible to macroeconomic and geopolitical sentiment. However, what may have been overlooked today is that ASML still commands a backlog of €33 billion, which largely underpins its short-term revenue.

During ASML's earnings call, management indicated that DUV net bookings for the entire year are already virtually accounted for in revenue, meaning new order inflows are now contributing to the backlog balance for fiscal year 2026.

Valuation Analysis

For my valuation analysis, I use 2030 as the base year. I assume a mid-range revenue forecast for ASML of €52 billion, alongside €18 billion in net profit, with free cash flow slightly below that figure. As ASML’s FY2030 guidance remains unchanged, and I have received no indications to adjust my targets, I have made no modifications to my valuation analysis.

Assuming an FCF yield of c.4% for 2030 (or a P/E multiple of c.25x), the above assumptions lead to a share price exceeding €1,200 that year. For a FCF yield of c.3.3% and a P/E multiple of c.30x, the share price would exceed €1,450.

Taking into account an average dividend payout ratio of approximately 34% (consistent with the 10-year historical average), the Internal Rate of Return (IRR) is 14.3% for the first scenario and 18% for the second scenario. At the current share price of €625, this, in my opinion, provides a sufficient margin of safety to absorb a potential larger contraction in multiple or to account for revenue and profit figures that fall below the mid-range for FY2030. However, if ASML continues its historical trend of under-promising and over-delivering, significant returns could be achieved in the coming years.

Please note that the above assumptions are based on ASML maintaining its significant moat.

Conclusion

Despite the negative sentiment surrounding ASML today, I assess the reported figures as solid. For now, ASML remains my highest conviction holding, and I foresee a positive outcome for the company. This holds true even if, due to negative sentiment and macroeconomic uncertainties, there might be a slight shift in its short-term profitability. This is certainly something to monitor closely in the coming quarters; a re-evaluation would occur if there are indications that ASML might experience lower profitability in the long term. For now, my long-term catalysts remain intact.

Source of figures: ASML, 2025.

Disclaimer: NFA / E&OE. The information above is provided for general informational purposes only and should not be construed as investment, accounting and/or financial advice. You should consult directly with a professional if financial, accounting, tax or other expertise is required.

Great analysis. Thanks for sharing.