A Deep Dive Analysis into 3i Group plc

Unraveling the universe of 3i Group plc ($III.L) and the secrets behind its core holding, Action.

Introduction 3i Group

To many, 3i Group is a relatively unknown company. This is unsurprising, as the investor’s name is rarely encountered. With a team of 223 talented professionals, 3i Group also remains unfamiliar to many consumers in Europe, despite its significant stake in a well-known company: the Dutch retailer Action.

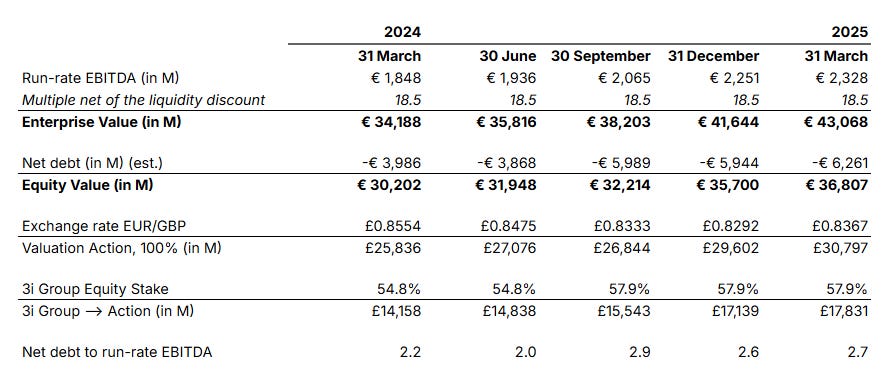

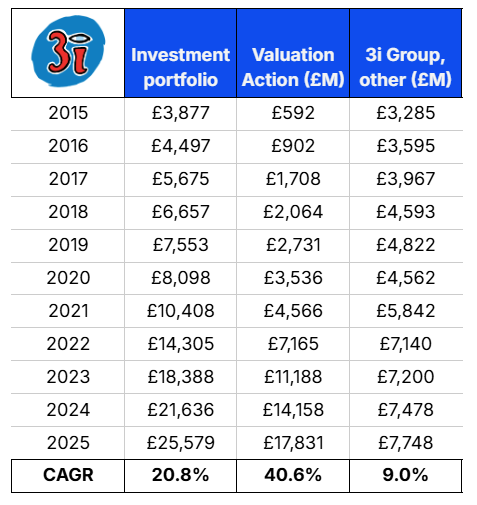

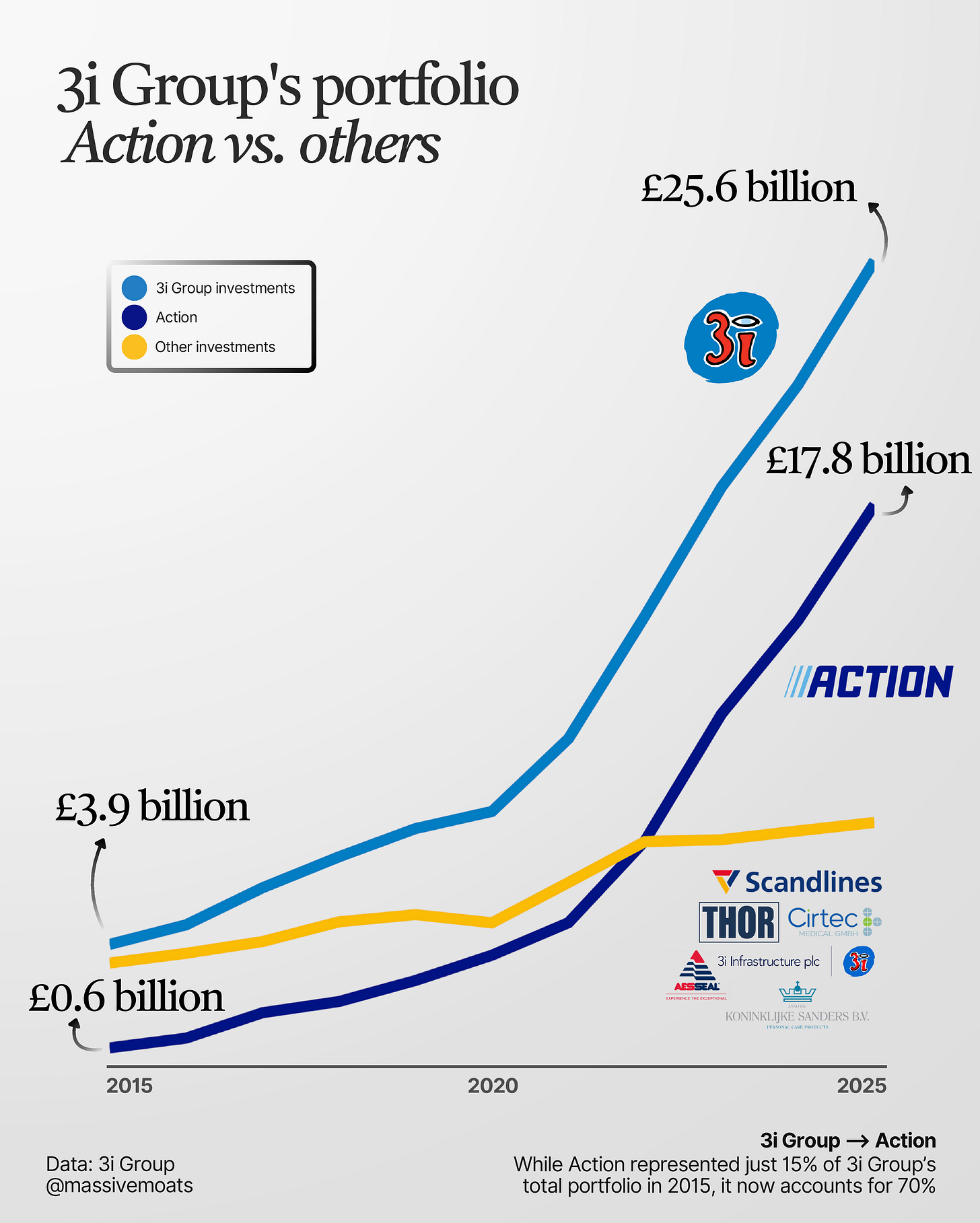

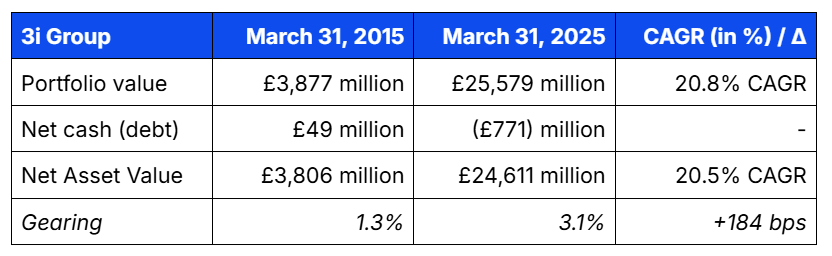

3i Group’s 57.9% stake in Action accounts for 72% of the total implied Net Asset Value (NAV) of 3i Group. Therefore, an investment in 3i Group is, to a large extent, an investment in Action.

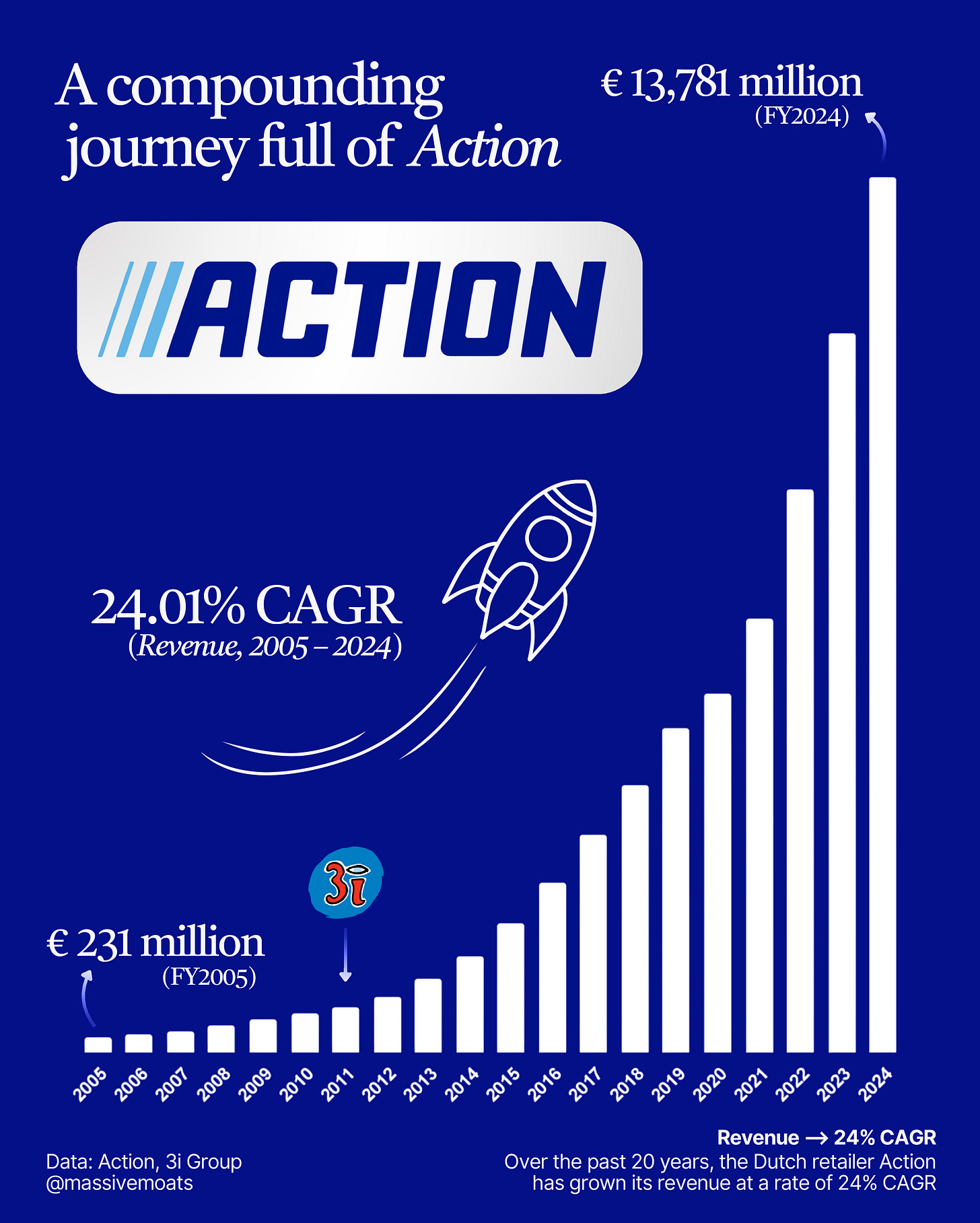

The Dutch discount retailer Action has been instrumental in 3i Group’s resurgence from the ashes of the 2009 financial crisis, during which it faced significant challenges and had to dilute its shareholders considerably. Thanks to the support of existing shareholders at the time, 3i Group persevered, enabling it to secure one of Europe’s most successful private equity deals in 2011: acquiring a majority stake in Action.

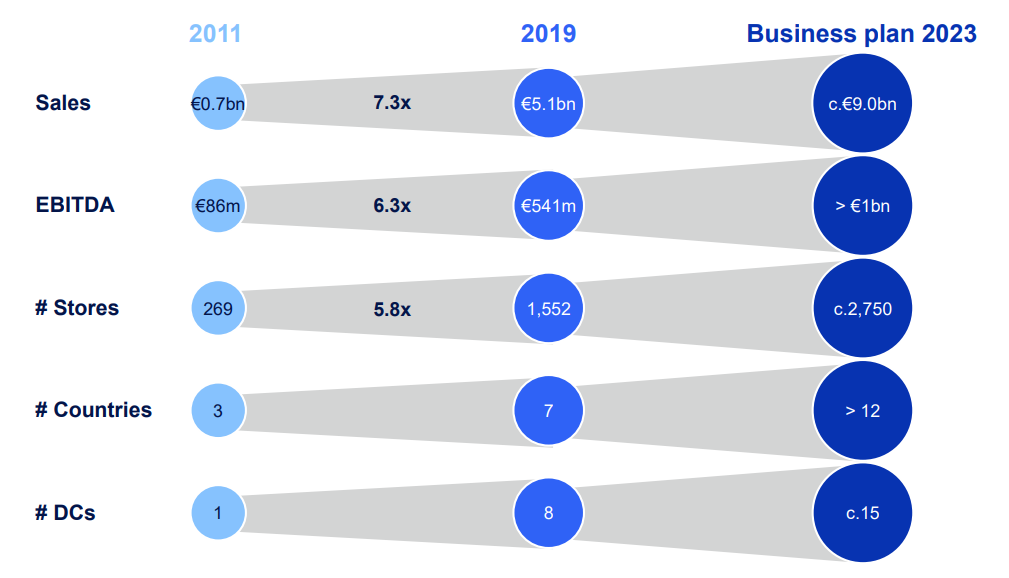

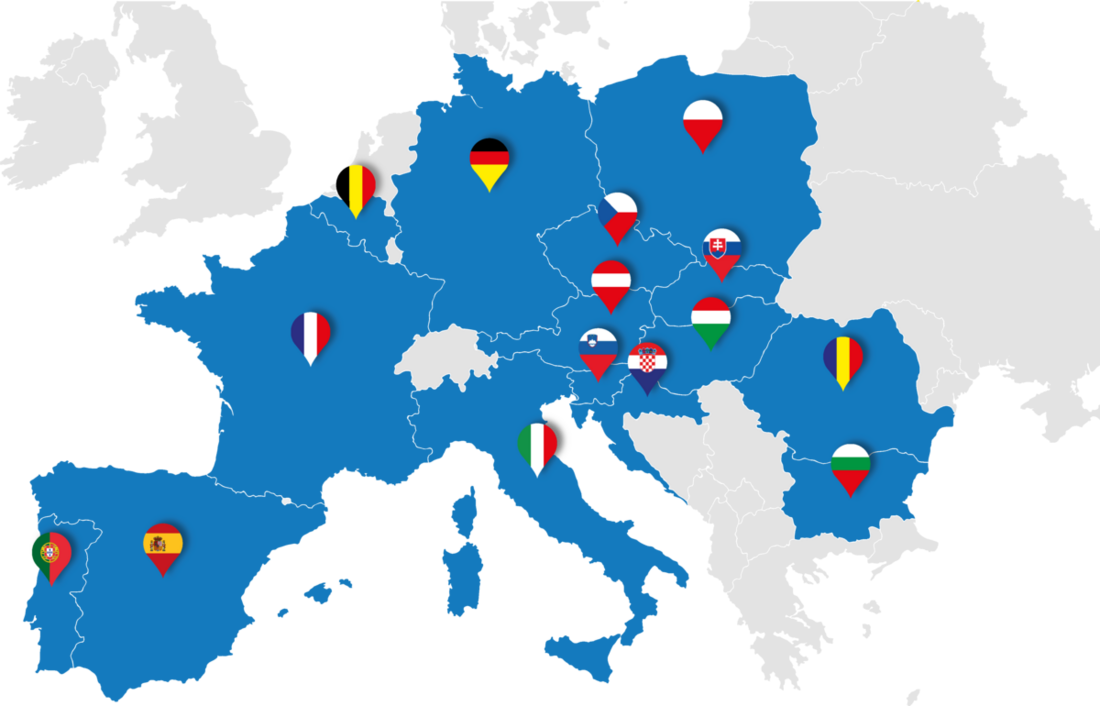

Under 3i Group’s leadership, Action has pursued significant expansion across Europe. From 269 stores in the Netherlands, Belgium, and Germany in 2011, it has since opened over 2,700 new stores across 12 European countries, serving more than 18.7 million customers weekly. This is a remarkable success story of Dutch origin, bolstered by British expertise.

Over a decade later, this partnership has proven to be a winning combination: 3i Group’s share price has risen significantly in recent years. This presents an opportune moment to explore 3i Group and Action in greater depth and reflect on this remarkable success.

I wish you an insightful read,

Eelze Pieters

Founder of Massive Moats

This deep dive is provided free of charge as a resource for everyone. For those who wish to support my work, a downloadable PDF version of this deep dive is available for purchase here: massivemoats.com

Chapter 1 | The History of 3i Group

To trace the origins of 3i Group, we must return to the 1940s in the United Kingdom. Shortly after the end of World War II, the predecessor of 3i Group was established: the Industrial and Commercial Finance Corporation (ICFC). The ICFC was founded by the Bank of England, in collaboration with the Treasury and several British banks (Copey & Clarke, 1995).

The ICFC was created to facilitate long-term investments for small and medium-sized enterprises (SMEs). In the years following World War II, the supply of capital was significantly insufficient to meet demand. The ICFC’s initial capital of £15 million (3i Group, 2025) was intended to complement the services provided by banks at the time. While banks primarily focused on providing loans for working capital, the ICFC’s capital was used to acquire long-term assets.

The ICFC was established to serve small and medium sized businesses through the provision of long term and permanent capital (typical investments of £5,000-£200,000). — 3i Group (2013)

Alongside the ICFC, the Finance Corporation for Industry (FCI) was also established, focusing on large corporations. In 1973, the ICFC and FCI merged to form Finance for Industry (FFI), which was later renamed Investors in Industry, or III—3i—in 1983 (Merlin-Jones, 2010).

In June 1994, 3i Group went public through an initial public offering (IPO). At that time, its owners—the Bank of England and several British banks—reduced their ownership by 45% through the IPO (Upi, 1994).

By then, 3i Group held investments in 3,400 companies, with a total portfolio value exceeding £2.5 billion. The highlights of the British investment company’s history are presented in the image below (3i Group, 2024).

While the predecessors of 3i Group initially focused on stimulating the British economy by providing long-term capital to businesses, 3i Group later expanded internationally, opening offices in Paris (1983), Frankfurt (1984), Singapore (1997), Amsterdam (1998), China and India (2005), New York (2007), and Brazil (2011) (3i Group, 2013; 2025).

The firm invested both its own capital on its balance sheet, as well as funds raised from investors through its managed funds, primarily to execute leveraged buyouts. However, following the 2008 financial crisis, 3i Group faced severe challenges. The company was overly leveraged, resulting in its NAV plummeting from £10.77 on March 31, 2008, to £4.96 on March 31, 2009 (diluted net asset value per ordinary share).

Leveraged Buyouts

A leveraged buyout (LBO) is the partial or full acquisition of a company, where a significant portion of the purchase price is financed through borrowed funds, with only a small portion contributed from equity. LBOs enable investment firms to undertake larger acquisitions with less committed capital. If the acquisition performs well and yields returns higher than the cost of the borrowed funds, the investor achieves amplified returns through this leverage. However, the downside is that if investment returns underperform, the debt burden can become unsustainable, leading to financial distress.

Net Asset Value (NAV)

The Net Asset Value (NAV) represents the net value of the assets of an investment company, typically expressed per share (NAV/share or simply NAV). This metric is calculated by summing the value of the company’s portfolio investments. These values may be estimated by the investment firm or aligned with market valuations for stakes in publicly listed companies. Cash holdings are added, and total debt is subtracted from this total. Further details on NAV are provided in the Valuation chapter.

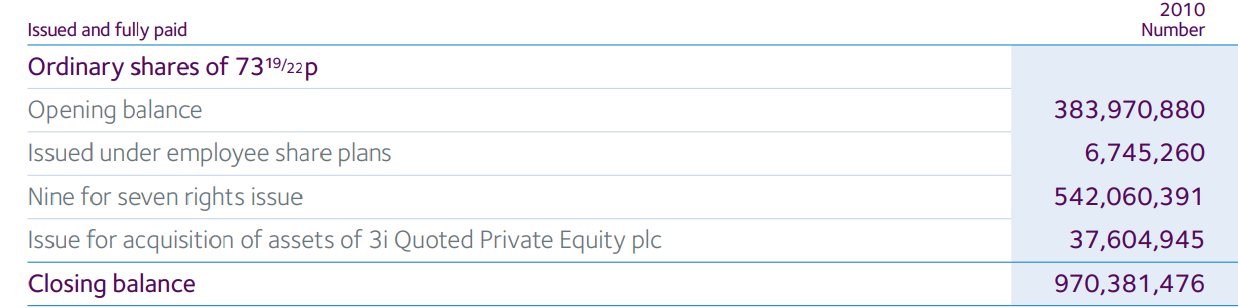

The high leverage proved unsustainable for 3i Group, forcing the company to raise additional capital in 2009 through a share issuance. It issued over 523 million new shares via a 9-for-7 rights issue (3i Group, 2009), allowing existing shareholders to purchase 9 new shares for every 7 shares held at the issue price. Shareholders who did not participate saw their ownership diluted. As a result, the number of outstanding shares increased by 542 million, reaching 970 million by March 31, 2010.

Additionally, 3i Group was compelled to divest its Venture Capital (VC) division, which focused on European VC investments, for approximately £130 million (Reuters, 2009). This marked its withdrawal from early-stage investments (Reuters, 2009).

The events surrounding 3i Group in 2008 were unfortunate. For long-term investors, crises often present opportunities for targeted investments. Nevertheless, this challenging period was a necessary turning point for 3i Group. By critically reflecting on past mistakes and learning from them, the company was able to reinvent itself—and with remarkable success.

Following the significant share issuance in 2009 and the appointment of Simon Borrows as Chief Investment Officer in October 2011—later announced as CEO in May 2012—3i Group embarked on a transformative journey:

We have made significant progress in the turnaround of 3i and this is demonstrated by our strong results. We are only one year into our three year strategic plan and there is plenty more that we are doing to drive performance and generate further shareholder value. — Simon Borrows (2013)

In addition to this three-year strategic plan, new frameworks were established for the company’s risk management:

Last year [2012], we implemented a new vintage control policy for the Group’s own balance sheet investments. This is designed to minimise the risk of overinvesting at the top of the private equity cycle in the future. In addition to monitoring investment and capital allocation within Private Equity, we have extended this approach to the rest of the Group and have combined it with our broader risk management framework which assesses and monitors other key risks for the Group. This forms part of our refined risk management approach which is more closely linked to our new strategic objectives. — 3i Group (2013)

In the years following the financial crisis, 3i Group underwent a thorough restructuring. Amid the ensuing turmoil, the company made a pivotal investment that would largely define its future success: Action. A simple press release on June 30, 2011 marked the starting point of a value creation worth tens of billions. This investment enabled 3i Group to rise like a phoenix from the ashes.

We look forward to working closely with the company [Action] to further develop and grow the business whilst maintaining its current entrepreneurial culture. We will help Action grow by opening new stores in the Netherlands, Belgium and Germany. We are present in these and other markets, and will use our knowledge, experience and network in Europe and the rest of the world to support Action. 3i is very excited about this investment. — 3i Group (2011)

With its 2011 investment in Action, 3i Group gained significant momentum, rewarding shareholders with a rapidly increasing intrinsic value of the company.

However, for those who invested during the 1994 IPO, the journey was not always smooth. The figure below illustrates the rollercoaster ride of 3i Group’s share price.

In September 2000, the share reached its then all-time high (ATH), only to plummet to its all-time low (ATL) eight years later, trading at over 90% below its 2000 peak.

Historical Returns

In 1994, 3i Group went public with an introductory price of 272 pence per share. At the time, the NAV per share was 314.40 pence, offering investors a 13.5% discount on the NAV (The New York Times, 1994).

Since the 1994 IPO, 3i Group shares have delivered a CAGR of 9.3% to its original shareholders. This figure reflects only share price appreciation, excluding the (special) dividend payments made since 1994.

Compound Annual Growth Rate

The Compound Annual Growth Rate (CAGR) represents the annualized growth rate of an investment over a specified period. As annual value changes can vary, and simply averaging these changes would provide an inaccurate picture, the CAGR accounts for the effects of compounding; the exponential growth.

It is calculated as follows:

CAGR =(End Value/Beginning Value)^(1/#years)-1

As of June 8, 2025, the share price of 3i Group is 4,265 pence. The NAV per share as of March 31, 2025, was 2,542 pence, representing a premium of 68% over the NAV.

Since 1994, 3i Group’s NAV has grown at a CAGR of 7.0%. With a share price return of 9.3% CAGR, this reflects an increasing premium of 3i Group’s market value relative to its NAV.

While investors at the time of the IPO could acquire shares at a 13.5% discount to the NAV, by June 2025, this has shifted to a premium of 68%.

Whether this significant premium of over 60% above 3i Group’s implied NAV is justified, will be explored in the chapter regarding 3i Group’s valuation. But first, we will delve deeper into 3i Group and its portfolio holdings.

Chapter 2 | Strategy

3i Group appears to have learned from the lessons of the period surrounding 2008. The company now focuses on businesses headquartered in Europe or North America (3i Group, 2025), while these businesses may operate globally. Through its portfolio companies, 3i Group indirectly maintains a global footprint, with operational activities spanning the world (3i Group, 2025).

2.1 | Long-term horizon

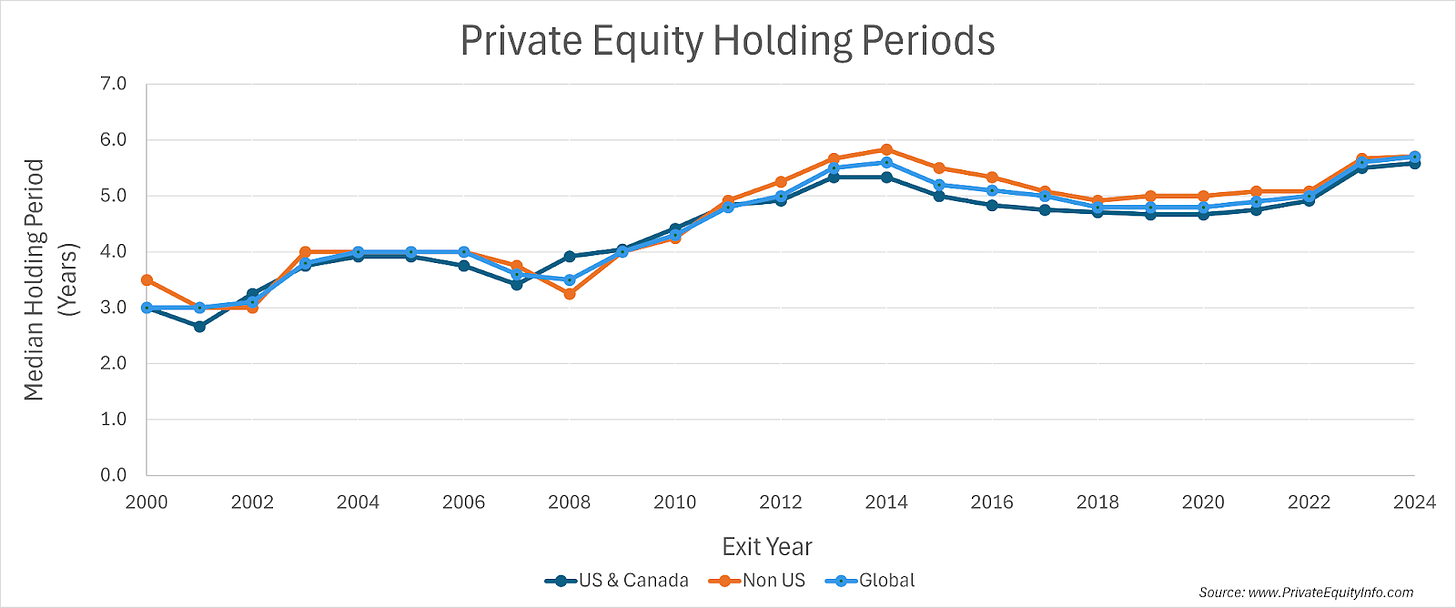

While most private equity firms have an average holding period—the duration for which a portfolio stake is held—of 5.7 years (Private Equity Info, 2024), 3i Group significantly exceeds this. For instance, it has held its stake in Action for 14 years now, choosing to expand its ownership in the Dutch retail chain rather than realizing profits.

Private Equity Info’s research on the average holding period from 2000 to 2024 is illustrated in the chart below. Their findings also indicate that it typically takes private equity firms 4–6 years to recover from macroeconomic shocks. This is largely because most private equity firms invest cyclically, following market sentiment. In down markets, they tend to hold their investments longer, as the prices they can obtain for their stakes are generally lower.

In contrast to other private equity firms, 3i Group explicitly emphasizes a long-term investment horizon:

We aim to compound value over time by investing in mid-market companies to create a diverse portfolio with strong growth potential. [...] Our proprietary capital affords us a medium to long-term investment horizon. We aim to compound our proprietary capital value through conviction in our best investments. — 3i Group (2025)

By exclusively investing its own capital in new companies (i.e., no longer using funds raised from third parties), 3i Group has full control over its investment timeline.

Over the years, 3i Group’s management has successfully implemented its renewed strategy within the company. However, changing a corporate culture is a multi-year process, including shifting employees’ mindsets to focus on the long term. Today, 3i Group takes pride in its people:

Our international teams are formed of local people with great knowledge and experience of their geography and sector. We view diversity as a strength and a plurality of perspectives enhances our origination, value creation and decision making. — 3i Group (2024)

2.2 | Geography & Sectors

We generate attractive returns for our shareholders and co-investors by investing in private equity and infrastructure assets. As proprietary capital investors, we have a long-term, responsible approach. We aim to compound value through thoughtful origination, disciplined investment and active management of our assets, driving sustainable growth in our investee companies. — 3i Group (2025)

The above paragraph is sourced from 3i Group’s annual report for the fiscal year 2025 (p. 3), covering the period from April 1, 2024, to March 31, 2025. This vision is reflected in 3i Group’s strategy, which can be summarized as allocating capital for the long term in mid-sized companies with an enterprise value typically ranging from €100 million to €500 million (at the time of acquisition) in its core markets of Europe and North America (3i Group, 2024, 2025).

Enterprise Value

The enterprise value (EV) of a company can be calculated by taking its market capitalization—determined by multiplying the number of outstanding shares by the share price—and then subtracting cash and adding debt.

For non-publicly listed companies, the enterprise value represents the total implied, self-estimated value of the business, including its net cash or debt position.

A detailed explanation of the enterprise value calculation is provided in the valuation section of this deep dive.

The objective of 3i Group is to enhance the value of investments through organic growth and growth via acquisitions.

We create value from the portfolio through active asset management and organic and acquisition growth. — Simon Borrows, CEO (2025)

In this context, 3i Group aims to create additional value through acquisition-driven growth, as well as fostering organic growth in its portfolio companies. These portfolio companies may, in turn, pursue their own acquisitions, with 3i Group playing an advisory and guiding role, and often screening the market for new add-on acquisition candidates. This approach is commonly referred to in industry jargon as a buy-and-build strategy.

Buy-and-build strategy

A buy-and-build strategy is one of the merger and acquisition (M&A) strategies pursued by a private equity firm. This strategy involves a private equity investor acquiring a portfolio company to serve as a platform for subsequent acquisitions (known as add-ons). These add-ons are integrated into the platform company, which is used as a foundation to expand within a specific segment of an industry.

3i Group adopts a medium- to long-term investment horizon (2025, p. 16). It seeks to acquire significant stakes, typically securing a majority or substantial minority interest, often accompanied by one or more board seats.

3i Group focuses on its sectors Consumer & Private Label, Healthcare, Industrial, and Services & Software. The company describes its approach as broad and flexible, yet investing solely in businesses that can capitalize on long-term structural growth trends (2025, p. 16).

The investor is also highly selective, making only a limited number of investments annually in sectors where it has established expertise and networks (2025, p. 16). As of March 31, 2025, 3i Group employs 223 people worldwide, describing its culture as ambitious, rigorous and energetic, built on principles of respect, integrity, and accountability (2024, p. 19).

As a publicly listed investor, 3i Group’s long-term objective is to generate attractive returns on invested capital, thereby growing shareholders’ capital through the value creation it facilitates.

We will only deploy capital and realise assets when we feel we are achieving optimal value for our shareholders. — David Hutchison, Chair Board of Directors (2024, p. 5).

After acquiring a stake in a company, 3i Group collaborates on its growth plans, acting not only as an investor but also as an advisor and strategic partner. This often involves securing a board seat or restructuring the portfolio company to optimize its growth trajectory, always with a focus on long-term value creation for 3i Group’s stakeholders.

Once invested, we work closely with our portfolio companies to deliver ambitious growth plans and aim to compound value from our best investments over the longer term. — 3i Group (2025, p. 21)

Chapter 3 | Portfolio 3i Group

The portfolio of 3i Group comprises three main components (valued as of March 31, 2025):

Private Equity (£23.6 billion);

Infrastructure (£1.5 billion);

Scandlines (£0.5 billion).

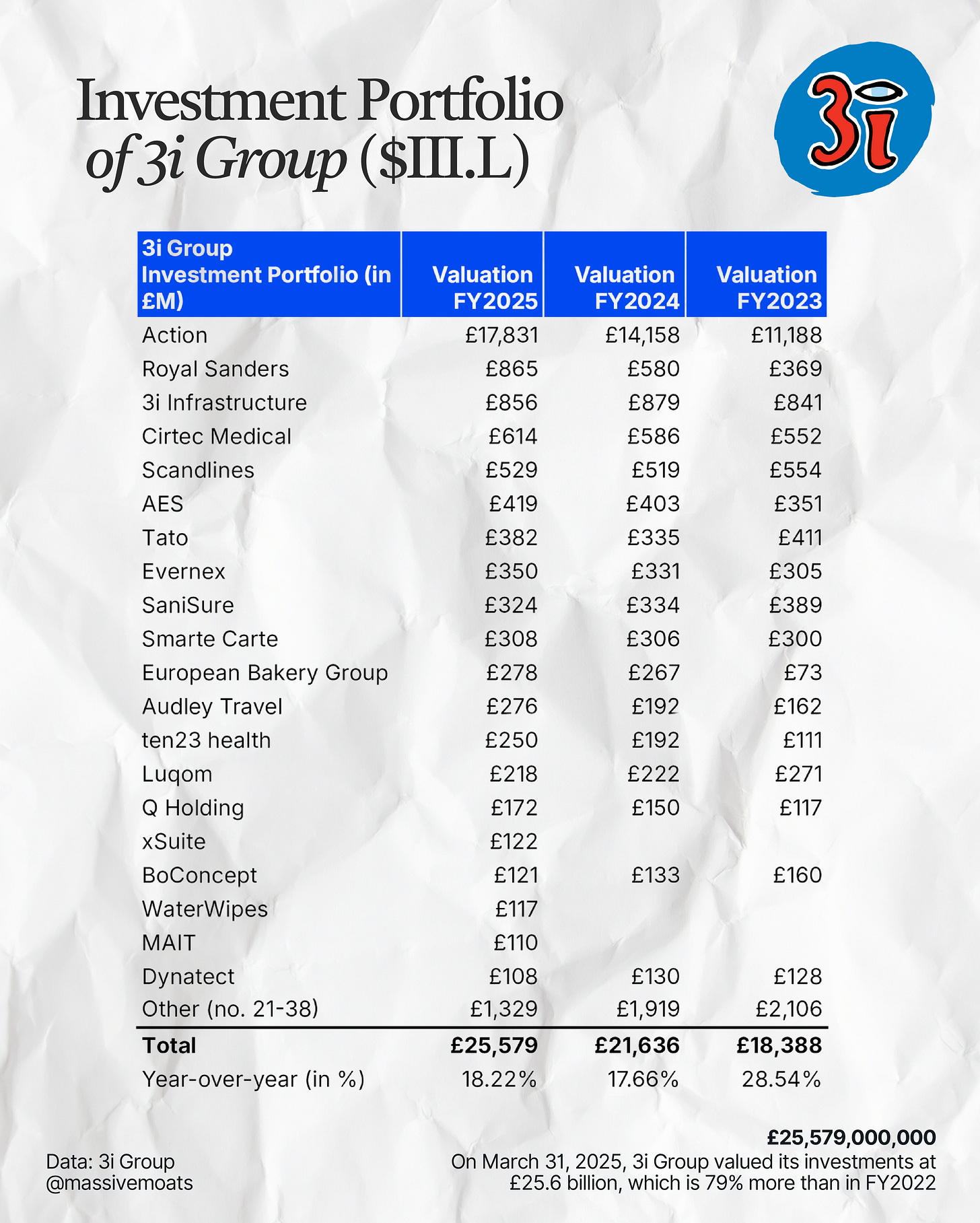

Below is an overview of 3i Group’s 20 largest holdings, derived from 3i Group’s Annual Report over FY2025.

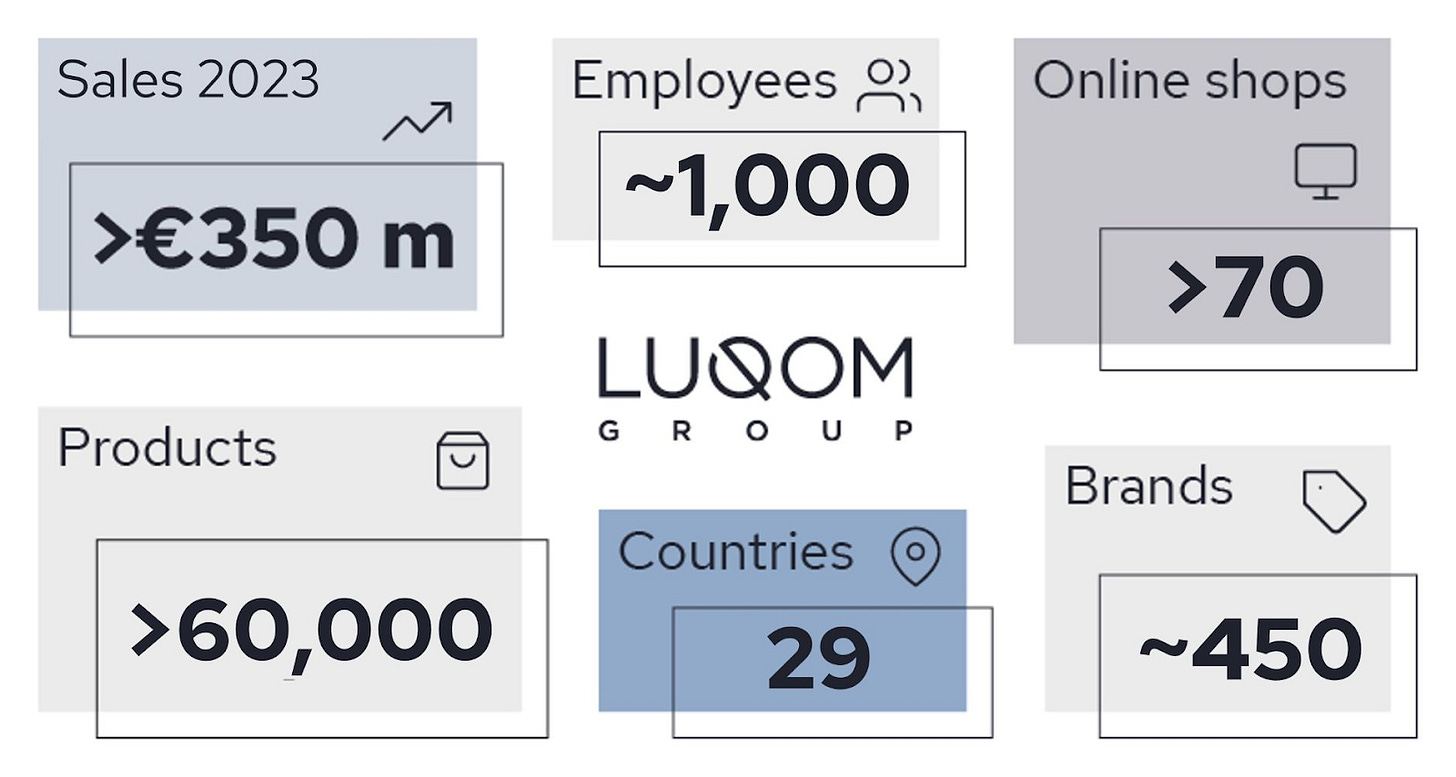

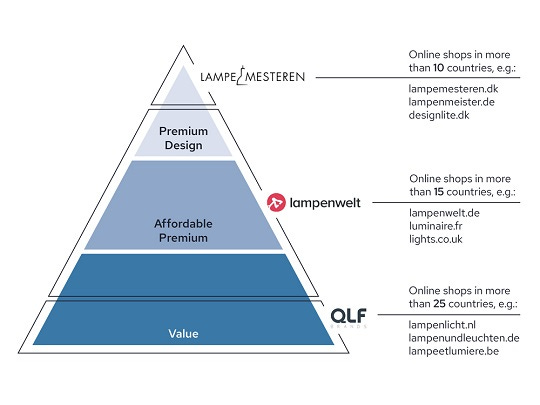

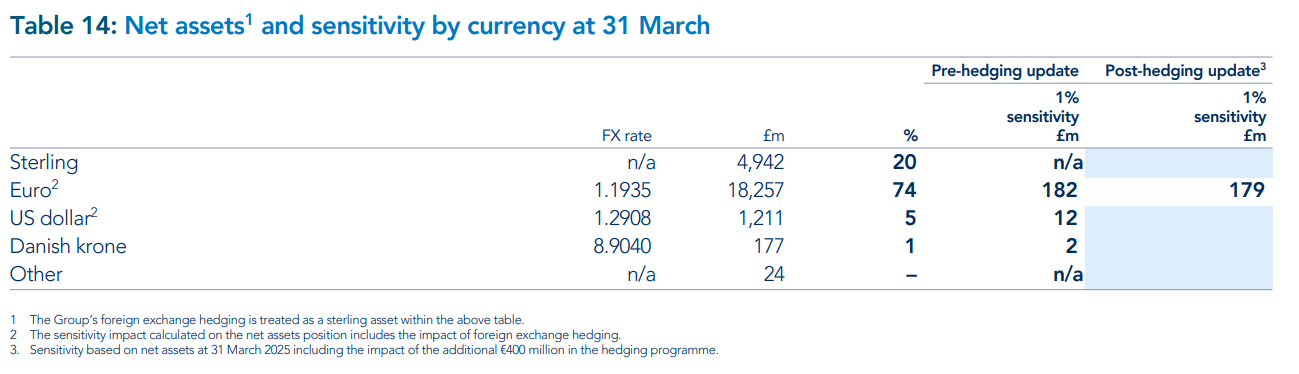

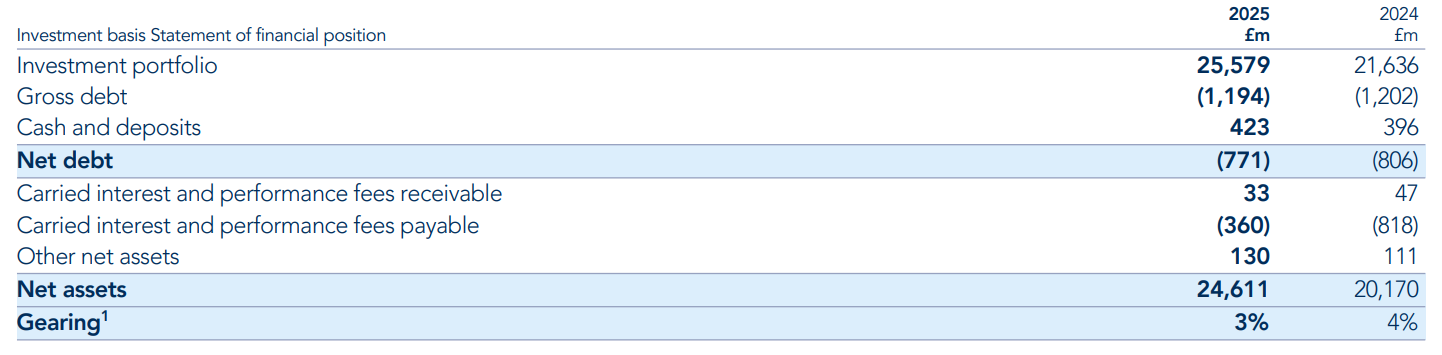

Over 90% of the total portfolio value is represented by the Private Equity portfolio. The majority of this portfolio’s value is derived from Action, which has an implied value of £17.8 billion. More on this later. Let us begin by examining the smaller holdings, 3i Infrastructure and Scandlines.

3i Infrastructure (£1,492 million) comprises a 29% stake in the publicly listed 3i Infrastructure (ticker: 3IN.L), valued at £856 million (based on the closing price as of March 31, 2025), as well as an investment in the portfolio company Smarte Carte (valued at £308 million using a discounted cash flow method) and £328 million in other infrastructure funds. The latter includes investments in infrastructure companies across Europe and North America, spanning the sectors of Communications, Energy, Social Infrastructure, Transport & Logistics, and Utilities (3i Infrastructure, 2025).

3i Infrastructure went public in March 2007 (3i Infrastructure, 2007). Its objective is to deliver an annual return of 8–10% for its shareholders (3i Infrastructure, 2025).

Since its IPO, 3i Infrastructure has achieved a Total Shareholder Return of 10.9% CAGR, compared to 6.0% CAGR for the FTSE 250 Index (3i Infrastructure, 2025). Currently, 3i Infrastructure holds 11 companies in its portfolio, each weighted between 3% and 17% (3i Infrastructure, 2025).

Scandlines (£529 million) represents a 35% stake in the eponymous ferry operator between Germany and Denmark. In 2018, 3i Group sold its Scandlines holding (partially from its Eurofund V fund) for €1.7 billion to First State Investments and Hermes Investment Management (3i Group, 2018). Subsequently, it reacquired a 35% stake to support further growth and sustainability initiatives for the ferry operator.

In early 2018, Scandlines was valued at £1,204 million in its entirety. As of March 31, 2025, its implied value stands at £1,511 million, reflecting a CAGR of 3.2% (from January 1, 2018, to March 31, 2025, excluding dividends received). Since this transaction, Scandlines has been recorded as a separate investment in 3i Group’s books, alongside its Infrastructure and Private Equity portfolios.

While 3i Infrastructure and Scandlines account for 5.8% and 2.1% of 3i Group’s total investment value, respectively, the Private Equity portfolio constitutes the majority, representing 92.1%.

3i Group Private Equity (£23,558 million)

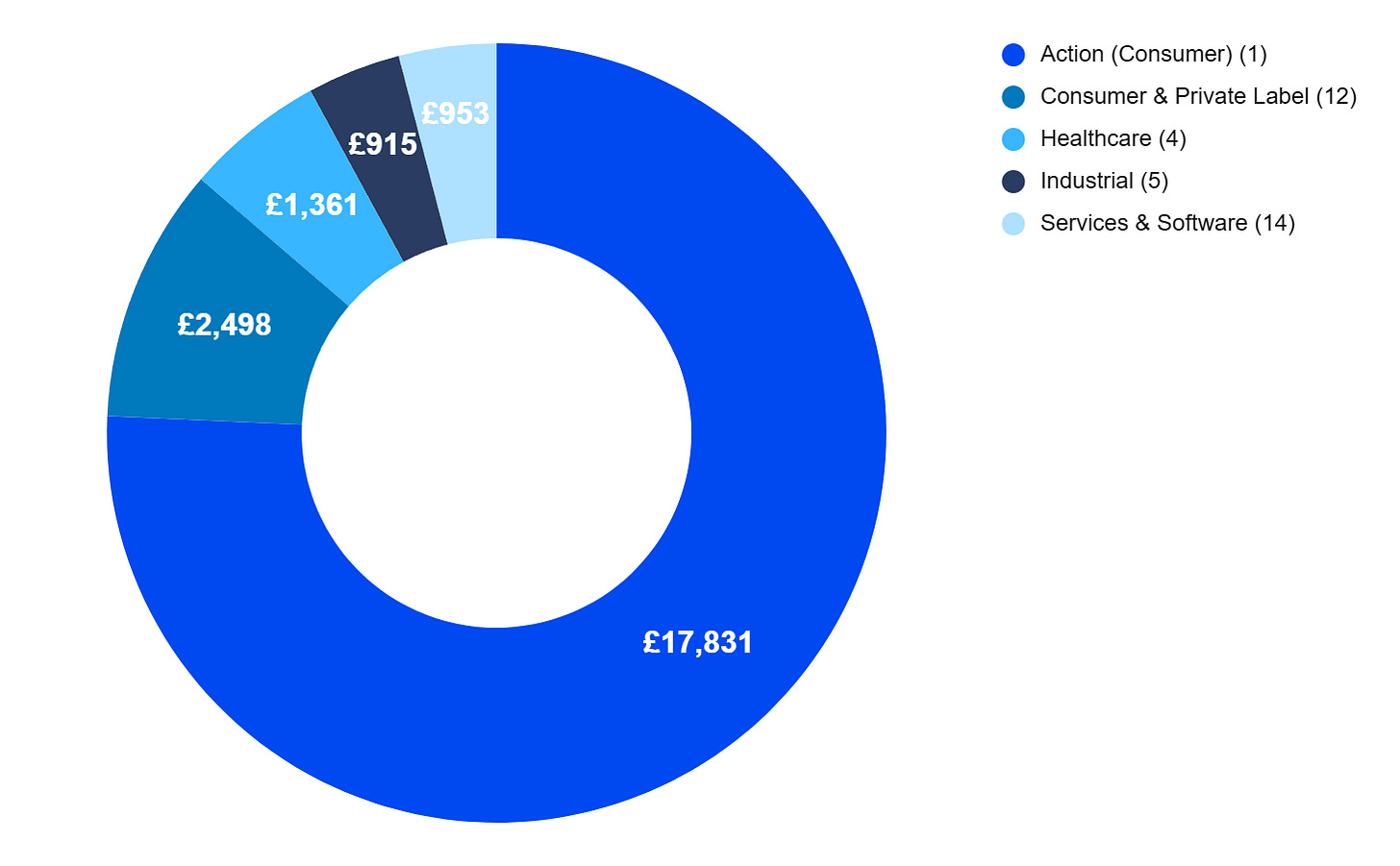

The Private Equity portfolio of 3i Group can be broken down into the following sectors, with values as of March 31, 2025 (and the number of portfolio companies):

Action (Consumer): £17,831 million (1);

Consumer & Private Label: £2,498 million (12);

Healthcare: £1,361 million (4);

Industrial: £915 million (5);

Services & Software: £953 million (14);

(In previous 3i Group reports, Services and Software were sometimes referred to separately or collectively as Business & Technology Services, Industrial was listed as Industrial Technology, and Consumer & Private Label was referred to as Consumer.)

A schematic view is provided below:

Action accounts for 76% of the Private Equity portfolio. Given that the Private Equity portfolio represents 92.1% of 3i Group’s total investment value, Action constitutes 69.7% of all 3i Group’s investments.

The total Private Equity portfolio of 3i Group comprises 36 portfolio companies. Together with Infrastructure and Scandlines, it forms the portfolio allocation of 3i Group, as displayed in the visual on the next page.

3i Group → Action

72.5% of 3i Group’s total implied NAV is attributed to its 57.9% stake in Action. Consequently, an investment in 3i Group is, to a significant extent, an investment in Action. When considering that the premium currently paid for 3i Group shares on the stock market is likely largely attributable to Action, the Dutch retailer accounts for an even higher weighting.

With 3,000 stores across 12 European countries, serving 18.7 million customers weekly, Action has become a resounding success for 3i Group.

Chapter 4 | Action

4.1 | The Origin of Action

To trace the origins of Action, we must go back to the Dutch village of Enkhuizen in 1993, in the province of North Holland (The Netherlands). Here, Gerard Deen and Rob Wagemaker laid the foundation for what would become a thriving European retail chain in just a few decades (Action, 2025).

In July 1993, the first Action store opened in Enkhuizen. This venture was spearheaded by Gerard Deen, an antiques dealer, and Rob Wagemaker, who had experience in the supermarket industry procuring non-food products. As a young man in his twenties, Gerard Deen ran an antiques shop but struggled to source compelling inventory (MT/Sprout, 2014). With the assistance of Rob Wagemaker, who brought his expertise as a buyer, they joined forces and began sourcing (surplus) stock at low prices.

This first store quickly proved to be a resounding success. Residents of Enkhuizen visited the shop with great curiosity, eager to discover the latest items the duo had acquired. Fueled by their entrepreneurial spirit, the store was continually restocked with new products, attracting local residents and those from surrounding areas to frequently check for new arrivals. The allure was heightened by the fact that once an item sold out, it was often gone for good.

This success prompted the duo—soon joined by Boris Deen, Gerard’s brother—to expand by opening additional stores across the province of North Holland. The concept resonated similarly in the towns and cities where new stores were established, leading to rapid growth. Within a decade, approximately 100 stores were opened.

Under the leadership of Rob Wagemaker, Gerard Deen, and Boris Deen, Action grew from a single store in 1993 to 100 stores by 2003. That same year, a distribution center was established in Zwaagdijk, where Action’s headquarters remain to this day.

In 2005, Action expanded internationally, opening its first store in Belgium. By the end of that year, the company operated 127 stores. Between 2005 and 2011, the number of stores more than doubled to 269, achieving a CAGR of 13.3%. On July 30, 2011, it was announced that 3i Group, together with the capital from one of its funds—which were still part of 3i’s business model at the time—acquired a majority stake in Action (3i Group, 2011).

In the joint press release issued by Action and 3i Group at the time, Action’s founders commented on the acquisition by 3i Group:

Action has significant growth opportunities in the Netherlands and abroad. We know the consumer demand is there. To seize these opportunities we now need to accelerate growth and 3i will help us in this respect. That is good news for our customers and our staff. It means more consumers will soon be able to experience what Action has to offer and that shopping can be more than just fun—it can also be surprising and cheap. At Action you can always find cool, new items that are excellent value too. That is and remains our goal. — Founders of Action (3i Group, 2011)

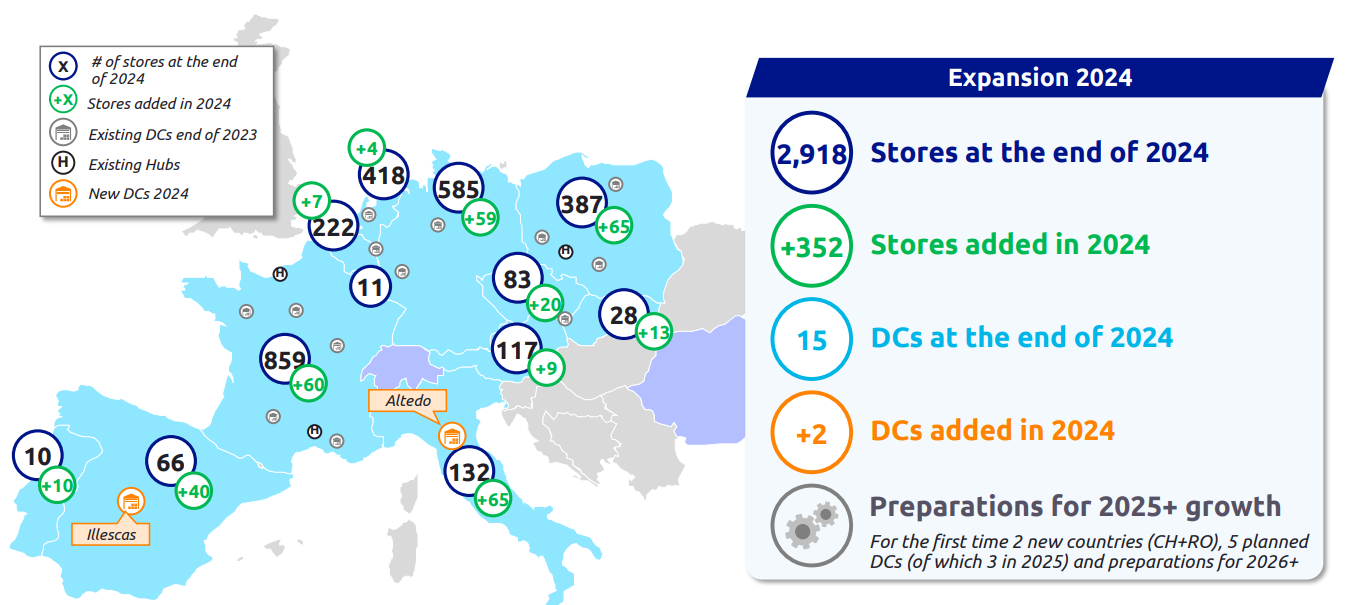

Since the 2011 buyout by 3i Group, the number of Action stores has grown by approximately 2,600 to 2,918 as of December 31, 2024, representing a growth of 20.1% CAGR over this period. This underscores 3i Group’s pivotal role in accelerating Action’s expansion.

The results have been remarkable. While 3i Group and its fund investors reportedly paid around €500 million for Action in 2011, the company is now valued at £31 billion (€36.5 billion) by 3i Group, and even more by investors as the NAV of 3i Group trades at a premium. Furthermore, Action’s owners have received substantial dividend payments in recent years. 3i Group has utilized these dividends, among other resources, to increase its stake in Action by acquiring shares from other existing shareholders and former fund investors. Action is poised to be recorded as one of the most successful private equity transactions in European history.

4.2 | Business Model

Action’s business model is straightforward: consistently procure non-food and food products—with a smaller portion of the assortment comprising pet food, snacks, and soft drinks—at competitive prices and distribute them across its stores. In essence, the strategy revolves around sharp procurement, cost-efficient distribution, and effective sales.

The foundations of this approach have remained largely unchanged since Action’s early years. The company continues to negotiate astutely with suppliers to secure the best possible prices, ensuring affordability for its customers. This responsibility is deeply ingrained in Action’s workforce, who are committed to delivering the lowest prices while sustaining the significant consumer surplus that defines Action’s value proposition. When combined with an element of surprise—where customers are delighted by new product offerings during each store visit—this creates a retail concept that is exceptionally robust.

The element of surprise, paired with competitive pricing, is fundamental to Action’s enduring success. Retailing, in itself, is not a complex science, with many concepts that come, but also often go.

While Dutch concepts like Big Bazar and Blokker succumbed to bankruptcy, Action has thrived in the physical retail landscape. The majority of the product ranges at retailers like Blokker and Big Bazar were predictable: consumers knew what to expect and typically visited these stores with 1) a specific purpose in mind, and 2) purchased only what they needed. In contrast, Action’s customers frequently leave the store with more items than they initially planned to buy, driven by the appeal of its dynamic assortment and value-driven pricing.

4.2.1 | Stores

Action generates its revenue through its network of over 3,000 stores (as of June 2025) and an online webshop. As of June 8, 2025, Action’s Dutch-language webshop listed 215 products, with prices ranging from €9.95 to €699. No data is available on the sales contribution of the webshop, but it is likely marginal, as I estimate that Action’s primary revenue is derived from its physical stores.

To maintain operational excellence, Action focuses on ensuring that existing stores operate efficiently and effectively. This includes modernizing its current store portfolio while actively seeking new, strategically advantageous locations in towns and cities. An example of this strategy is the relocation of the store in Purmerend (The Netherlands) detailed below.

As part of my deep dive analysis, I visited several Action stores in the Netherlands, including both modernized and non-modernized locations. The differences between these stores were immediately evident to me as an observer. However, customers—especially those who predominantly shop at just one location—may not perceive these distinctions as clearly.

At Action, customers seek new, surprising products at the lowest possible prices. The store environment plays a critical role in reinforcing this low-price perception. Modernized stores, with their improved lighting, clean shelving, and optimized aisle widths, create a sleek and inviting atmosphere without compromising the budget-friendly shopping experience. In my view, these enhancements encourage customers to make additional purchases, thereby reinforcing Action’s value proposition.

During my store visits, I evaluated several factors. I selected a range of branded products and compared their prices with those at nearby competitors, such as supermarkets and drugstores, with findings discussed below. Additionally, I observed customer shopping behaviors, employee workflows, interactions among staff, and their engagement with customers. (For context, I have prior experience working in various roles at two supermarkets and a wholesaler, including shelf stocking, sales processing, order picking, and team leadership.)

In fact, Action’s store operations mirror those of a supermarket: customers deplete inventory throughout the day, occasionally inquiring about product locations or restocking timelines, and complete their purchases at the checkout. By evening, a restocking team replenishes shelves with products delivered from the distribution center, ensuring readiness for the next day.

The average Action store has a sales area of c.900 square meters. Store locations are strategically selected within areas having a catchment exceeding 40,000 (3i Group, 2025).

4.2.2 | Assortment

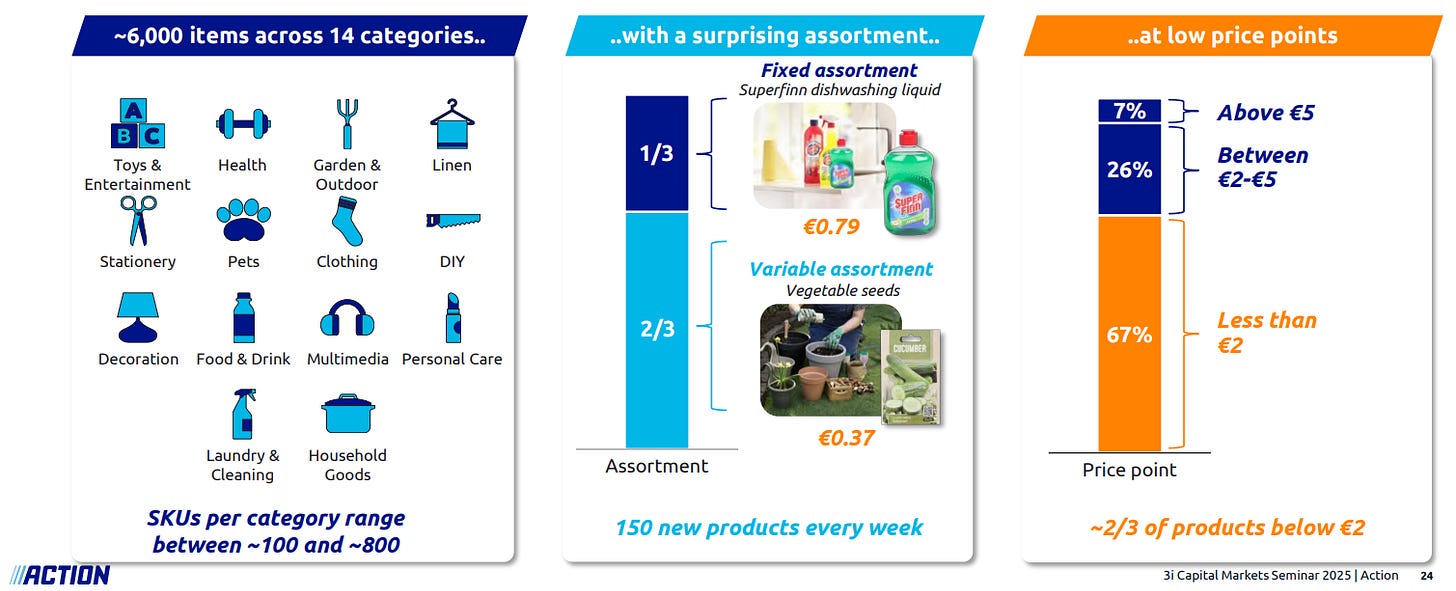

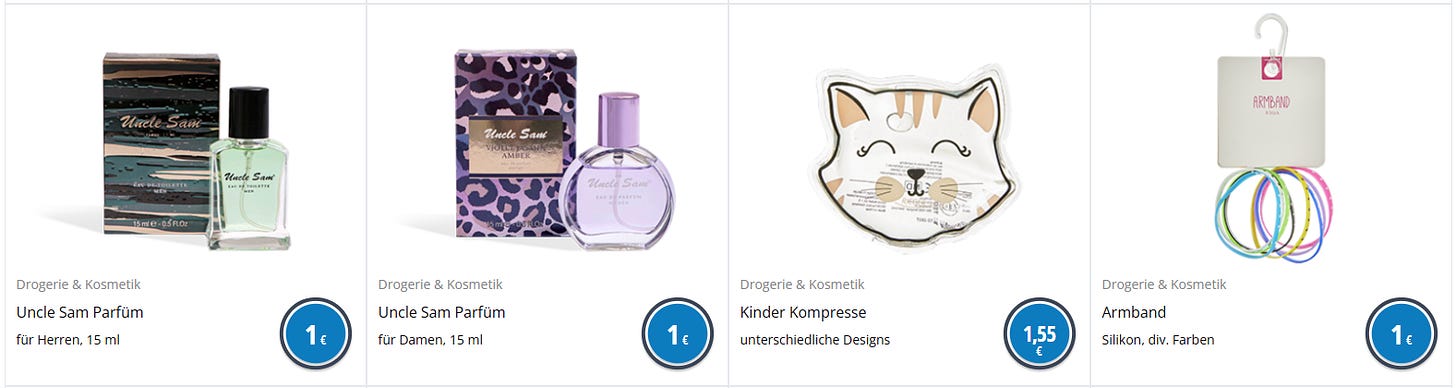

Action offers products across 14 categories (see image above). The company maintains approximately 6,000 individual Stock Keeping Units (SKUs), each representing an unique product with its own barcode. Notably, only one-third of Action’s SKUs form a fixed part of its product assortment.

Two-thirds of Action’s product assortment is variable and subject to regular changes. Each Action store receives approximately 150 new products weekly, including seasonal and themed items for spring, summer, Halloween, and Christmas, as well as one-off products that the company can procure at highly competitive prices.

In addition to the 14 product categories mentioned previously, Action’s assortment can be segmented into 3 groups: branded products (A-brands), white labels, and private labels.

A-brands

The inclusion of A-brands enhances the perception of a high-quality assortment. By offering well-known A-brand products, Action enables consumers to directly compare its pricing against competitors, reinforcing its commitment to low prices. Furthermore, A-brands purchased in bulk—mostly custom made packaging and stocklot traders—allow Action to offer these products at exceptionally competitive prices, creating a treasure hunt experience that encourages customers to hunt for bargains.

Action sells well-known A-brands familiar to consumers in Europe, such as Lotus biscuits, Whiskas cat food, Mars and M&M’s chocolates, Listerine mouthwash, and local A-brands such as Robijn laundry detergent and Dreft dishwashing liquid.

Based on my price comparisons of A-brand products, Action consistently offers lower prices than competitors. For instance, a pack of Lotus biscuits is priced 16.5% higher at the Dutch supermarket Albert Heijn than at Action. Similarly, a 135-gram bag of M&M’s is 36.5% more expensive at supermarkets (Albert Heijn, €2.99; Plus, €2.99) compared to Action (€2.19).

These comparisons involve products that are part of Albert Heijn’s regular assortment and may also be consistently available at Action (at least available for longer periods than seasonal items).

Additionally, Action acquires batches of A-brand products that are discontinued from the regular assortments of supermarkets and drugstores, such as limited-edition Robijn laundry detergent.

The Robijn Special as displayed above is explicitly a limited-edition product available only for a limited period.

When Unilever—Robijn being one of its brands—introduces a new limited-edition variant of its Robijn laundry detergent, it discontinues supply of the previous special to its customers, such as supermarkets, to make room for the new variant. If Unilever has residual stock in its warehouses, a retailer like Action provides a solution. Action can purchase these batches at highly competitive prices due to its substantial distribution capacity, enabling it to acquire large volumes of surplus inventory in a single transaction. This frees up warehouse space for Unilever while allowing Action to offer these products to customers at significantly reduced prices. For instance, in the case of the aforementioned Robijn laundry detergent, Action’s price is 70% lower than that of the Plus supermarket in the same town, offering a high consumer surplus for its customers.

White Labels

White label products are manufactured by third-party producers and branded with a label chosen by Action. These products, with different labels, may also appear at other retailers. The contents remain identical, with only the labeling differing.

White label products enhance Action’s assortment, particularly for seasonal items, by providing flexibility in procurement and inventory management. The ability to scale purchasing up or down allows Action to maintain optimal stock levels, which in turn reduces costs.

Private Labels

Action’s assortment also includes private label products, which are manufactured exclusively for Action by external producers. This allows Action to exercise direct control over the entire procurement process. Through its private labels, Action can offer a highly competitively priced product range. As of 2024, Action’s 73 private labels have frequently received accolades across various product categories (Action, 2025). For instance, the towels sold under the Hotel Royal brand have been recognized for their quality. The Hotel Royal private label is positioned with the following motto [translated]:

Treat yourself to the luxury and comfort of a hotel at home. With the elegant towels and duvet covers from Hotel Royal, you can experience that hotel feeling at home for a fraction of the price. — Action (2024)

Other award-winning private label products include makeup under the Max & More brand, cleaning products under Superfinn, tissues under Pure Soft, and paint under the Spectrum label (Action, 2025).

Having established a deeper understanding of Action’s product assortment, it is now time to examine the second pillar of Action’s business model further: pricing.

4.2.3 | Pricing

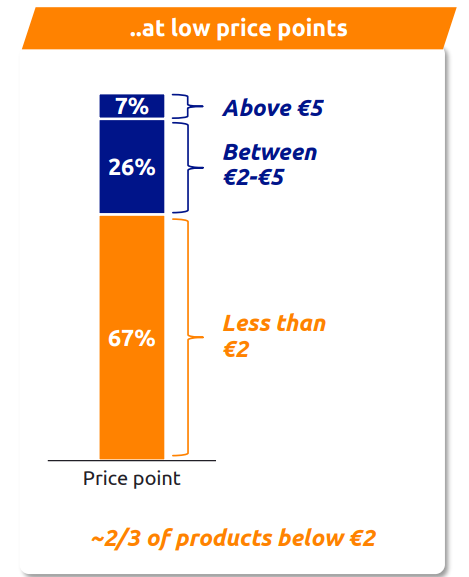

67% of Action’s assortment of around 6,000 products is priced below €2, while only 7% of products carry a price tag above €5 (Action, 2025).

This pricing strategy establishes a foundation for the bargain hunting experience, with Action’s price points significantly shaping consumer perception of value.

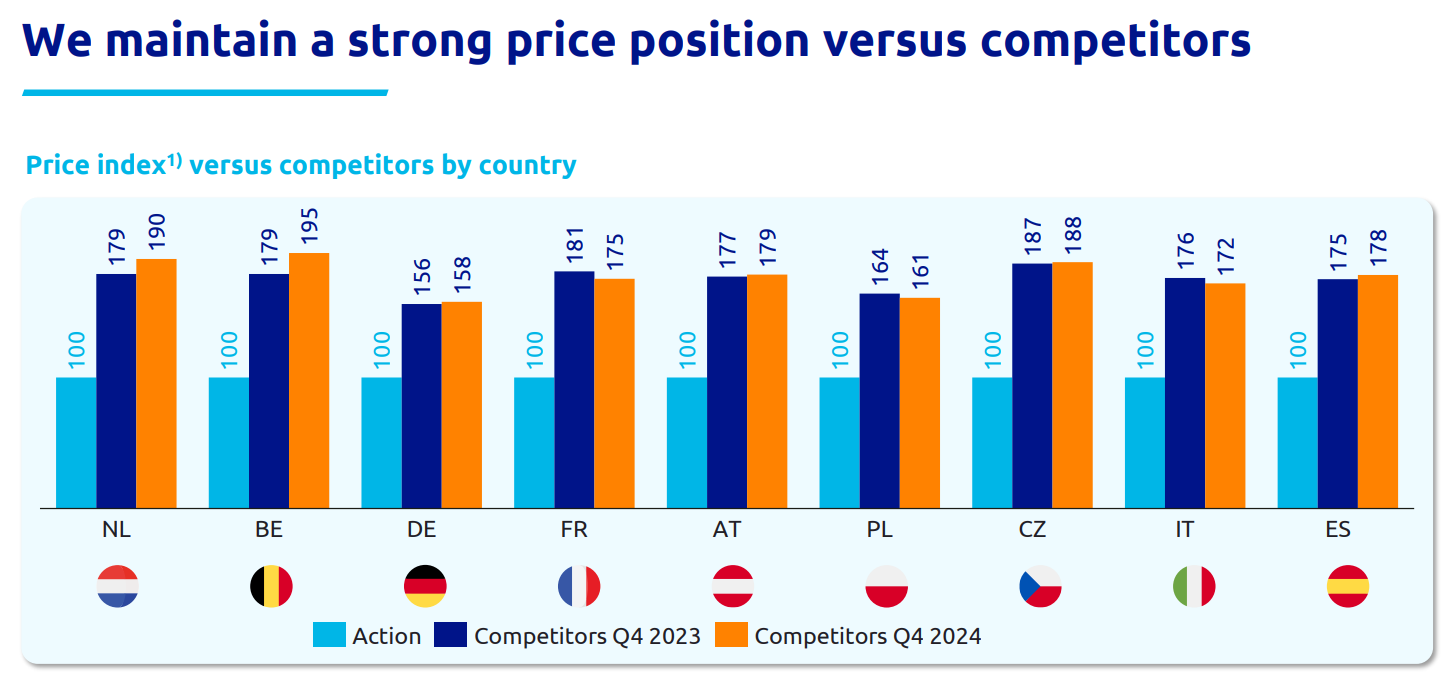

As observed earlier with specific product’s price comparisons, Action’s comparable products are priced lower than those of competing retailers. This is further illustrated in the figure below, compiled based on price comparisons of 1,500–2,000 similar products offered by Action’s competitors, with distinctions made by country.

In the Netherlands, competitors’ product prices are 90% higher than those at Dutch Action stores. This price gap has widened by 11 percentage points since Q4 2023 and by 22 percentage points since Q4 2022.

Across Europe, the price differential ranges from 58% to 95%, with Germany exhibiting the smallest gap at 58%. Unlike in the Netherlands, where supermarkets and drugstores frequently offer promotions, such discounts are less common in Germany.

On November 14, 2024, the Dutch financial newspaper ‘Het Financieele Dagblad’ published an article citing research by Circana, which revealed that nearly 60% of Dutch drugstore revenue now stems from promotional offers. The article also quoted Gerard Spierenburg from the Dutch Consumentenbond, who noted that personal care products in Germany are, on average, 50% cheaper. It further stated that the base price of products in the Netherlands, excluding promotions, is approximately 25% lower. Additionally, Laurens Sloot, Professor of Retail Entrepreneurship at the University of Groningen, highlighted that around 25% of an average Dutch supermarket’s revenue currently comes from promotions, up from 14% twenty years ago.

Action, by contrast, does not rely on promotional discounts to drive sales; instead, it maintains consistently low fixed prices. However, the company does introduce weekly campaigns to highlight new products, often including seasonal, themed, or bulk items, within its assortment.

Unlike retail concepts such as the Dutch Hema, Eurowinkels, certain drugstores, or discount stores, which predominantly use uniform pricing (e.g., €2, €4, €0.99, or €1.99), Action prices its assortment based on the cost of procurement plus a margin. This results in product prices such as €1.23, €1.52, or €1.11, which, in the interest of the customer, are not rounded up to the nearest €1.49 or €1.99. That said, Action’s assortment also includes many products priced at figures like x.x9 or x.95.

In 2024, Action reduced the prices of 2,000 products (3i Group, 2025), following price cuts on 2,500 products in 2023 (Action, 2024). These initiatives underscore Action’s commitment to prioritizing the customer, a principle embedded in its six core values.

4.3 | Core Values, Customer Satisfaction, and Customer Segments

4.3.1 | Core Values

Action’s core values are built on six key pillars: customer focus, teamwork, simplicity, discipline, cost-consciousness, and respect (Action, 2025).

Customer Focus

The customer comes first in everything we do. We offer a surprising assortment of good quality products at the lowest possible prices. With our customers’ interests in mind, we keep costs as low as possible. The value Customer Focus guides everyone at Action, not just our staff working in the stores.

Teamwork

We believe that teamwork gets the best results. It is important to offer to help each other, because together we can achieve more. As a team, we share ownership, we have common goals, and our deliverables are clear. Successes and disappointments are to be shared, and we address issues within the team immediately – transparently and respectfully.

Simplicity

In a rapidly growing organisation, losing simplicity – one of our original strengths – is a big risk. Many larger organisations become political, complex and bureaucratic and lose their edge. Maintaining simplicity does not mean idealising a lack of structure. Quite the contrary: making and keeping things simple requires structured, controlled ways of working across large parts of our business.

Discipline

Discipline encompasses all of Action’s values. When we are disciplined, we are on time and prepared for meetings, which is respectful to others and also enhances teamwork. Being disciplined and sticking to the rules means we are cost conscious and keep things simple. Most importantly, we are disciplined in always keeping the customers’ interests at the forefront of our minds.

Cost conscious

This is the cornerstone of our business model. Cost consciousness is not about not spending money; it is about spending money efficiently and keeping costs low, all in the interest of our value proposition to customers. We want to use simplicity and scale to save money and offer the lowest prices. This is a key value that guides us in staying humble.

Respect

Respect is what we owe each other as human beings. This value is important when it comes to customers, colleagues and business partners. Combining sympathy and kindness with direction and clarity to create a sense of belonging and safety. We maintain a culture in which giving and receiving constructive feedback is always considered a sign of respect.

Unsurprisingly, Customer Focus ranks first among Action’s six core values. The other five values—teamwork, simplicity, discipline, cost-consciousness, and respect—also directly benefit the customer. By maintaining a straightforward business model and culture, coupled with a deliberate emphasis on minimizing overhead costs, Action achieves lower operational expenses. This approach inherently creates greater flexibility to offer competitive pricing, enabling Action to surpass more expensive retail chains.

4.3.2 | Customer Satisfaction

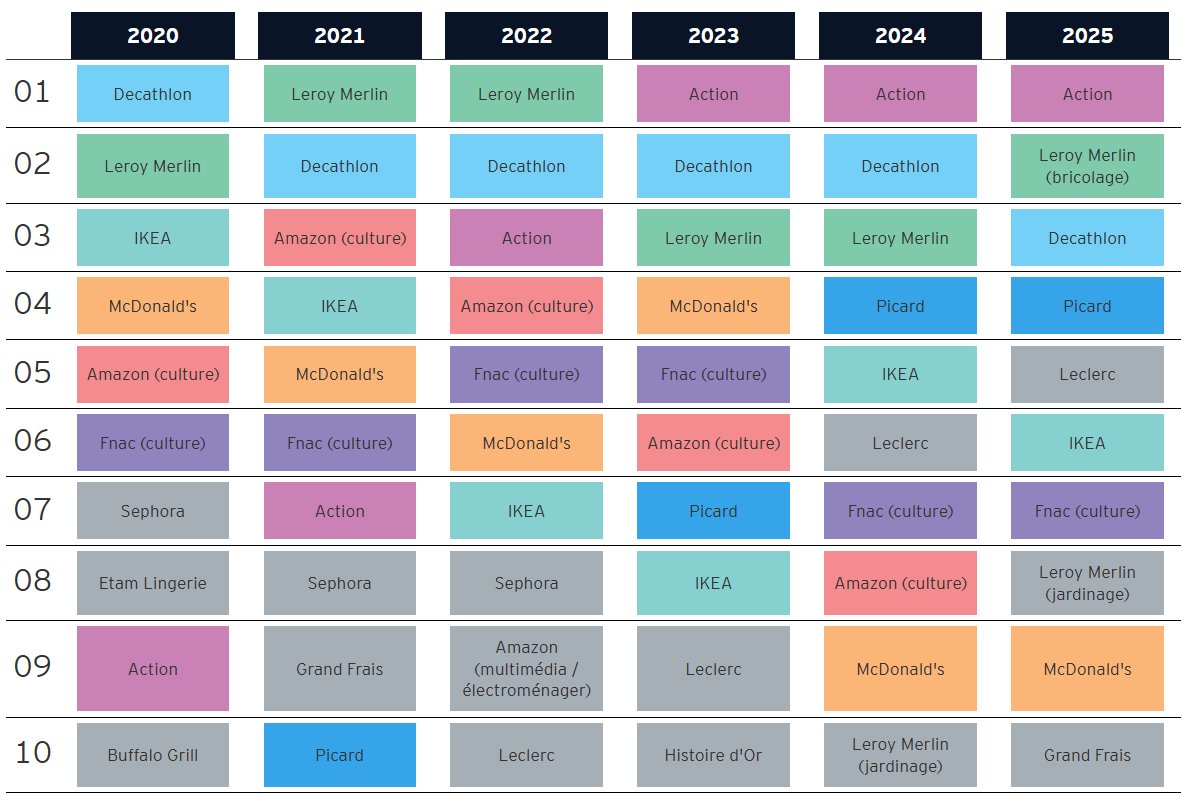

Action’s prioritization of the customer is reflected in its strong customer satisfaction metrics. In France, where Action operates over 850 stores, the company was named the favorite brand (Enseigne préférée des Français, 2025) for the third consecutive year in 2025. This accolade places Action ahead of prominent competitors such as Decathlon, IKEA, and McDonald’s.

Action’s rise in this ranking has been notable: it entered the top 10 in 2020 at 9th place, climbed to 7th in 2021, secured third place in 2022, and has consistently held the top position in the years since.

In addition to the Netherlands and France, Action frequently receives accolades in other European countries, including Poland, Germany, Belgium, and Austria (Action, 2024).

4.3.3 | Customer Segments

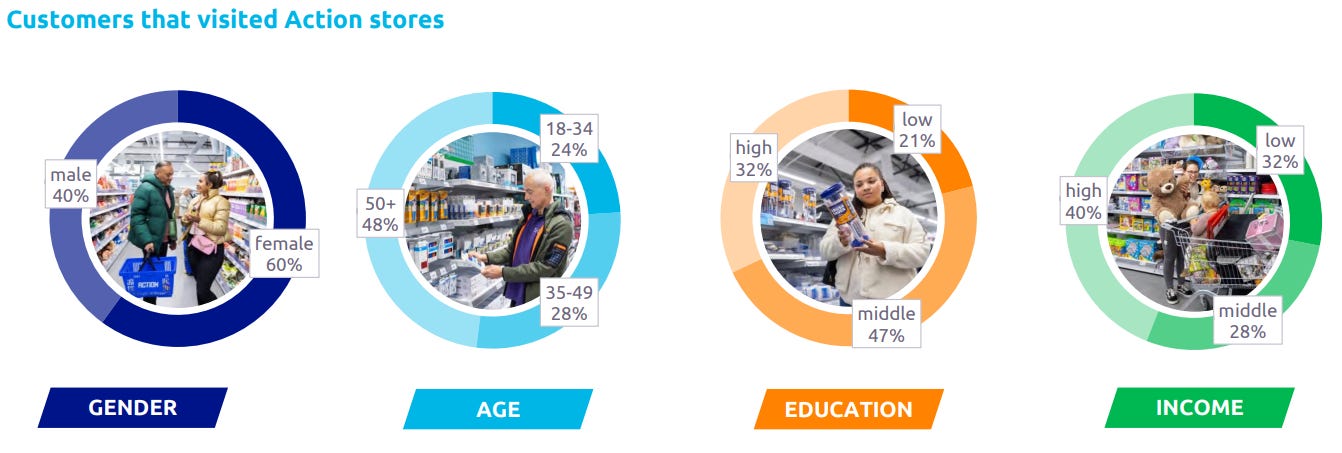

So, who shops at Action? A customer survey conducted by Action in 2024, summarized in the table below, highlights the diversity of its customer base. Action appeals to a broad demographic, including men and women, young and old, those with practical or theoretical education, and individuals across income levels. This versatility positions Action as a retailer that caters to all segments of the market (Action, 2024).

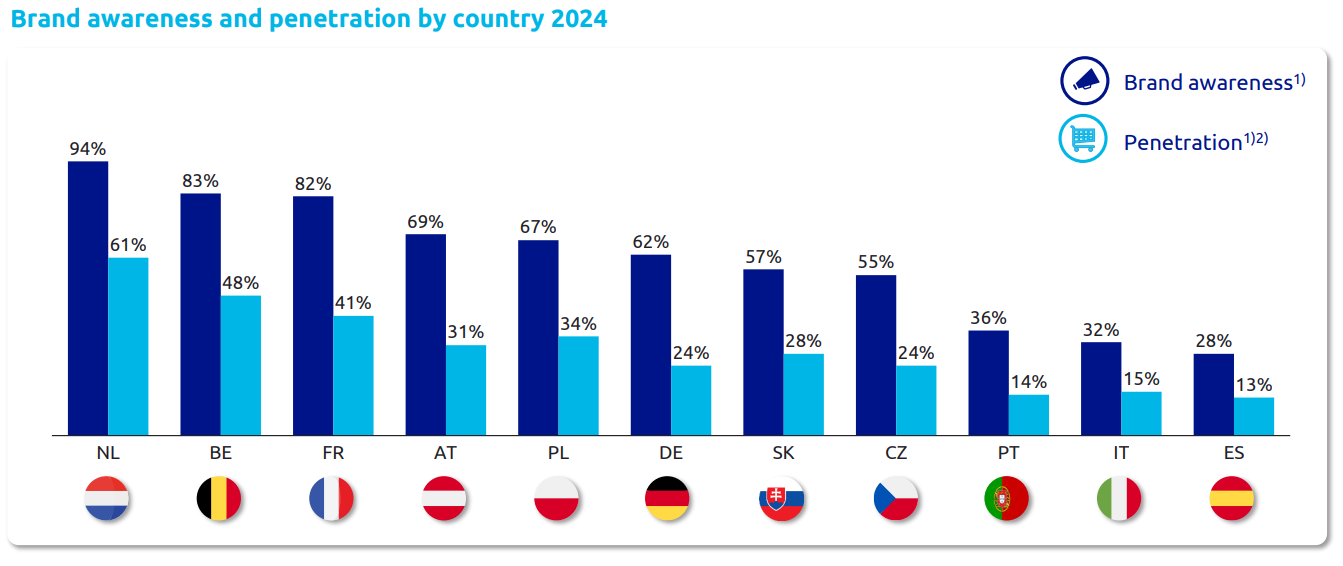

The figure below illustrates Action’s brand awareness and penetration rates across the countries in which it operates.

In its home market of the Netherlands, 94% of respondents are familiar with Action, and 61% reported purchasing one or more products in the six months prior to the survey. These metrics are notably lower in other European countries, indicating both challenges and opportunities for further market penetration.

4.4 | European Expansion

Under 3i Group’s ownership, Action has significantly expanded its presence across Europe since 2011. Following the acquisition by 3i Group, the number of Action stores grew from 269 to 2,755 by September 30, 2024.

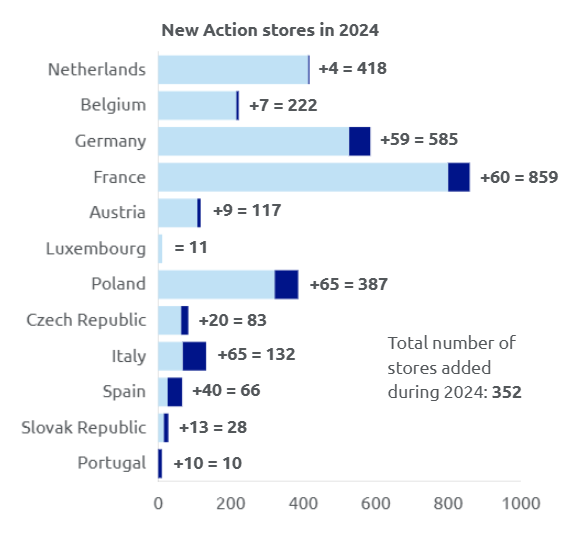

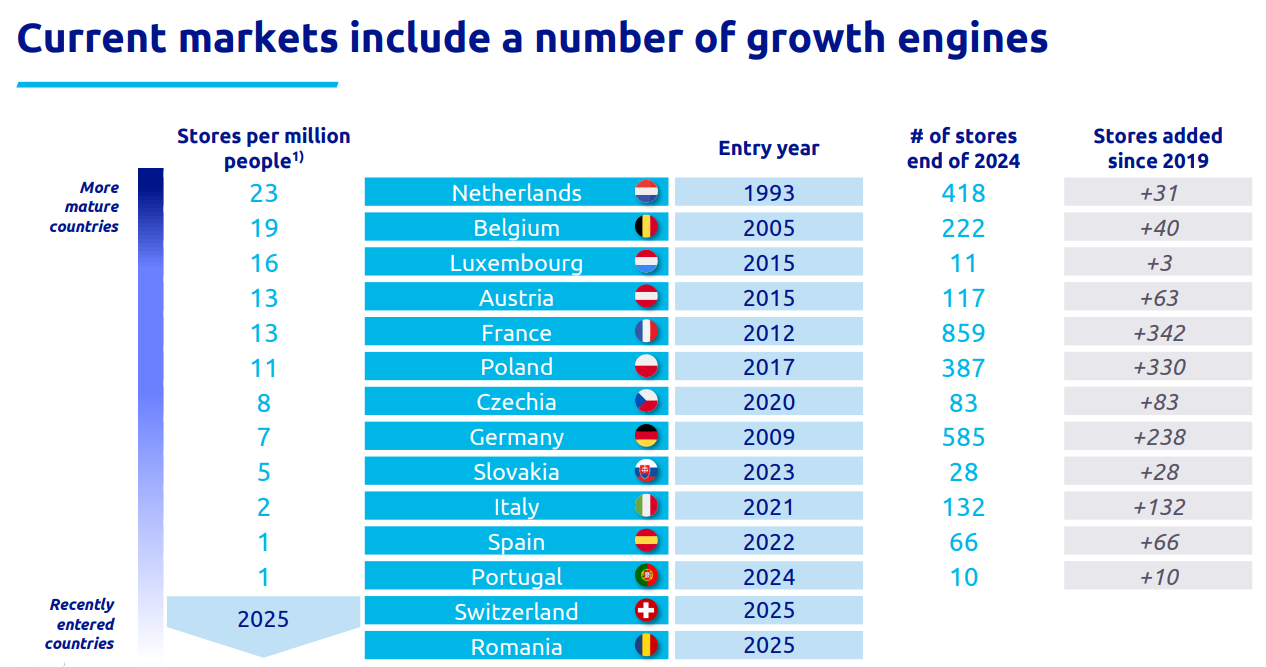

In 2011, the majority of Action’s stores were located in the Netherlands. However, by early 2025, the Netherlands accounts for only 14% of the company’s total store count, with 418 stores.

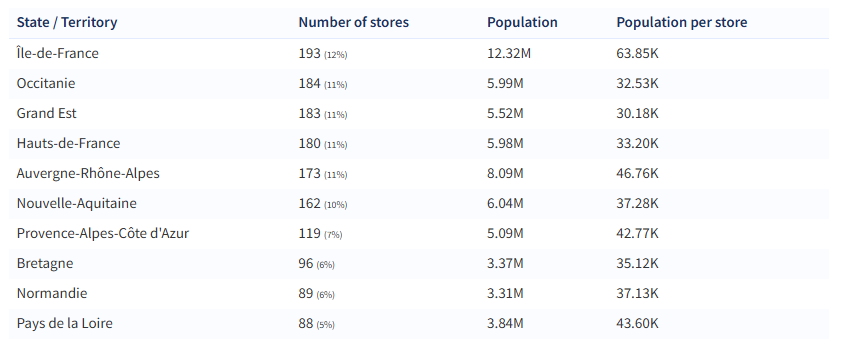

3i Group recognized significant growth opportunities and facilitated Action’s further expansion across Europe. The investment firm acted swiftly following its entry, opening Action’s first store in France in 2012. Today, Action operates over 850 France stores, representing 29% of Action’s total store network, making it the company’s largest market in terms of store count.

Germany ranks second with 585 stores, accounting for approximately 20% of Action’s total store network. The Netherlands follows in third place, while Poland ranks fourth with 387 stores (13%). Belgium holds the fifth position with 222 stores (8%), and Austria is sixth with 117 stores (4%).

Together, France, Germany, the Netherlands, and Poland constitute the core markets, representing 77% of Action’s total stores at the moment.

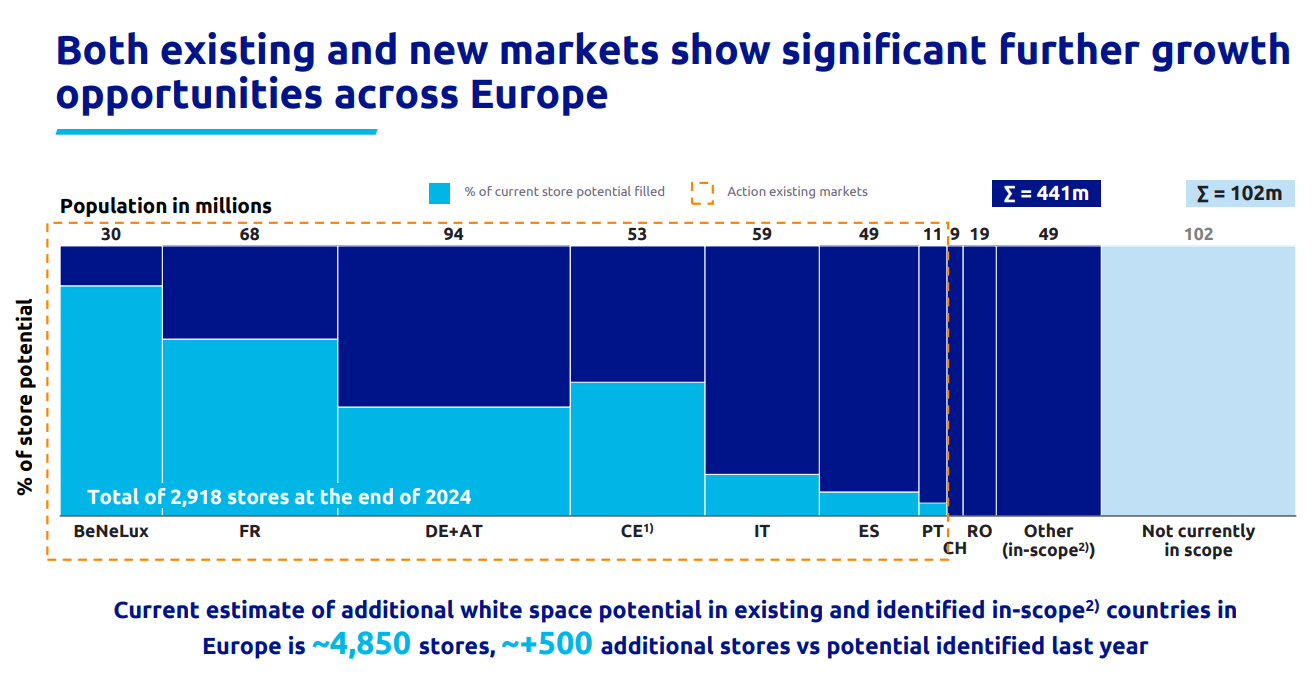

Countries such as Spain, Italy, Slovakia, Portugal offer significant growth potential, according to Action. The figure below ranks Action’s operating countries based on the number of stores per million inhabitants. The Netherlands, Action’s home market, is largely saturated, whereas Spain—with a population of over 48 million, approximately 170% larger than the Netherlands—remains in the early stages of market penetration.

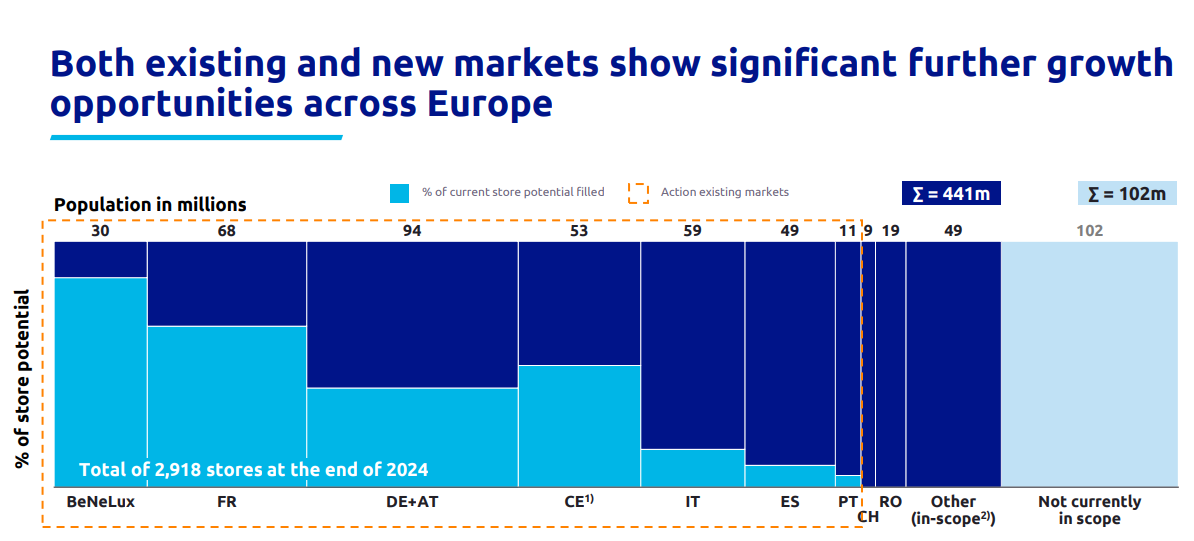

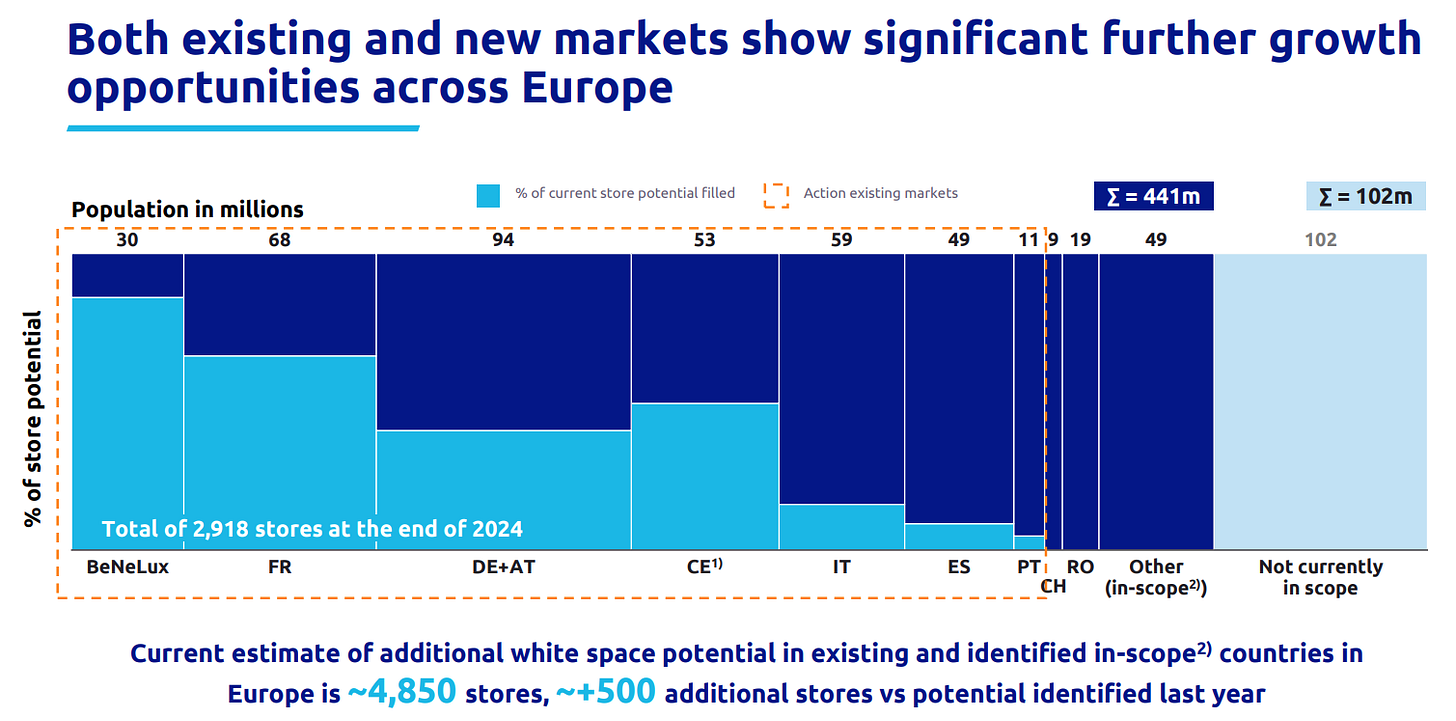

The subsequent figure illustrates the growth potential of Action’s in-scope countries. While the Benelux region (Belgium, the Netherlands, and Luxembourg) shows limited potential for further expansion, countries such as France, Germany, and Central Europe present substantial opportunities for future growth.

In markets where Action has recently entered, such as Italy, Spain, and Portugal, the growth potential exceeds 80%.

3i Group estimates that Action’s potential for new stores within existing and identified in-scope countries is approximately 4,850. With a current base of around 3,000 stores, this represents a potential to expand Action’s footprint by 160%. This figure excludes additional growth opportunities in countries currently outside the scope of Action.

The potential for Action’s future expansion is explored in greater detail in the chapter addressing valuation.

4.5 | Logistics

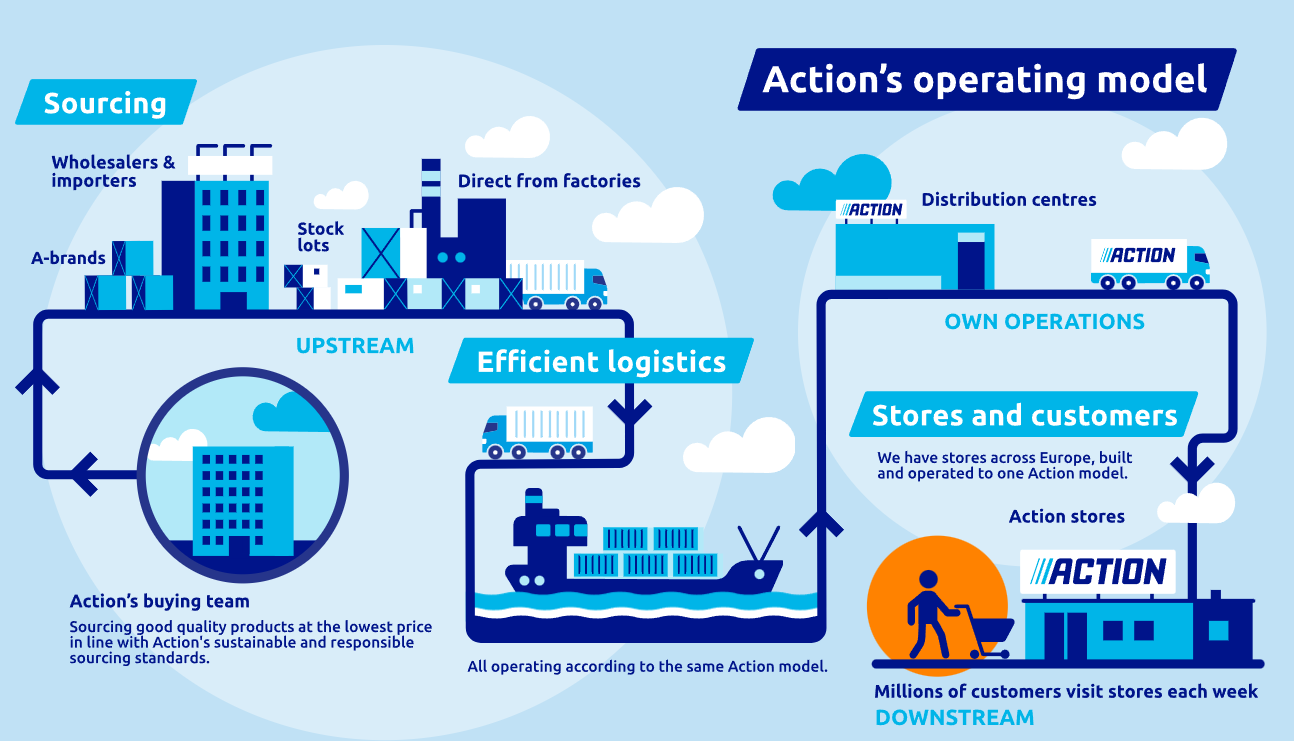

All 3,000 Action stores require consistent restocking, as inventory is critical to generating revenue. An efficient distribution system is therefore paramount for Action. The figure below provides an overview of Action’s logistics chain.

Action’s procurement team sources products at the lowest possible prices while ensuring a good level of quality.

These products are then shipped or transported directly from the manufacturer or supplier warehouses to Action’s distribution centers.

From there, Action distributes the products to its stores.

Beyond maintaining an efficient and seamless distribution process—which has not always been flawless in Action’s history, as discussed later—Action’s competitive advantage stems primarily from its ability to procure compelling products at sharp prices, both in terms of cost and assortment variety. This is coupled with cost-efficient distribution and a focus on minimizing overhead expenses. And rather than investing in expensive marketing campaigns or premium store locations, since Action channels these cost savings into price reductions, directly benefiting its loyal customer base.

4.6 | Competitive Analysis

To initiate the competitive analysis, we begin with the domestic market of Action’s home country, The Netherlands. In the Netherlands, no concepts precisely replicate Action’s business model. The closest competitors, or those that historically came nearest to Action’s approach, include retailers such as Kruidvat and Big Bazar.

Big Bazar

Big Bazar was established in 2007 by Blokker, also a Dutch retailer, as a strategic response to Action’s rapid growth. Big Bazar shared numerous similarities with Action’s product categories, offering personal care products, perfumes, cleaning supplies, household and drugstore items, pet products, hobby and craft materials, and snacks and soft drinks, all priced below typical supermarket prices. At its peak, the company operated 135 stores across the Netherlands and Belgium, employing approximately 1,300 staff. However, Big Bazar ultimately faced insolvency. What went wrong, and what lessons can be derived to safeguard Action’s position?

In 2019, Michiel Witteveen acquired Blokker, including Big Bazar, through his Mirage Retail Group, following over 122 years of leadership under the Blokker family. Witteveen pursued aggressive expansion, planning to open 50 new stores in 2019, leveraging former Op=Op Voordeelshop locations (Op=Op Voordeelshop, with over 140 branches, went bankrupt earlier that year). Additionally, Witteveen sought to introduce the Chinese discount chain Miniso to the Netherlands, acquiring rights to open 50 stores (Retail Trends, 2019). As of 2025, however, Miniso’s website lists only 10 locations (Miniso, 2025).

Despite efforts to revive Big Bazar after its 2021 acquisition by Frisian entrepreneur Heerke Kooistra from Witteveen, the company was declared bankrupt in 2023.

Big Bazar’s mounting debts, owed to numerous creditors, were compounded by a significant decline in customer footfall in its final years. The bankruptcy report issued by the administrators (2023) outlined the following (translated):

According to Big Bazar’s management, post-acquisition in late 2021, the company faced multiple challenges, including COVID-19-related lockdowns, shifting consumer behavior, rising wages, rents, and other operational costs, retail financing difficulties, and the withdrawal of credit insurance coverage for suppliers. Management reported that these factors created a negative spiral, resulting in a loss-making operation and suboptimal inventory levels. This downward trajectory could not be reversed. The administrators are investigating the stated causes of the bankruptcy.

What stands out to me is the changing consumer behavior. This must be viewed specifically in the context of the Big Bazar concept. After all, Action continued to thrive, even during the COVID period despite the many restrictions.

From what I recall about Big Bazar, a significant portion of their product range was fixed—comprising a mix of A-brands and other labels, but with limited variation over time.

In conclusion, we can infer that Big Bazar failed to establish the critical success factors for a discount retail model: (1) a dynamic, surprising assortment offered at competitive prices, and (2) cost-conscious and efficient operations, particularly in inventory management and supply chain logistics—allowing these operational advantages to be passed on to the consumer.

These insights underscore the importance of adaptability and operational excellence to sustain competitive advantages in the (discount) retail sector.

Kruidvat

In contrast to Big Bazar’s trajectory, The Dutch retailer Kruidvat, part of AS Watson Group, its business model aligns closely with its slogan (translated): Always Surprising, Always Affordable. This could have been the slogan of Action. Kruidvat has refined its concept effectively, despite maintaining a predominantly fixed assortment centered on personal care and cosmetics, primarily featuring A-brands. To complement this, Kruidvat incorporates rotating displays in its stores, showcasing thematic and seasonal products, as well as promotional offers. A portion of its core assortment is periodically discounted as part of these promotions—a strategy that diverges from Action’s approach of consistently low, fixed pricing. Beyond cosmetics, makeup, and snacks & soft drinks, Kruidvat also sells over-the-counter medications, a category Action does not cover, though Action does offer related products such as bandages and dietary supplements.

NORMAL

An international competitor to Action is the Danish retail chain NORMAL, established in 2013. NORMAL primarily focuses on personal care products and related items but also includes seasonal non-food products and snacks & beverages, such as imported confectionery. This creates a notable overlap with Action’s product assortment.

Operating under the motto Normal goods at fixed low prices, NORMAL targets everyday essentials, with a particular emphasis on female consumers—reportedly, 80% of its customer base is female (Berlingske, 2014). Its product range heavily features cosmetics, makeup, and perfumes, aligning with its target audience.

NORMAL adheres strictly to a fixed low-price strategy, ensuring products are consistently priced at the lowest possible level without promotional discounts. This approach mirrors Action’s pricing model, emphasizing predictable affordability.

At NORMAL, we sell completely normal goods at fixed low prices. The assortment includes well-known brands within categories such as skin care, hair care, oral care, shampoo, makeup, and cleaning. In short: All the things that you cannot do without in your everyday life and which should not be missing on the shelves in your home. All items are sold at fixed, low prices, meaning that you will not be able to find special offers and bargains with us. But what you can find for sure is lots of new and exciting items on the shelves. — NORMAL (2025)

Like Action, NORMAL recognizes the importance of a dynamic and surprising assortment to maintain customer engagement, regularly refreshing its product offerings to sustain interest:

Because NORMAL is much more than fixed, low prices and well-known brands. Our goal is that it should always be a new and unique experience to visit one of our stores. Even if it has only been a week since you last visited the store. That is why in NORMAL - in addition to the regular assortment of well-known branded products - there is a constant replacement and circulation of products on the shelves and podiums so you will always have new products to discover and explore. Our maze-like store set-up invites you to go treasure hunting among the many exciting items from well-known and unknown brands, and it is always easy to fill the shopping basket - without emptying your bank account. — NORMAL (2025)

However, NORMAL’s store layout appears less structured compared to Action’s. Shelves often appear to be arranged haphazardly, with products from different categories placed adjacent to one another. For instance, Kinder Bueno bars may be shelved next to dry shampoo, and Doritos chips positioned alongside men’s deodorant. This contrasts with Action’s more organized merchandising.

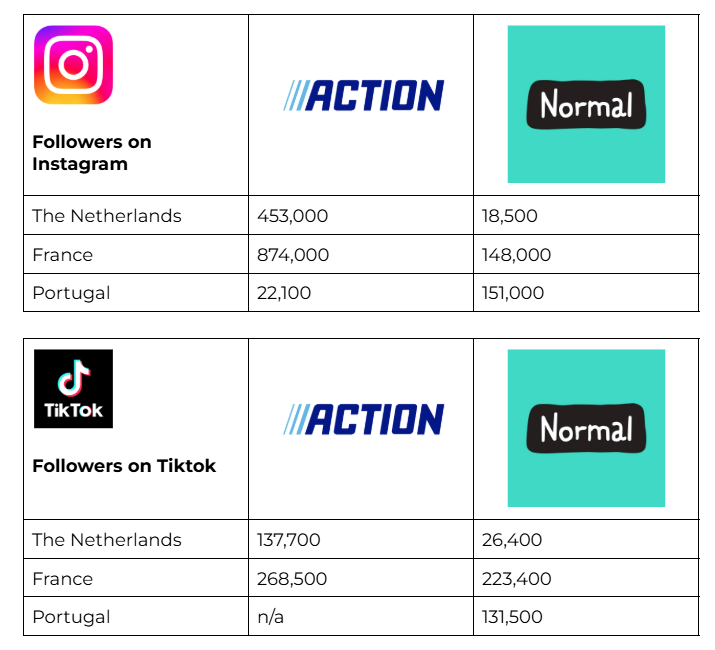

Does NORMAL pose a significant threat to Action?

NORMAL emerges as a formidable competitor, particularly given its rapid expansion and current scale. The chain operates over 850 stores across Scandinavia, Spain, Portugal, France, Italy, and the Netherlands, with new locations added weekly. Furthermore, NORMAL introduces approximately 100 new or established brand-name products to its assortment each week, reinforcing its appeal.

NORMAL’s stores, averaging 300 square meters, are notably smaller than Action’s, focusing on prime, high-traffic locations in bustling urban shopping districts, as emphasized by founder Mouritsen (Le Monde, 2022). This strategic choice maximizes visibility and accessibility but limits the breadth of inventory compared to Action’s larger-format stores.

NORMAL employs a proactive social media strategy, producing localized video content in the native language of each market it serves, filmed in and around its stores. This approach aligns closely with Action’s social media tactics, which leverage the “treasure hunting” experience online to engage customers digitally.

In addition to the official social media channels operated by both companies, there is also a notable presence of so-called fan accounts for both Action and NORMAL. These accounts are often run by individuals who regularly visit stores and create video content highlighting newly added products. This trend is commonly referred to as ‘Action finds’ in case of Action.

The phenomenon originated in the United States, where similar content is known as ‘Costco finds’. These videos tend to perform exceptionally well on social media platforms. Their appeal lies in the element of discovery, engaging viewers in a search for new bargains. The implicit incentive is that viewers may encounter attractive products, which in turn can drive additional foot traffic to physical store locations.

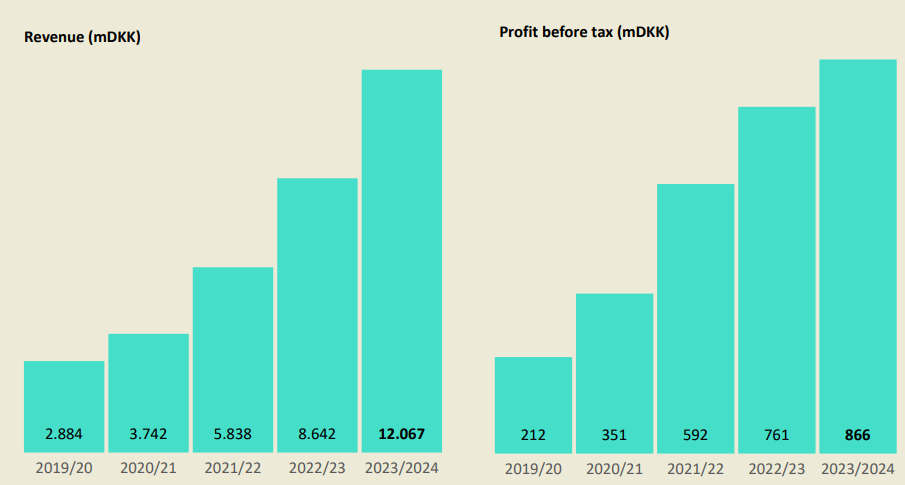

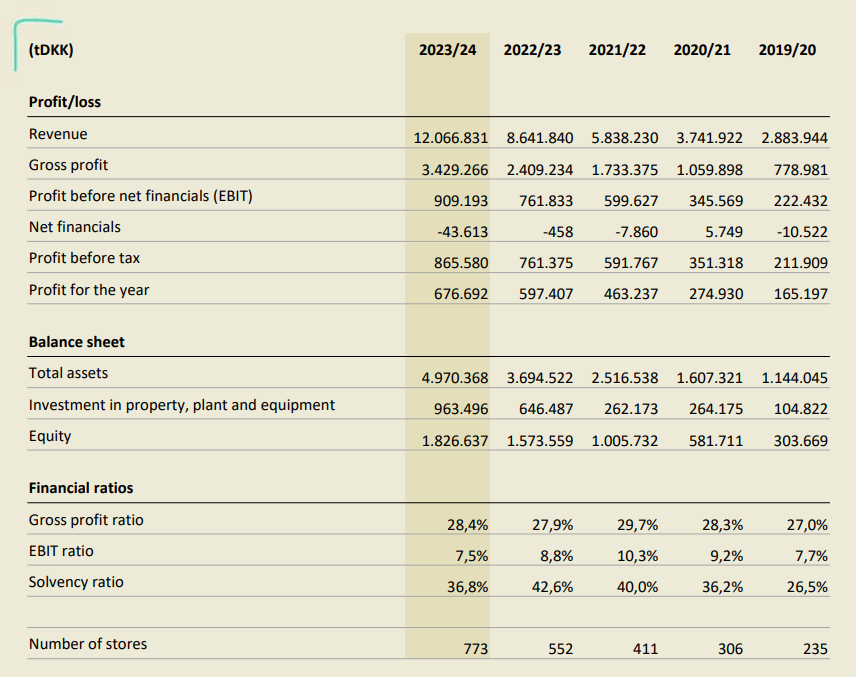

According to the most recent financial disclosures available, NORMAL provides insight into its financial performances. The graph presented above includes the progression of revenue and profit before tax, both reported in millions of Danish Krone (DKK). Below you can find the KPIs of NORMAL over the period from 2019/20 to 2023/24.

Further analysis of NORMAL as a risk factor for Action will be discussed later in this deep dive.

Pepco

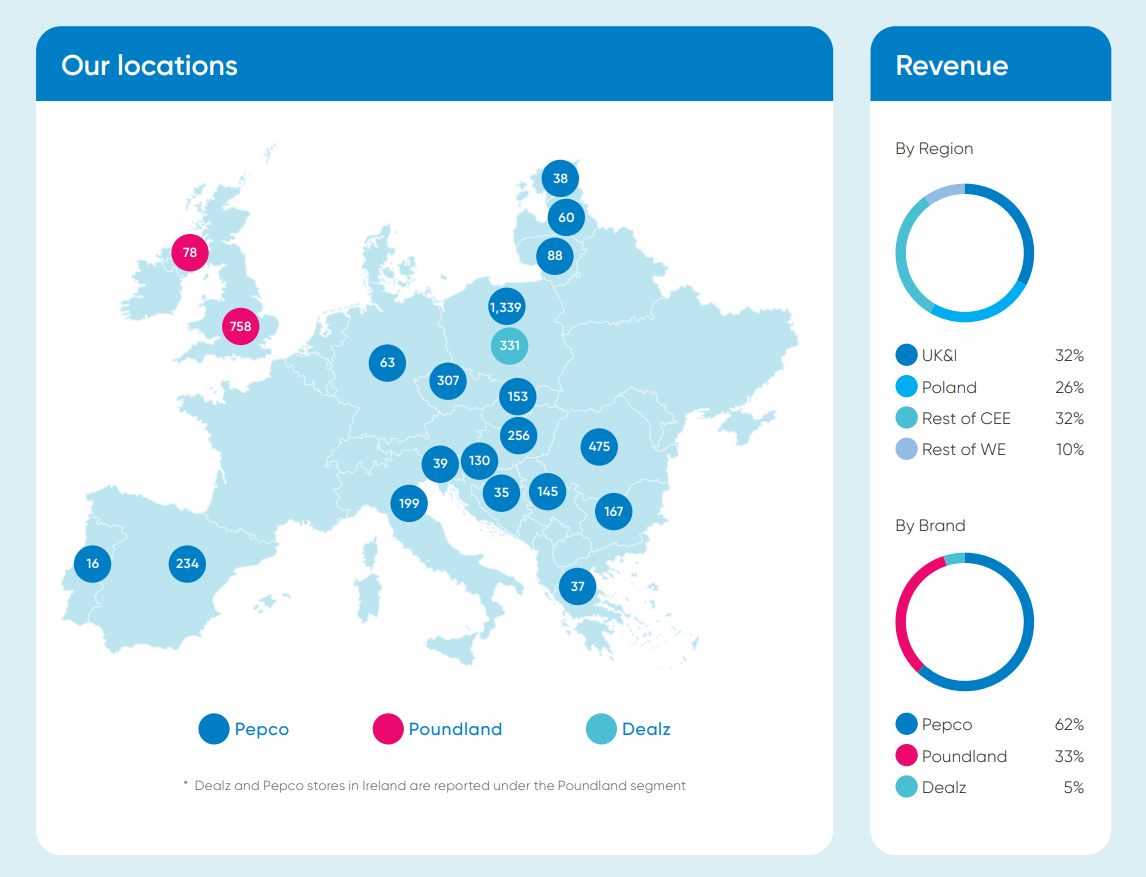

The Pepco Group, with its HQ in Poland, encompasses the retail chains Pepco, Dealz, and, until recently, Poundland.

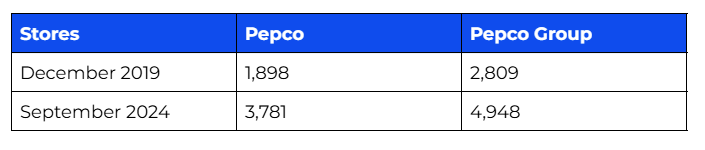

Pepco operates c.3,800 stores across Europe (Pepco, 2024). Its product assortment overlaps with Action’s, including household goods, toys, and personal care items, though Pepco also emphasizes various apparel categories. This aligns it more closely with the Dutch retailer HEMA, particularly in its pricing strategy, which favors whole-number pricing without decimals. However, Pepco’s stores are smaller than Action’s, with an average floor space ranging from 350 to 700 square meters (Pepco, 2025). According to Pepco’s FY2024 annual report (p. 22), the group’s total retail floor space spans 2,343,000 square meters across 4,948 stores, resulting in an average store size of approximately 474 square meters.

As of December 2019, Pepco operated 1,898 stores, with the Pepco Group managing a total of 2,809 locations (Pepco, 2020). This reflects significant growth over the past five years, underscoring the group’s expansion strategy.

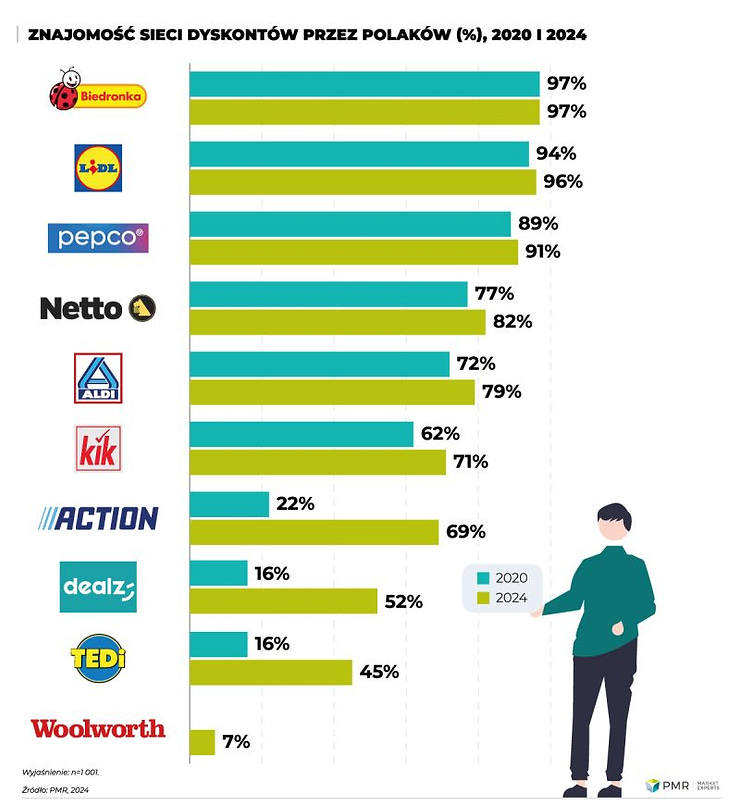

The development of brand awareness among Polish consumers for various retail chains in 2020 and 2024 (green) is illustrated in the figure below (PMR, 2024). In Poland, both Pepco Group’s Dealz and Pepco are active. Pepco’s brand recognition in Poland stayed almost the same at c. 90% over the past 4 years. Meanwhile, Action’s brand recognition surged from 22% in 2020 to 69% in 2024, driven by its robust expansion in the market. This growth has enabled Action to surpass Dealz, which entered Poland in 2018.

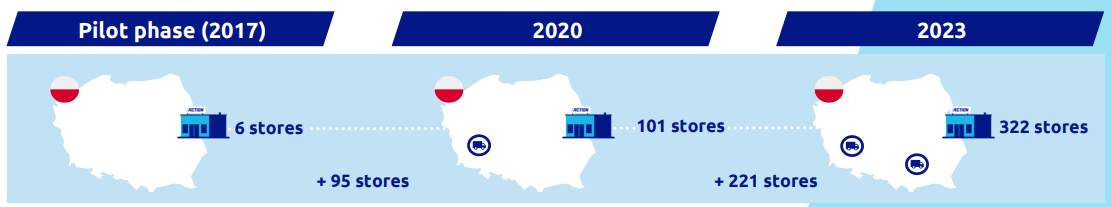

In 2017, Action entered the Polish market. By 2020, it operated 101 stores, growing to 322 stores by the end of 2023. As of the end of 2024, this number increased to 387 stores.

Dealz

Dealz is also a subsidiary of the Pepco Group, although slated for divestiture in the medium term as announced by the company. As of the end of 2023, Dealz operated 283 stores in Poland, offering a range of 3,000 fast-moving consumer goods across 18 product categories (Dealz, 2025). Unlike Action, which generally maintains fixed pricing (with the exception of weekly promotions), Dealz employs a discount-driven pricing strategy. Dealz’s product categories are comparable to those of Action. Until 2023, Dealz was active in Spain and France, but these operations were phased out in favor of Pepco stores. A similar transition occurred in Ireland in 2024.

Further details on the risks posed by Pepco and Dealz to Action are provided in the Risks chapter.

TEDi

TEDi, an abbreviation for Top Euro Discount, is a German discount retail chain with over 3,500 stores across 15 countries (TEDi, 2025; 2025). The first store opened in 2004, and by the end of its inaugural year, TEDi had established 120 new locations (TEDi, 2025). This reflects the company’s rapid expansion, with its current store count exceeding 3,500. TEDi has set an ambitious target to grow to 10,000 stores across Europe.

TEDi prioritizes A- or B+ locations in high-traffic neighborhoods, targeting towns and cities with at least 10,000 residents in the immediate vicinity or over 20,000 residents within a 15-minute travel radius. Its stores typically have a sales floor area ranging from 600 – 1,200 square meters (TEDi, 2025).

TEDi’s product assortment bears similarities to that of Action, including disposable party supplies, decorative items such as candles and pillows, stationery, household goods, personal care products like makeup and perfume, and toys. These are predominantly white-label and select private-label products, with minimal presence of A-brands noted on TEDi’s websites and brochures.

TEDi employs a distinct pricing strategy, as evidenced by its brochures and websites, focusing on unit pricing. The majority of its assortment is priced at €1. Further details on the risks posed by TEDi to Action are discussed in the Risks chapter.

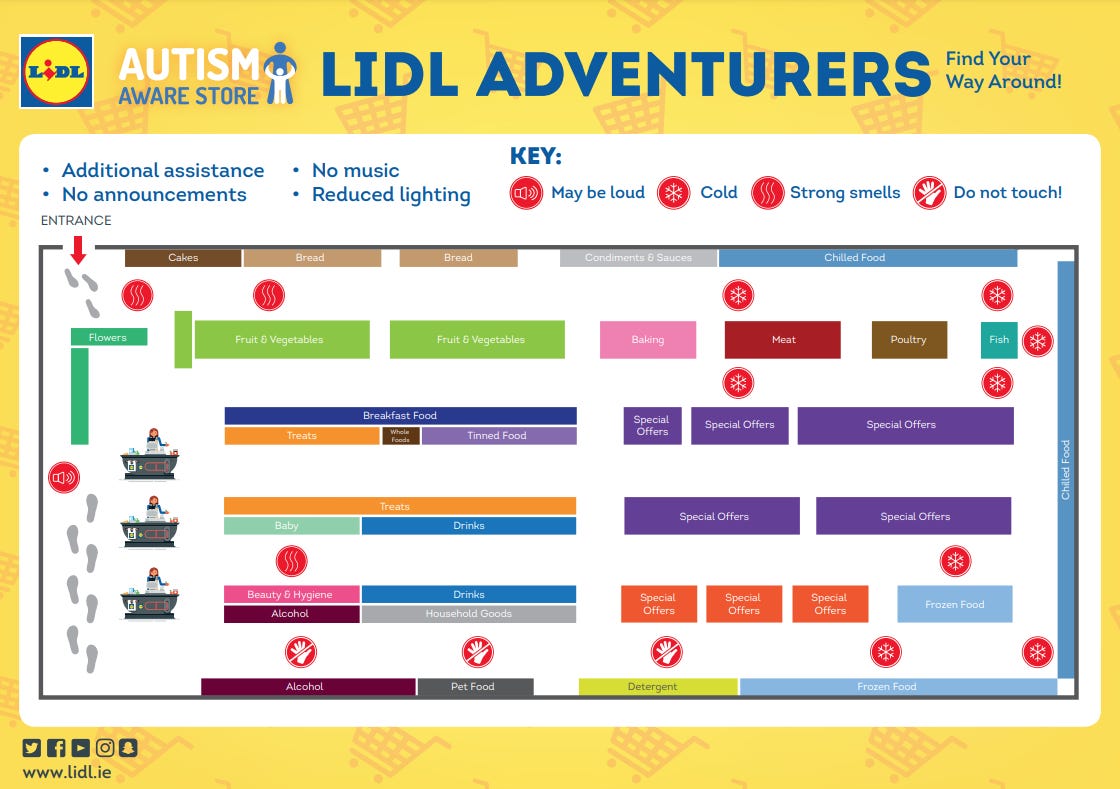

Lidl

While not a direct competitor, the discount supermarket chain Lidl employs a similar concept in parts of its stores. In addition to overlapping with Action in its core categories—Food & Drinks, Laundry & Cleaning, Personal Care, and Pets—where Lidl has increasingly incorporated A-brands into its assortment in recent years, it also mirrors Action by offering a rotating selection of products in certain store sections.

Given Action’s broad range of daily necessities, some overlap with the assortments of supermarkets and other retail stores is inevitable. What distinguishes Lidl is its rotating offerings in product categories such as Do-it-Yourself (DIY), Garden & Outdoor, Clothing, Household & Goods, Stationery & Hobby, Health, and Toys & Entertainment—categories also offered by Action.

Lidl rotates these categories based on seasons and topical themes. For instance, Garden & Outdoor products dominate in spring, while Toys & Entertainment and Decoration items, such as candles, feature prominently during the holiday season.

Regular visitors to Lidl stores may notice that the store perimeters are typically dedicated to a fixed assortment, while the central or end aisles are reserved for a rotating selection, often featuring weekly promotions in the categories outlined above. This rotating assortment is depicted in purple as ‘Special Offers’ in the figure below.

History of Lidl

In 1930, Joseph Schwarz founded the food wholesaler Lidl & Schwarz KG in the German town of Neckarsulm, where the headquarters of Lidl’s parent company, the Schwarz Group, remains located today (Lidl, 2024).

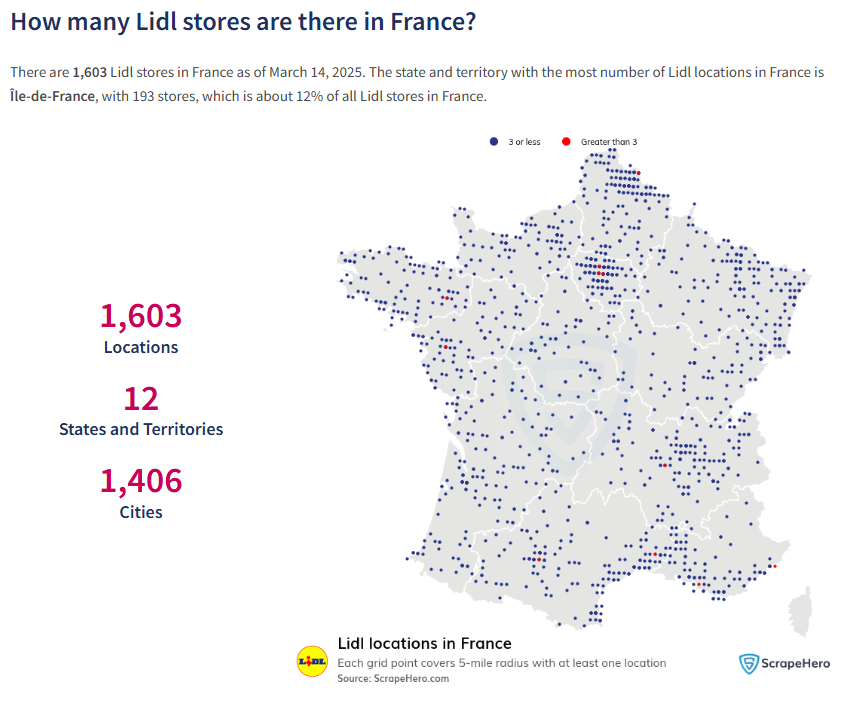

While Action first expanded beyond its home country in 2005, Lidl, which opened its first modern store in Ludwigshafen in 1973, began its international expansion in April 1989 with its first store in France, located in Sarreguemines, just across the German border (ISN Magazine, 2022). Action followed 23 years later, opening its first French store in 2012. Lidl currently operates approximately 1,600 stores in France.

Of these approximately 1,600 supermarkets in France, 60% have a sales floor area between 300 m² and 1,000 m², while 40% range between 1,000 m² and 1,700 m² (Lidl, 2023). For comparison, an average Action store has a floor area of approximately 900 m². Action targets its stores to be positioned in areas with populations exceeding 40,000.

In France, with a population of approximately 66.6 million, Lidl’s 1,600 stores equate to roughly one store per 41,500 inhabitants.

As of December 31, 2024, Action operated 859 stores in France, resulting in approximately 77,500 inhabitants per store. Excluding regions with low population density, Action has significant growth potential in France, with the company estimating a white space opportunity of approximately 35% as of March, 2025.

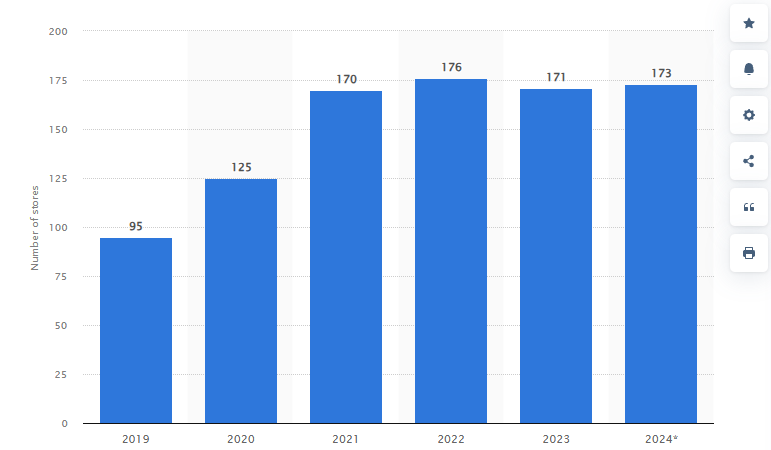

United Kingdom

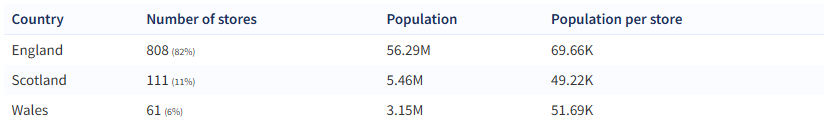

The United Kingdom is a market where Action is not currently active, but Lidl is. According to Lidl UK’s website (2025), the company operates over 980 stores across England, Scotland, and Wales, a figure consistent with ScrapeHero (2025). The figures below illustrates the distribution of Lidl stores in the UK and their customer reach.

With approximately 68 million inhabitants in the UK, each Lidl store serves an average of 69,400 people.

Is the UK not a potential expansion opportunity for Action?

Chains such as Poundland (758 stores in the UK), B&M (over 700 stores in the UK), and Home Bargains (over 500 stores in the UK) have already established strong positions in the market. In my view, it is logical for Action to prioritize further expansion on mainland Europe, where there is greater white space and fewer well-established competing concepts. However, could the UK be a consideration for the future? Or might Action first pursue an entry into the United States?

United States

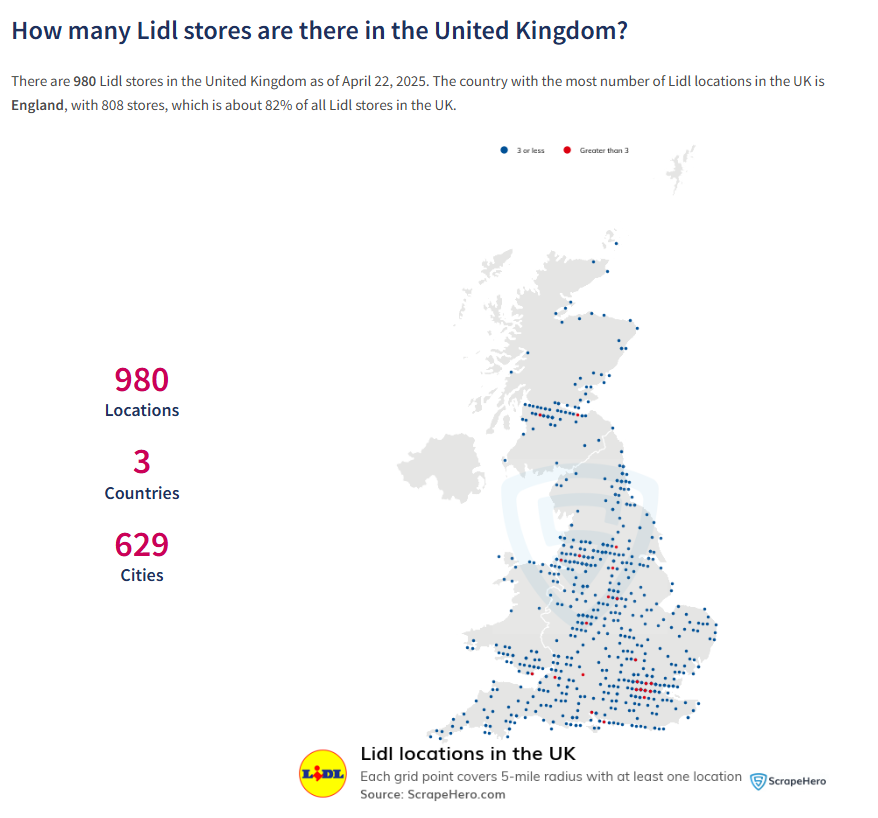

In 2017, Lidl opened its first store in the United States. As of 2025, the company operates approximately 186 locations along the East Coast (ScrapeHero, 2025).

In contrast, Aldi’s overseas expansion in the U.S. has been significantly more robust, with 2,546 stores as of June 2025 (Aldi, 2025). Despite Lidl’s entry into the U.S. market in 2017, its store growth has stagnated in recent years (Statista, 2024). Aldi, having entered the U.S. market earlier in 1976 with its first store in Iowa (Aldi, 2025), has established a stronger footprint.

In the United Kingdom, Aldi operates approximately 1,044 stores, slightly outpacing Lidl’s 980 stores. While Aldi maintains a larger presence in both the U.S. and the UK, Lidl dominates on the European mainland, offsetting its smaller scale in the U.S. and UK markets. This positions Lidl as the marginally larger entity compared to Aldi globally.

In FY2024, Aldi (Nord + Süd) reported global revenues of €121 billion (€32 billion + €89 billion, +6% YoY) (Distrifood, 2025; Aldi South Group, 2025). Lidl, by comparison, recorded revenues of €132.1 billion (+5.3% YoY) (Schwarz Group, 2025). The broader Schwarz Group, which includes Lidl, achieved total revenues of €175.4 billion (+4.9% YoY). In comparison, Action reported revenues of €13.8 billion in FY2024.

Key Insights

We learned that discount retailers, such as Aldi and Lidl, are steadily capturing market share from traditional retail chains, including established supermarkets and drugstores.

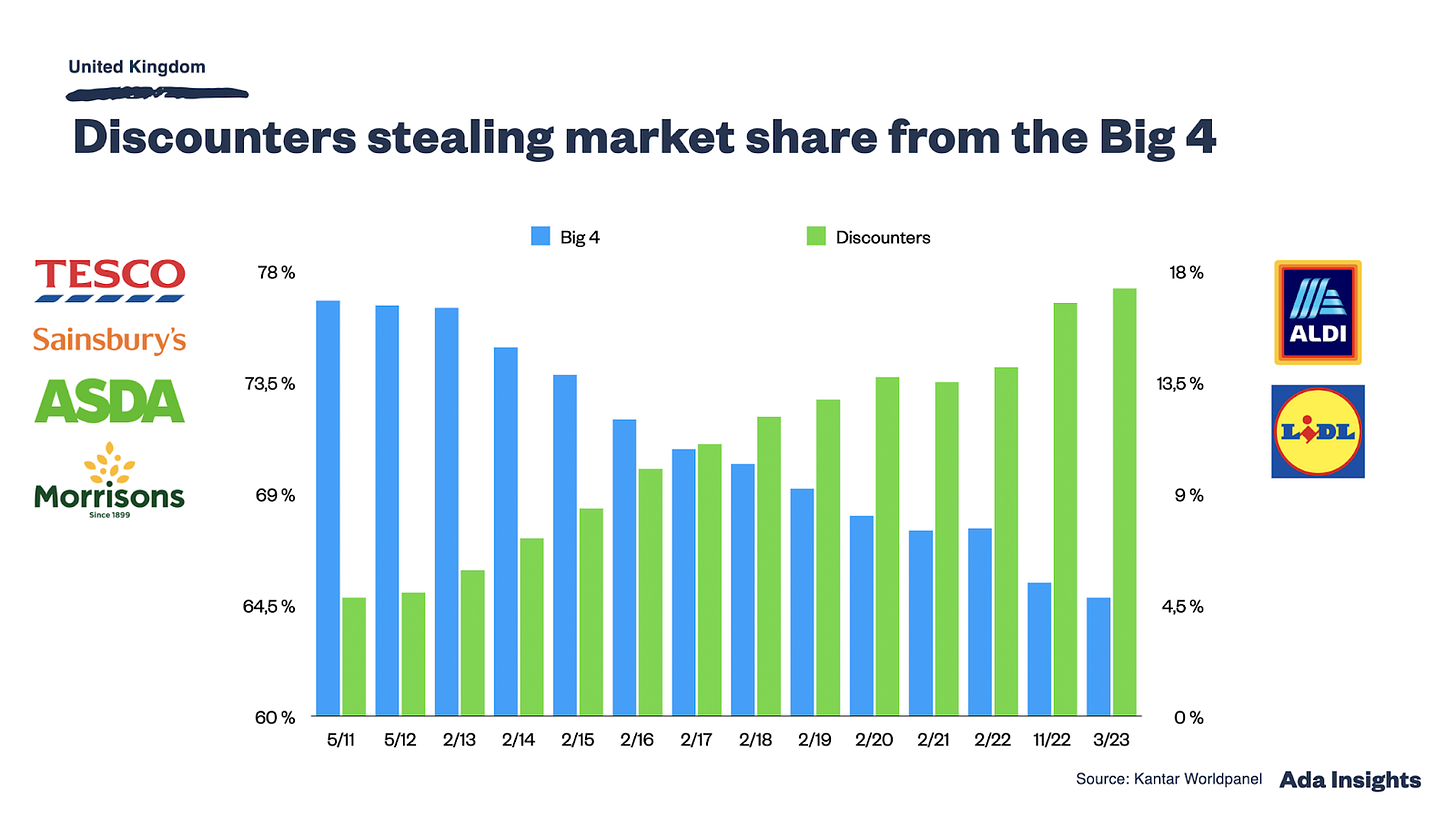

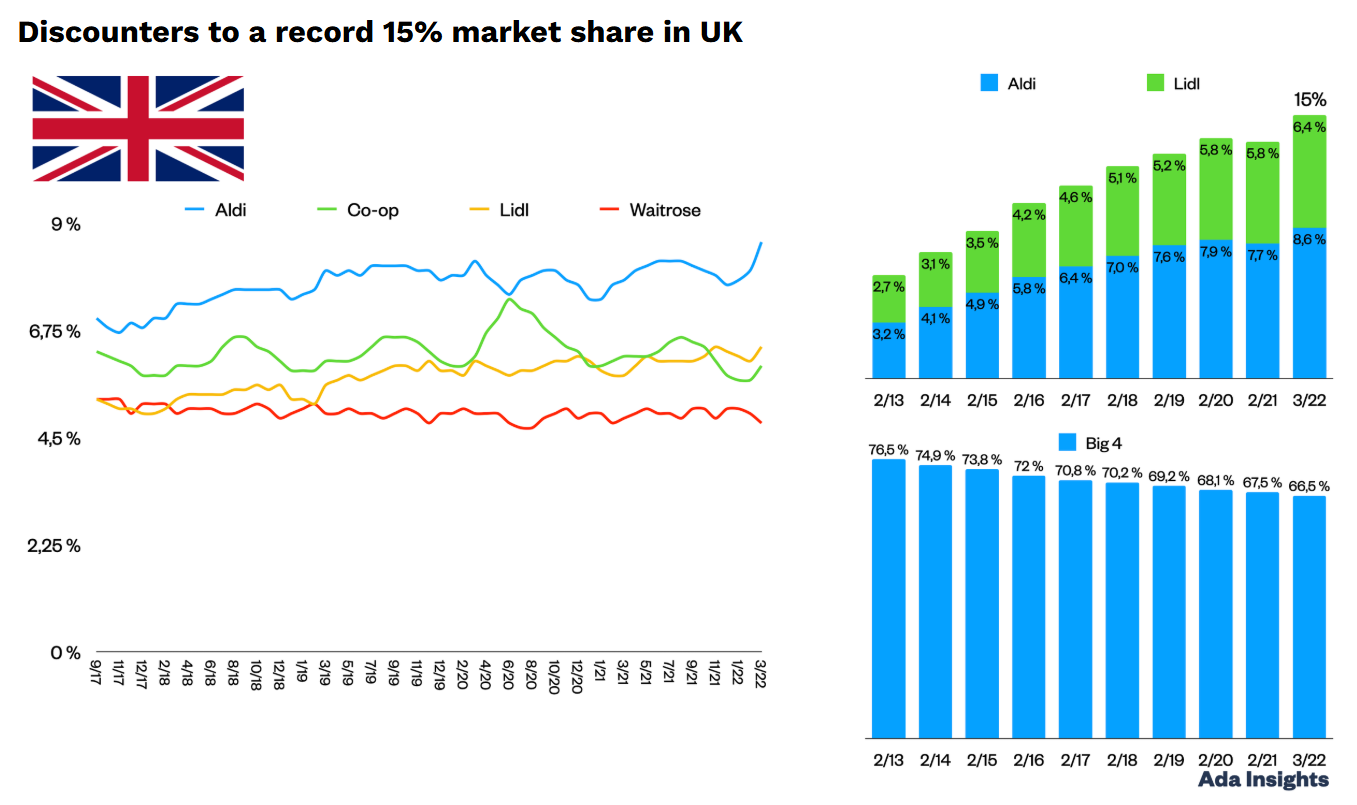

The chart below illustrates the market share of discounters (Aldi and Lidl) compared to the Big 4 (Tesco, Sainsbury’s, ASDA, and Morrisons) in the United Kingdom. Note that the Y-axes have been adjusted to highlight trends more clearly. Between 2011 and 2023, the Big 4’s market share declined from 76% to 64%, while Aldi and Lidl’s combined market share rose from 5% to 17%.

Was Lidl’s U.S. entry in 2017, over 40 years after Aldi’s, simply too late? Potentially, though, Aldi's U.S. market share remains modest at 2.1%, compared to Lidl’s 0.3% (Dunnhumby, 2023).

According to Dunnhumby’s research, Aldi’s relative success in the U.S. over Lidl stems from several factors:

A 40-year head start, allowing Aldi to capitalize on competitive and dynamic market conditions in the 1970s, 1980s, and 1990s.

Lidl’s choice to launch its U.S. expansion in 2017 on the East Coast, a region where Aldi was already well-established.

Despite Lidl’s lag, Dunnhumby notes that Lidl has “strengths to rest on,” citing its “excellent prices and a strong private brand portfolio.” However, the report highlights a “slight misalignment between customer needs, assortment, and store experience,” noting that “in an intensely competitive landscape [...], slight misalignments are going to matter.

Dunnhumby suggests that with patience, Lidl could succeed in the U.S. but “will need to capitalize on its personalization engine, revisit its marketing communications with customers to establish a more clearly differentiated, and establish a foothold in the West before Aldi does.”

Should Action consider entering the U.S. or UK markets, it could benefit from studying the growth trajectories and challenges faced by Lidl and Aldi in their expansions.

4.7 | Financials

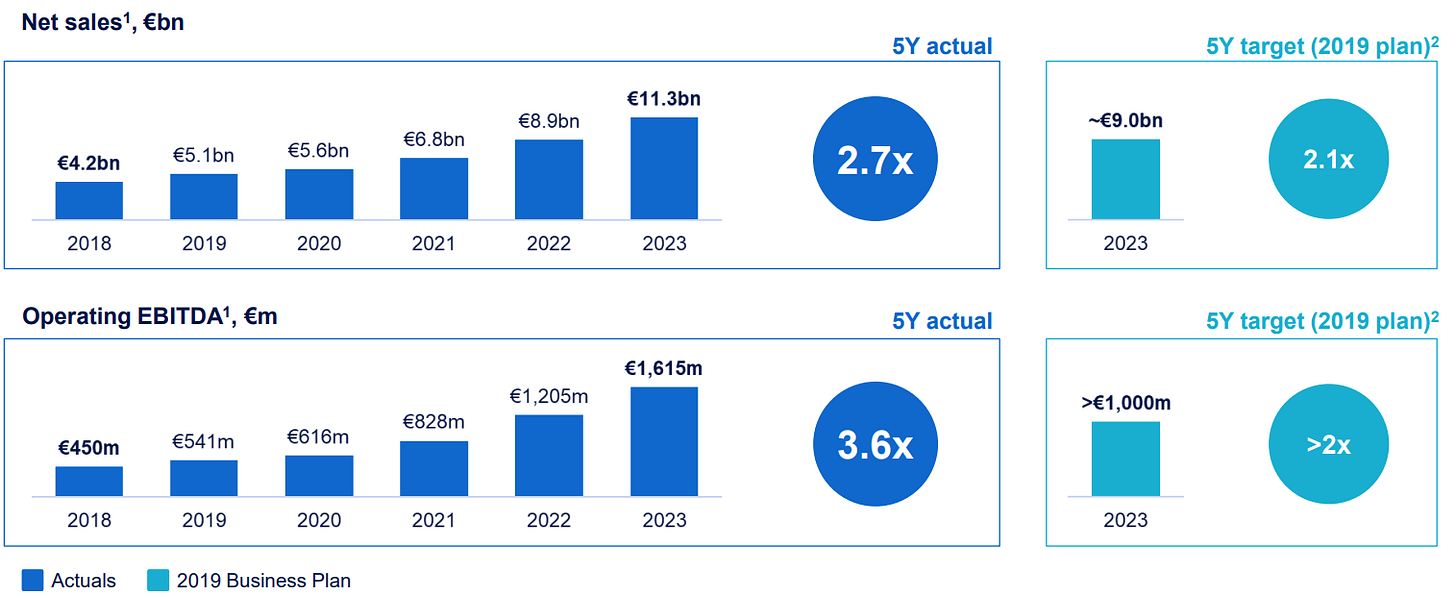

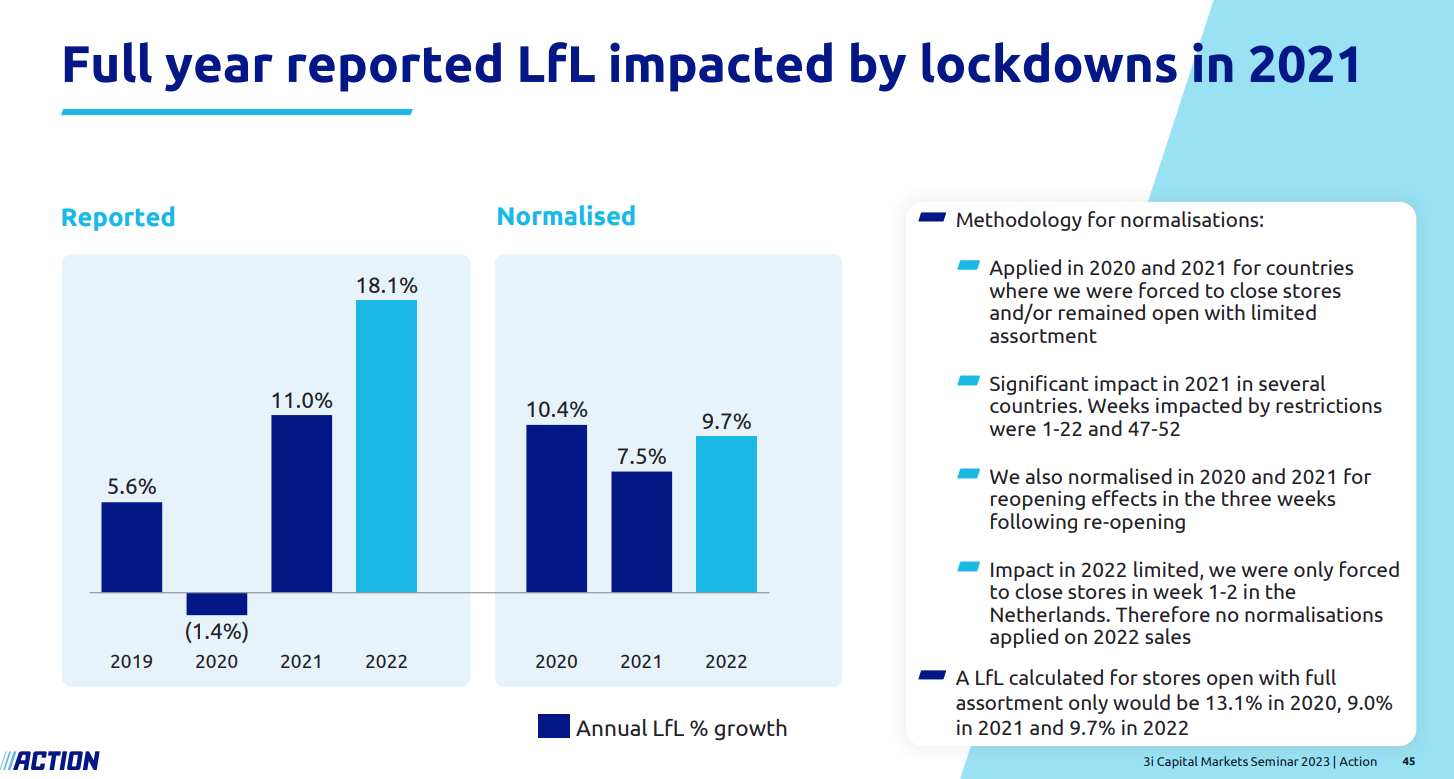

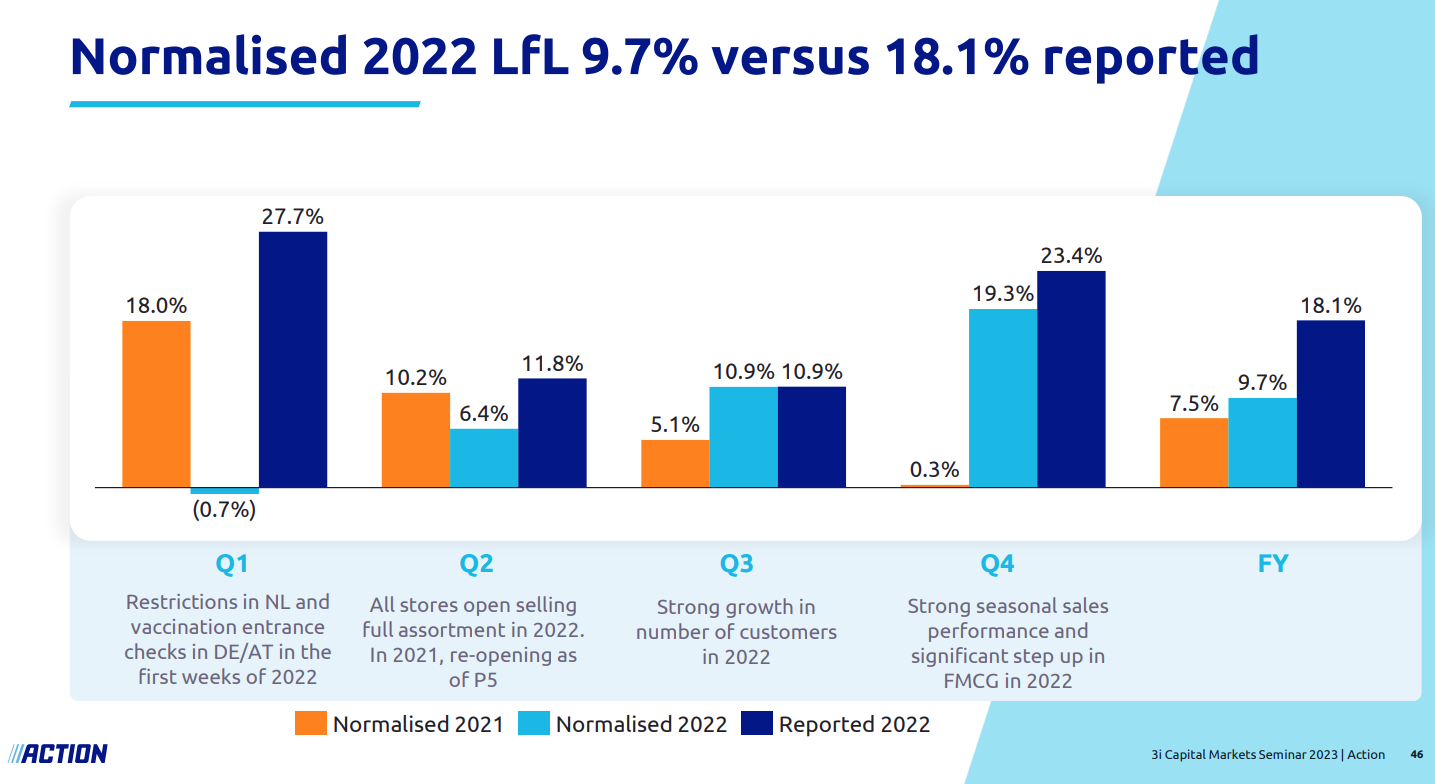

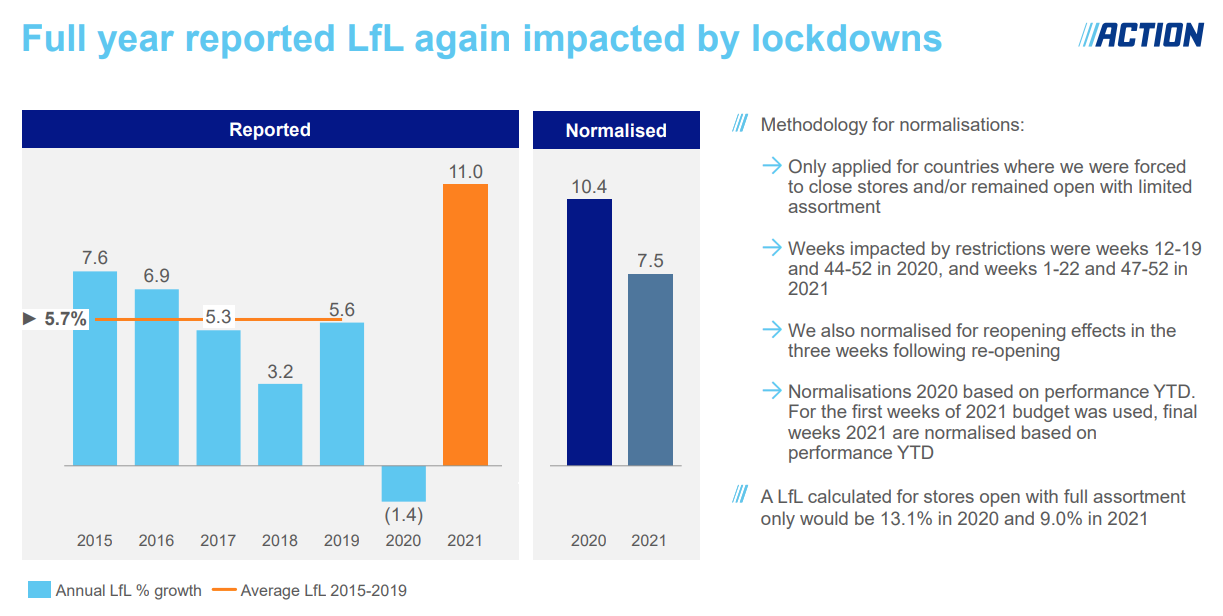

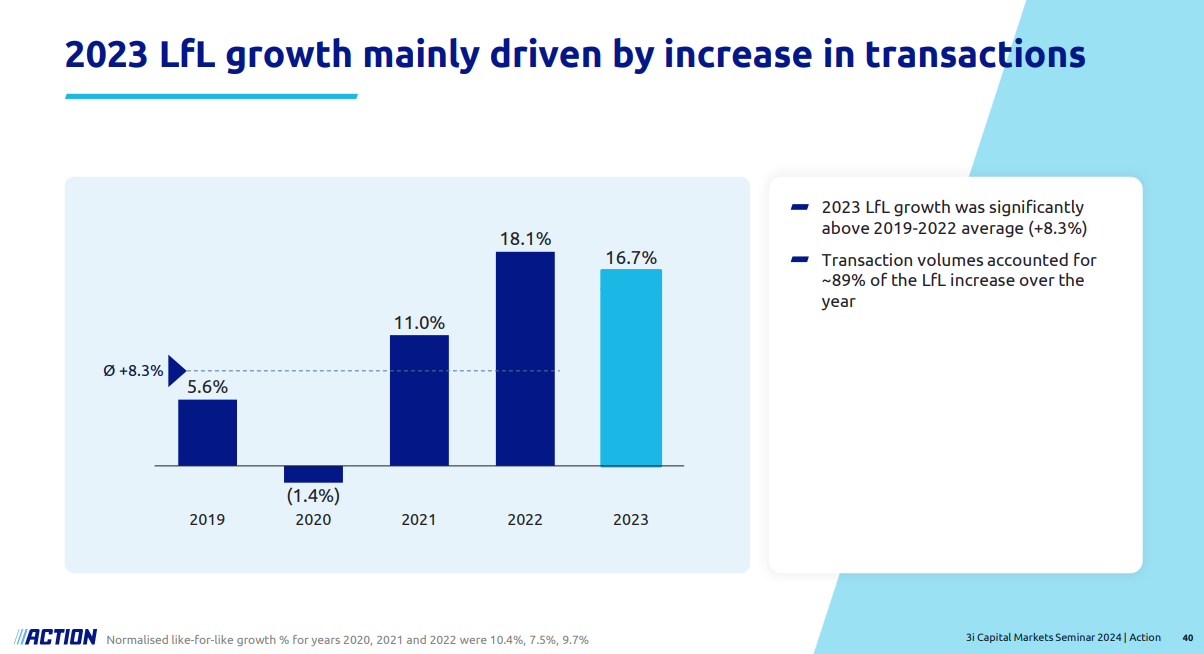

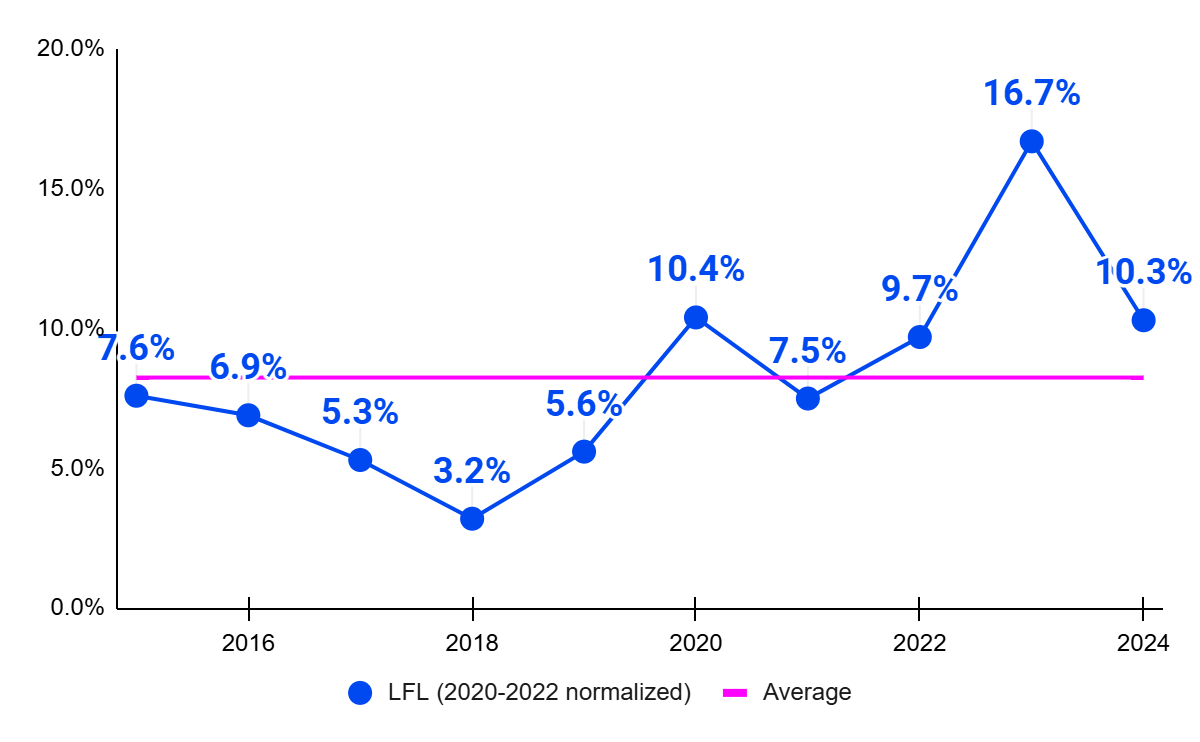

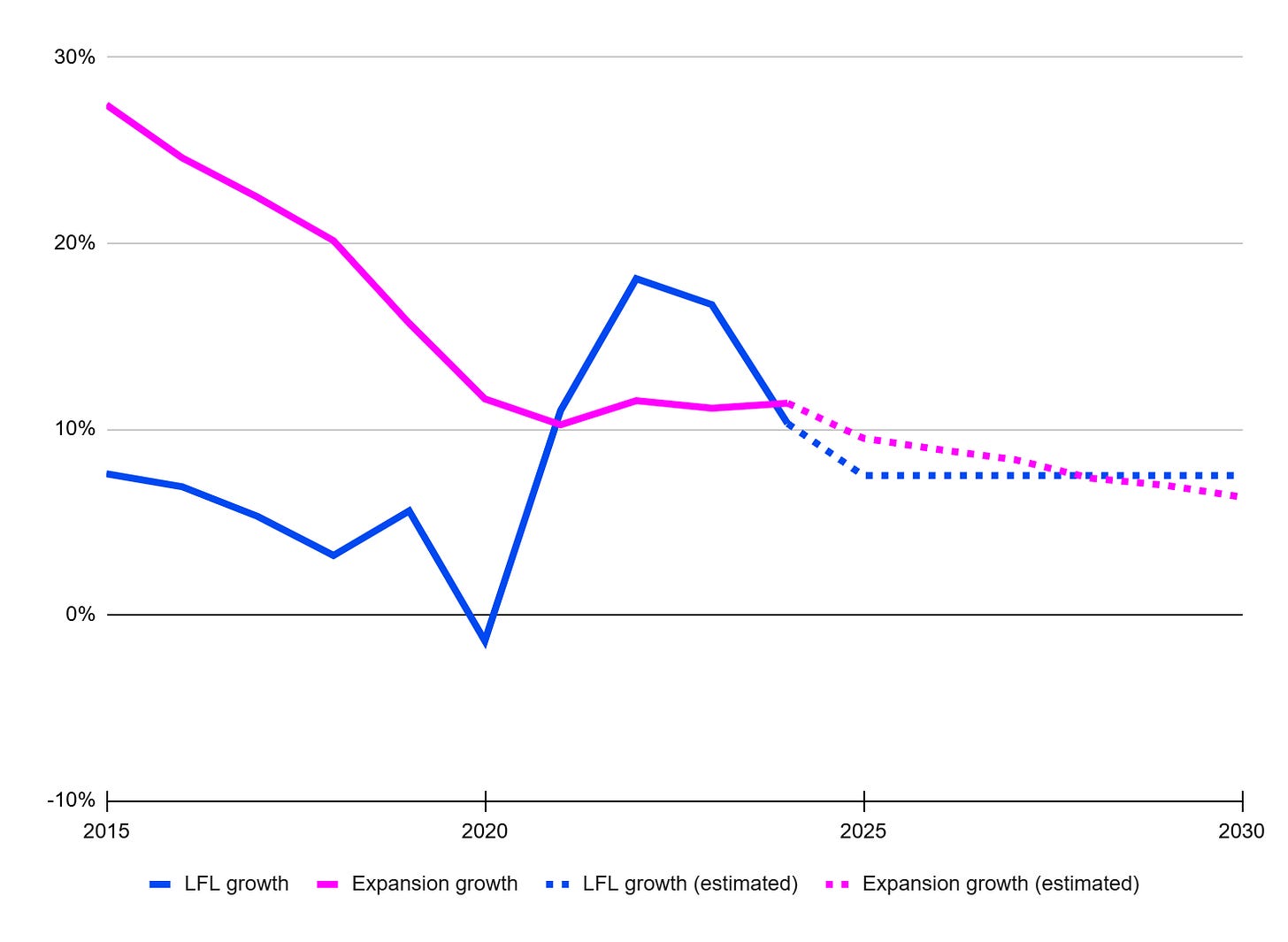

In the calendar year 2024, Action’s revenue grew to €13.8 billion, reflecting a 21.7% increase from 2023, following a 27.8% growth in the previous year compared to 2022. Of this growth, 10.3 percentage points were driven by organic like-for-like (LFL) revenue growth from existing stores, primarily due to higher transaction volumes. This volume growth accounted for 102% of the LFL growth.

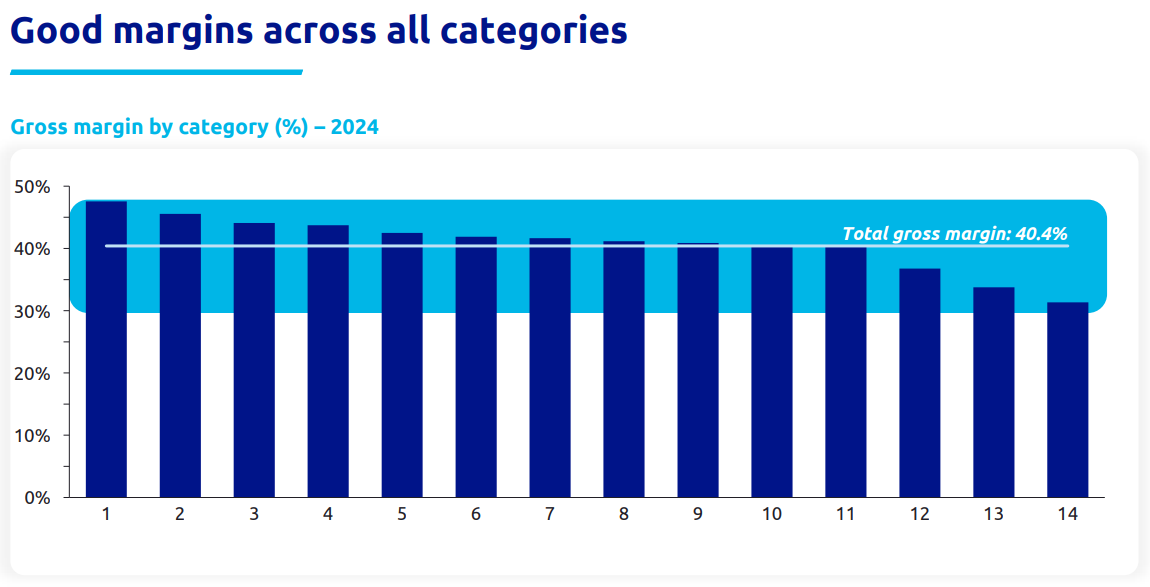

In 2024, Action achieved an average gross margin of 40.4% across its product categories, as illustrated in the figure below.

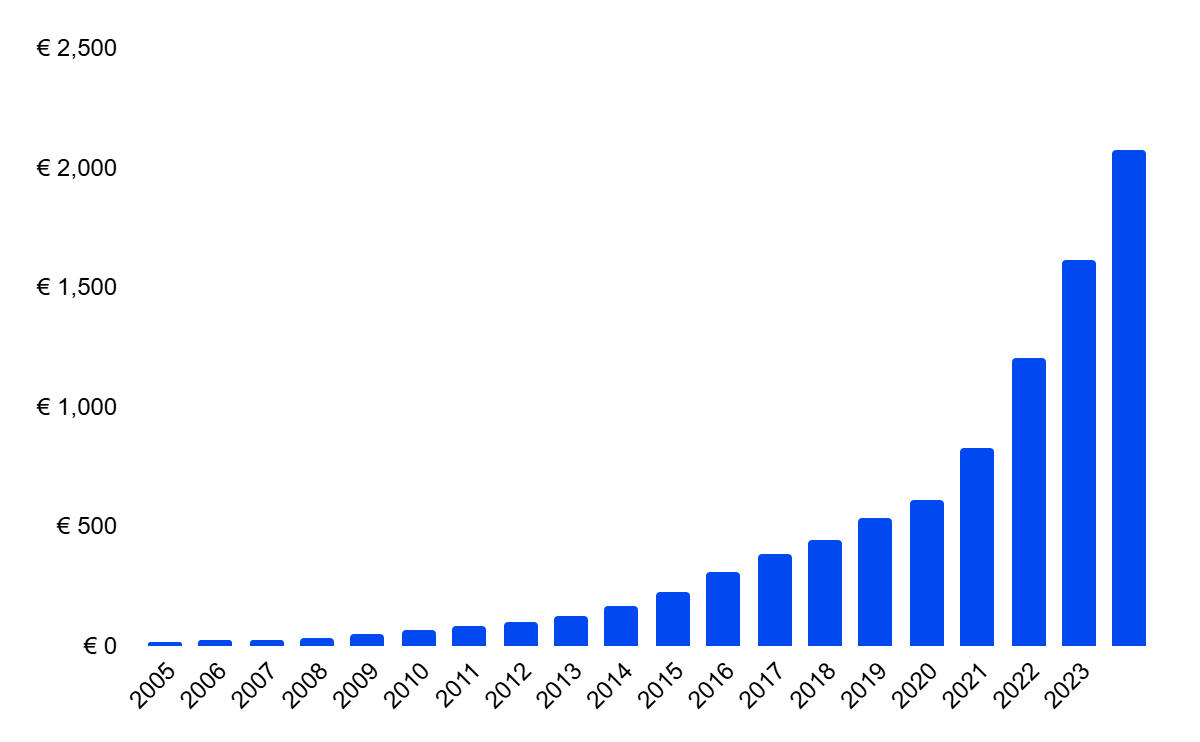

Action’s operational EBITDA rose from €1,205 million in 2022 to €1,615 million in 2023, and further to €2,076 million in 2024, representing year-over-year increases of 34% and 29%, respectively. The figure below depicts the evolution of Action’s operational EBITDA since 2005.

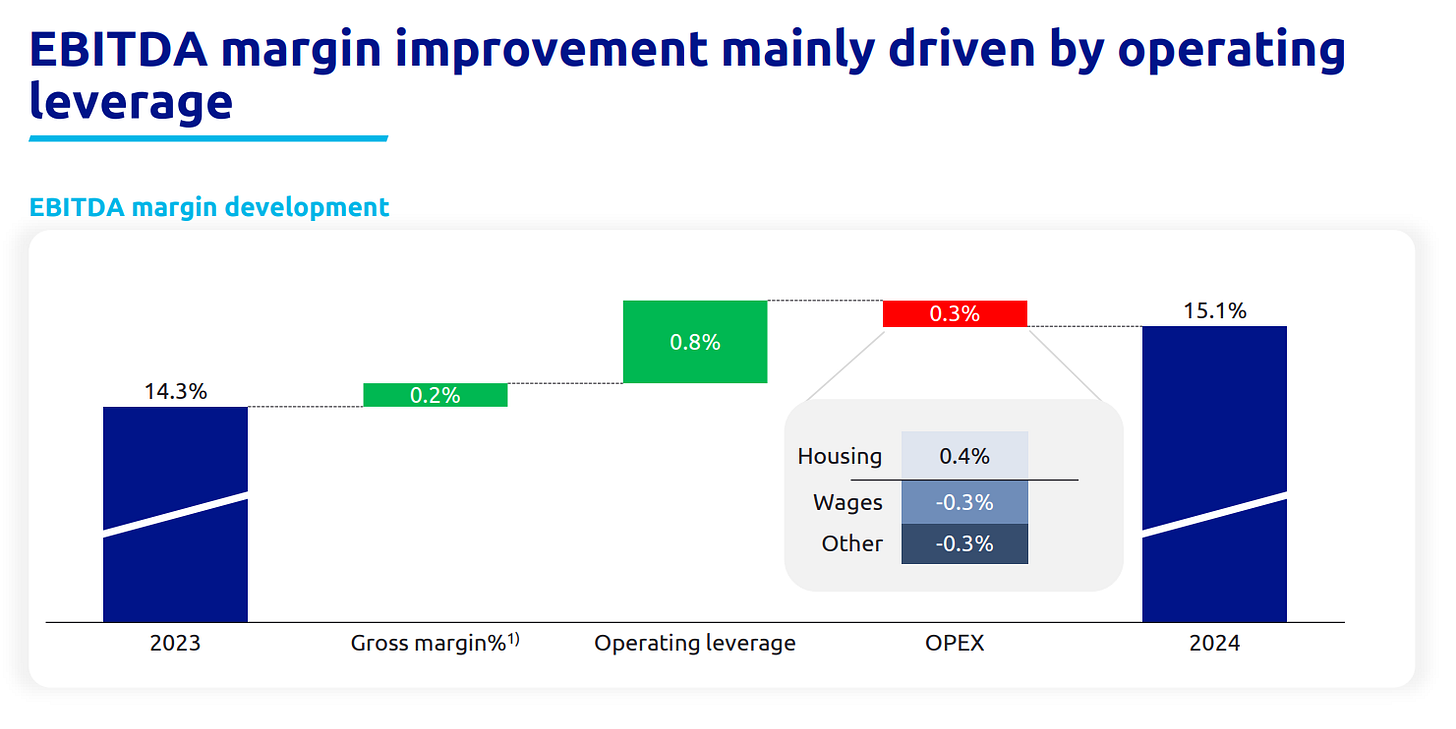

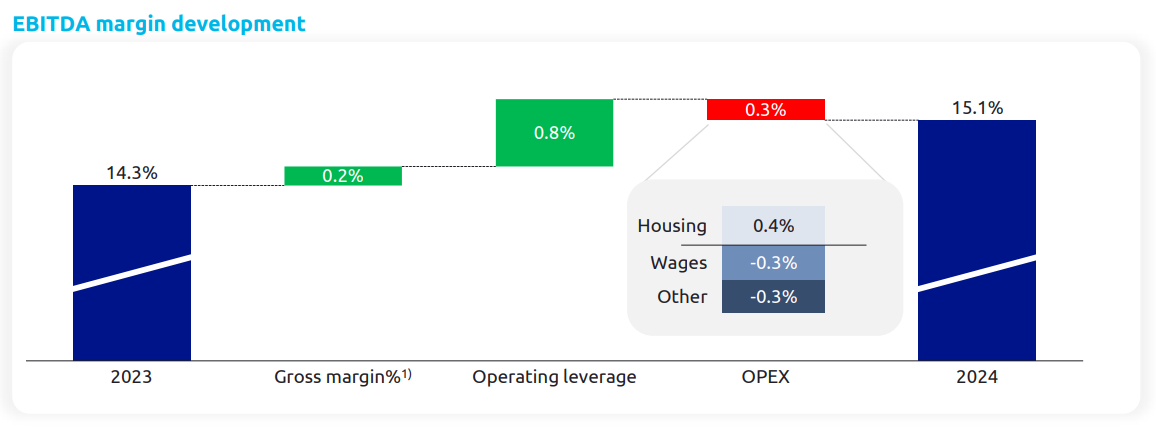

With operational EBITDA growing faster than revenue, Action’s operational EBITDA margin improved from 10.6% in 2019 to 15.1% in 2024. For context, this margin hovered around 9% in the years prior to 2010.

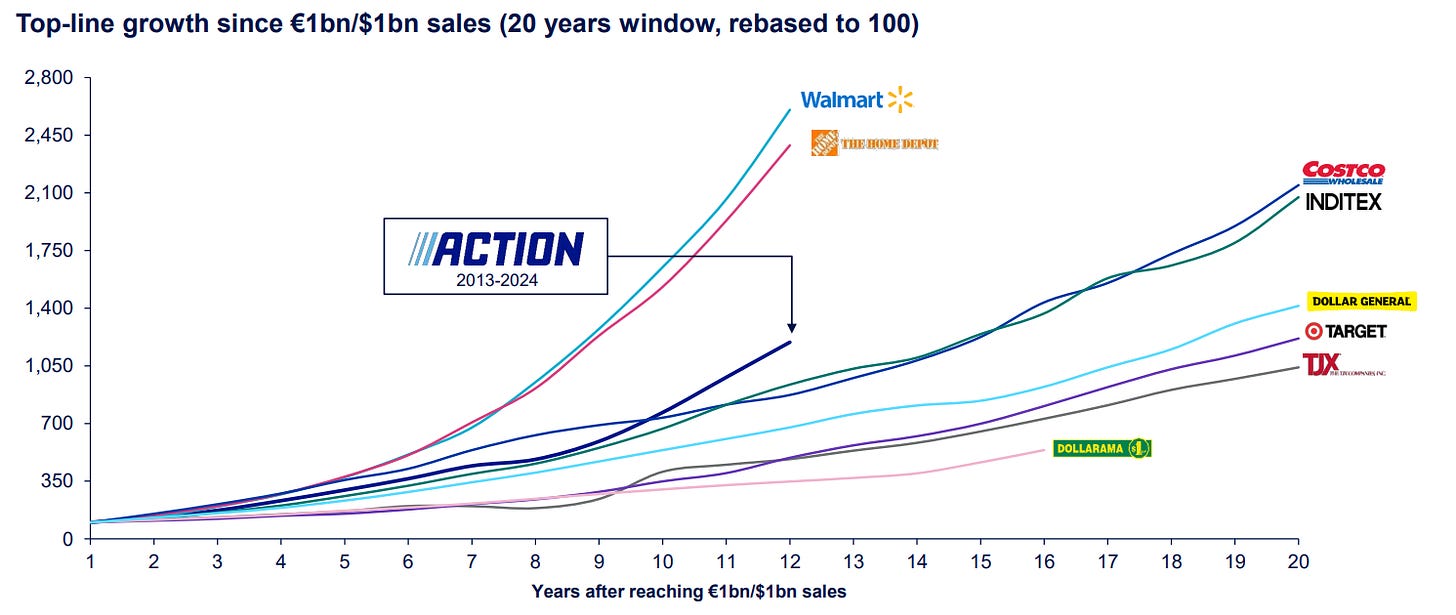

Since the buyout of Action by 3i Group in 2011, revenue has grown at a CAGR of 25.5%, operational EBITDA at 27.8% CAGR, and the number of stores at 20.1% CAGR. These growth rates were significantly lower in the period prior to the acquisition, up to 2011. For instance, store count grew at a CAGR of 13.3% from 2005 to 2011. The involvement of 3i Group has clearly accelerated Action’s growth trajectory.

The figure below illustrates the year-over-year growth from expansion, total revenue growth, and operational EBITDA growth since 2006.

According to 3i Group, Action’s rising profitability is driven by economies of scale from its expansion and a disciplined focus on cost control.

Economies of Scale

As Action expands its store network, it increasingly benefits from economies of scale. The mechanism operates as follows.

Action incurs fixed costs at its headquarters and distribution centers. By spreading these largely fixed overhead costs across a growing number of stores, the proportion of these costs relative to revenue decreases, thereby enhancing the operational profit margin.

Additionally, individual stores also face fixed costs, such as labor, rent, and utilities. As Action’s brand recognition and market penetration increase in a given region, its stores generate higher sales volumes. This boosts the profitability contribution of each store to the group.

For instance, with a stable base of daily customers, an additional customer incurs no incremental fixed costs, allowing the gross profit from their purchases to flow almost entirely to operational profit. In essence, each additional euro of revenue per store is more profitable than the initial euros earned.

Furthermore, expanding its store network enables Action to optimize organizational efficiency and strengthens its negotiating power with suppliers, its buying power, further driving cost efficiencies.

In the calendar year 2024, Action increased its store count by 352, reaching a total of 2,918 stores by December 31, 2024. On June 5, 2025, the company celebrated the opening of its 3,000th store in San Rocco al Porto, Italy (Action, 2025).

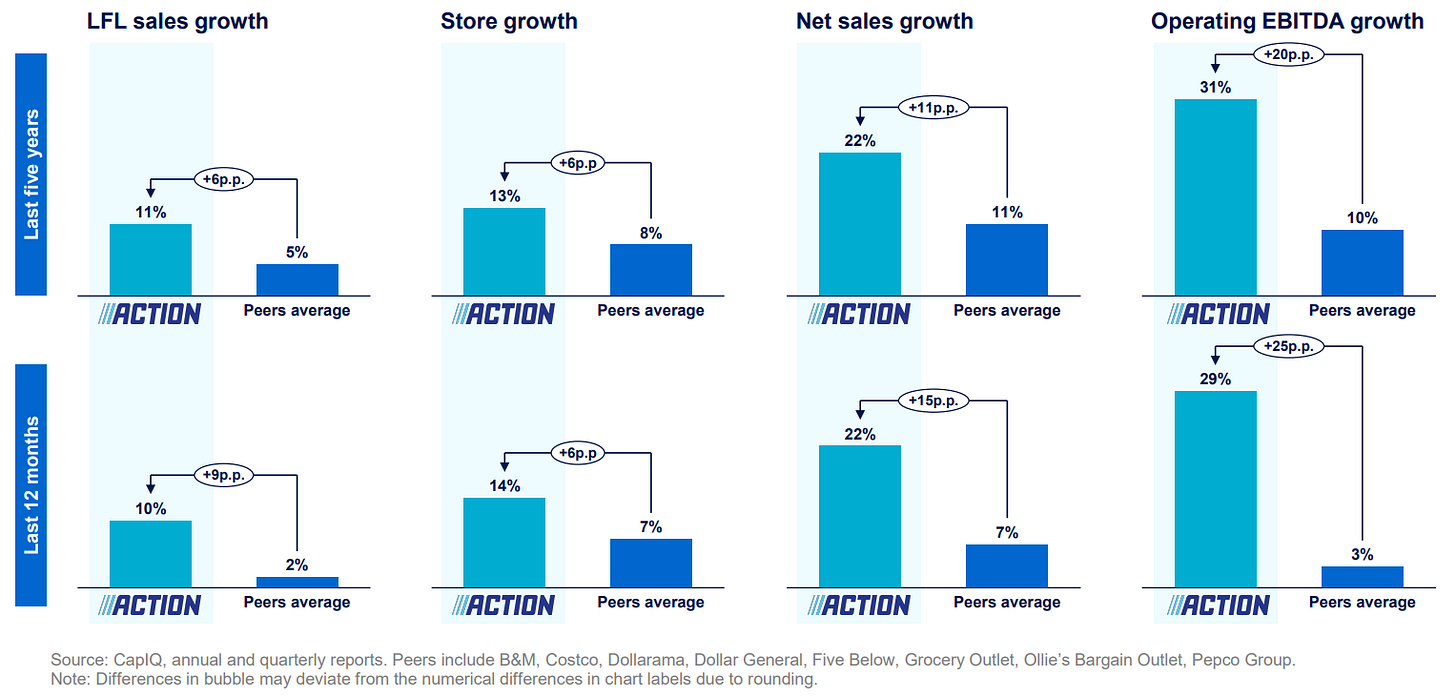

In the above charts, Action compares itself to its peers, including B&M, Costco, Dollarama, Dollar General, Five Below, Grocery Outlet, Ollie’s Bargain Outlet, and Pepco Group. It should be noted that Action is significantly smaller in scale than most of these competitors and remains in a robust expansion phase. Nevertheless, the comparison highlights Action’s growing ‘market share’ within a collective (notional) total market of these retailers.

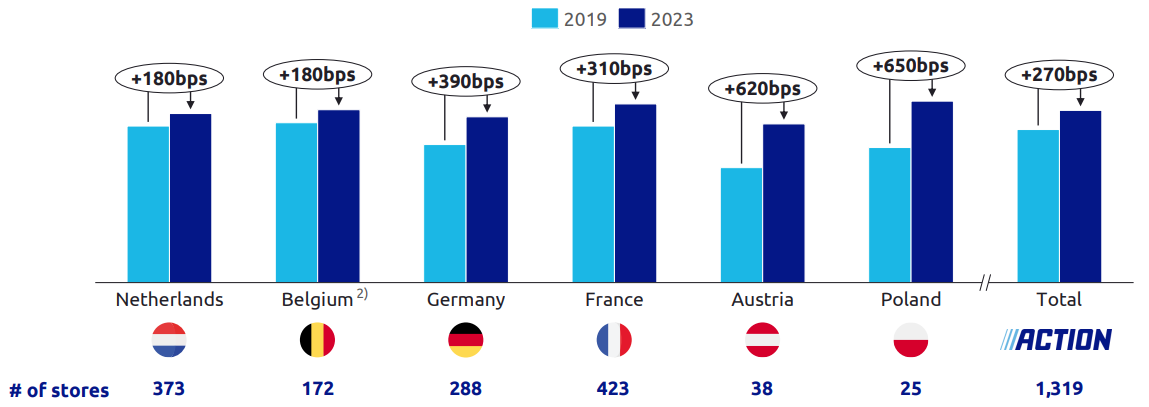

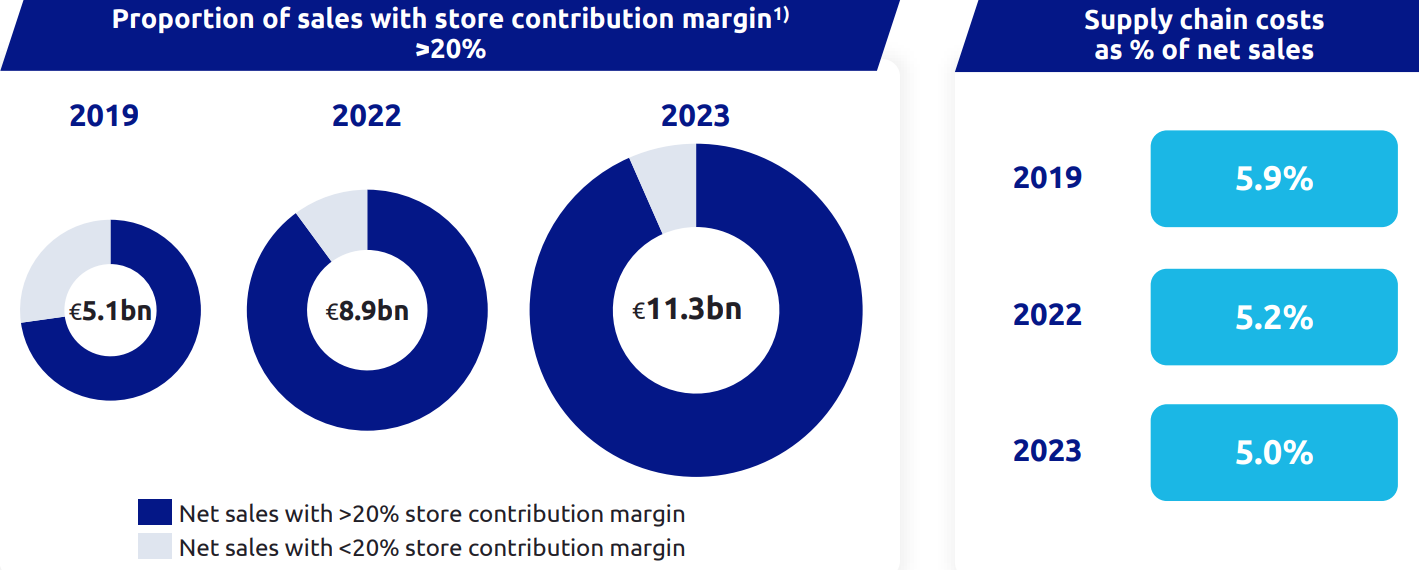

The contribution margin of Action’s stores in countries where it was active prior to 2019 increased significantly over the period from 2019 to 2023.

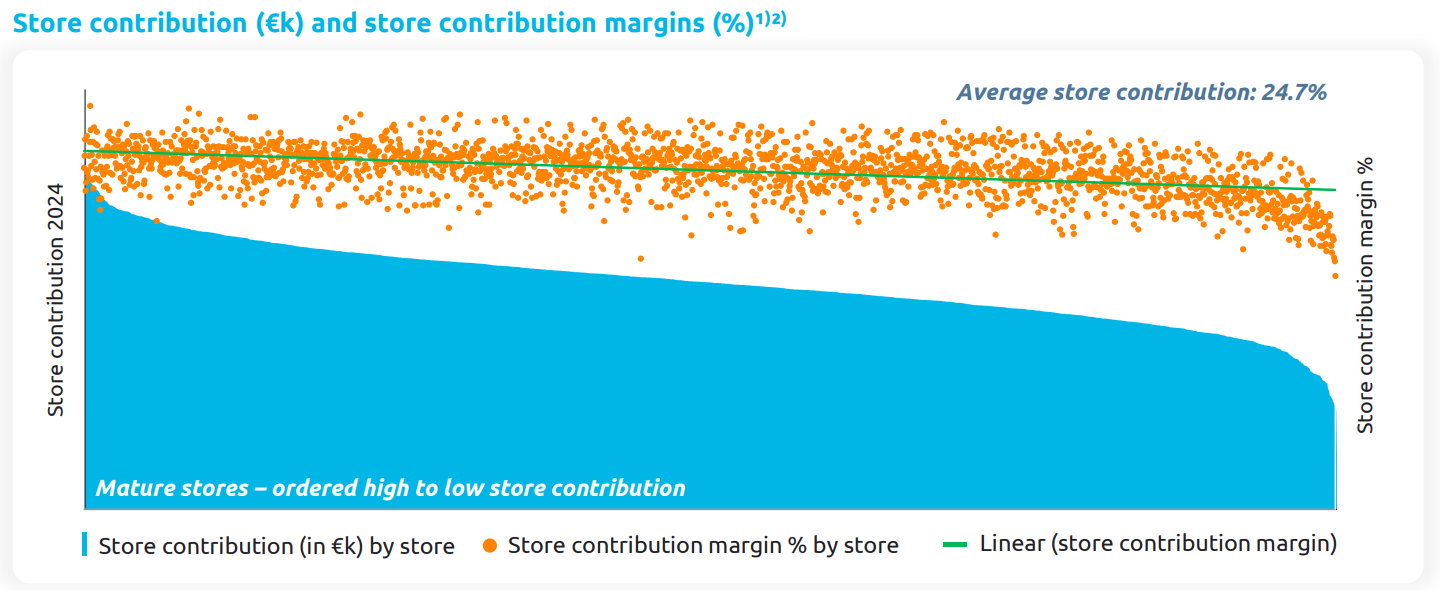

The contribution margin is calculated by deducting direct costs in these countries—such as labor, rent, and other sales and store-related expenses—from gross profit, excluding headquarters and supply chain costs. The average contribution margin of Action’s stores reached 24.7% in 2024 (2023: 24%) as illustrated in the figure below. This indicates a notable improvement in the profitability of Action’s stores over recent years.

The table above includes Action’s mature stores, defined as those open for at least two years at the time of compilation. The blue bars represent the absolute contribution in euros, starting with Action’s most profitable store. The orange dots above indicate the contribution margin, expressed as a percentage of total revenue per store.

As observed, the percentage margin generally increases slightly as the absolute contribution in euros—and thus absolute revenue—rises. Stores with lower revenue typically exhibit a marginally lower contribution margin. However, one fact remains clear: all of Action’s mature stores (open for 2+ years) are profitable.

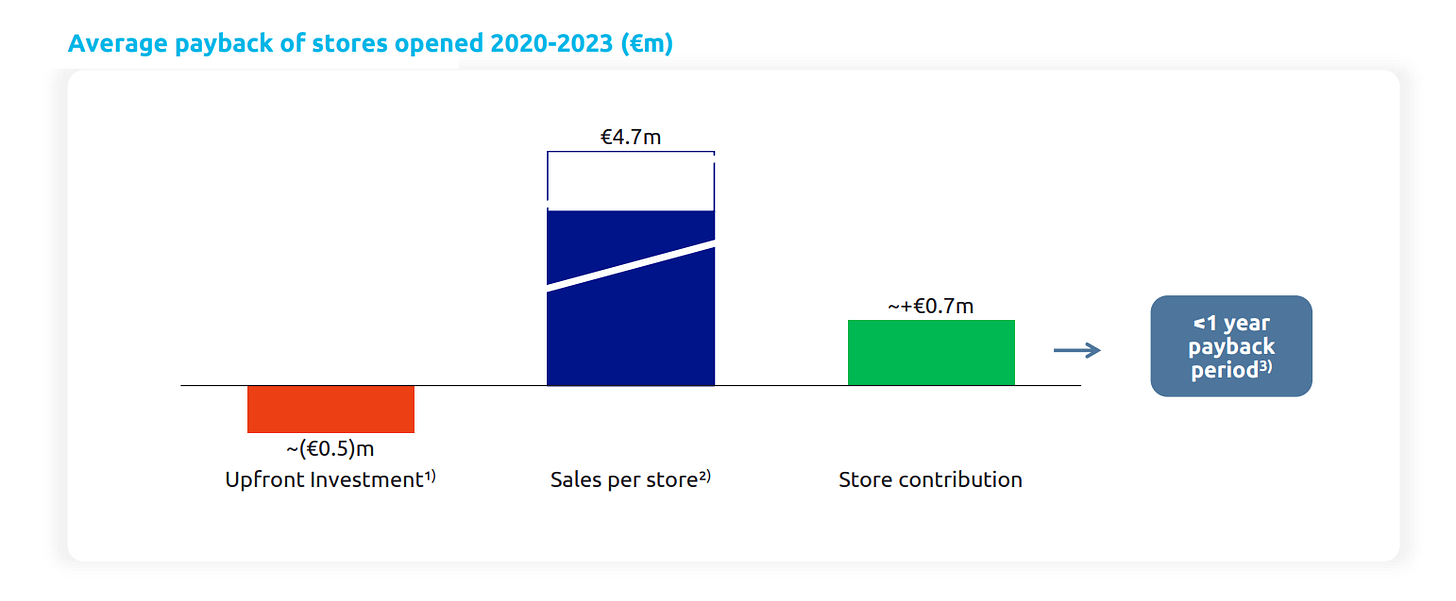

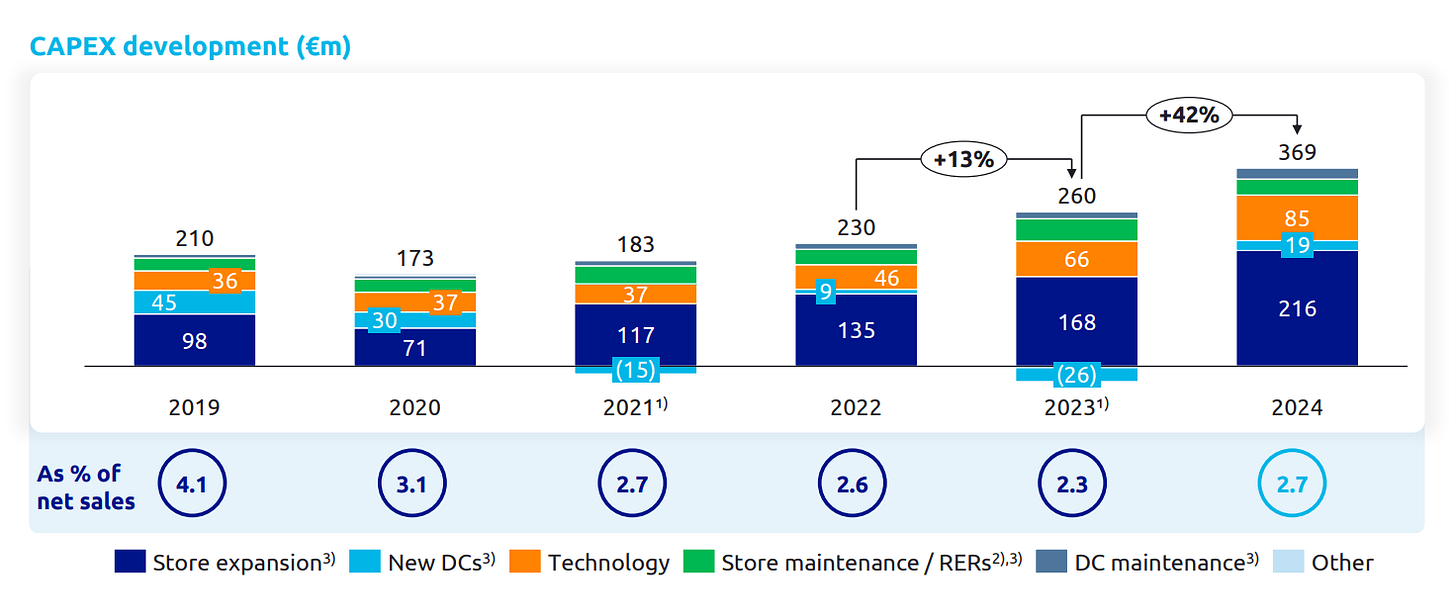

The chart above illustrates the average payback period for newly opened Action stores. The upfront capital expenditure (CAPEX) investment required to open a store has averaged €0.5 million in recent years, with an estimated amount of approximately €614,000 in 2024. Based on the average contribution margin of newly opened stores from 2020 to 2023, of approximately €0.7 million per year, the average payback period is less than one year.

This underscores the compelling nature of Action’s business model: it is highly scalable due to relatively low upfront CAPEX, delivers a high return on investment (ROI), and results in an exceptionally short payback period.

The above refers to the contribution that a new store adds to Action’s overall performance, excluding costs incurred at headquarters and in the supply chain to support these operations. Consequently, the net contribution margin will be lower. Nevertheless, the data demonstrates that Action has established a highly profitable and scalable business model.

The table below shows an increasing number of stores achieving a contribution margin exceeding 20%.

The right-hand side of the figure above displays the supply chain costs as a percentage of revenue. This percentage decreased from 5.9% in 2019 to 5.0% in 2023.

When allocating supply chain costs across all Action stores, the average net contribution margin for the group is 19% (24% -/- 5%). To derive the EBITDA margin for the entire Action group, headquarters-related costs must be deducted.

With an EBITDA margin of 14.3% in 2023, these headquarters costs accounted for approximately 4.7% of Action’s total revenue. In 2024, the EBITDA margin increased to 15.1%.

The figure above includes the 2024 EBITDA bridge. In addition to a 0.2 percentage point gain from a higher gross profit margin, the EBITDA margin improved by 0.5 percentage points year-over-year on an operational basis (net, including increased operating costs).

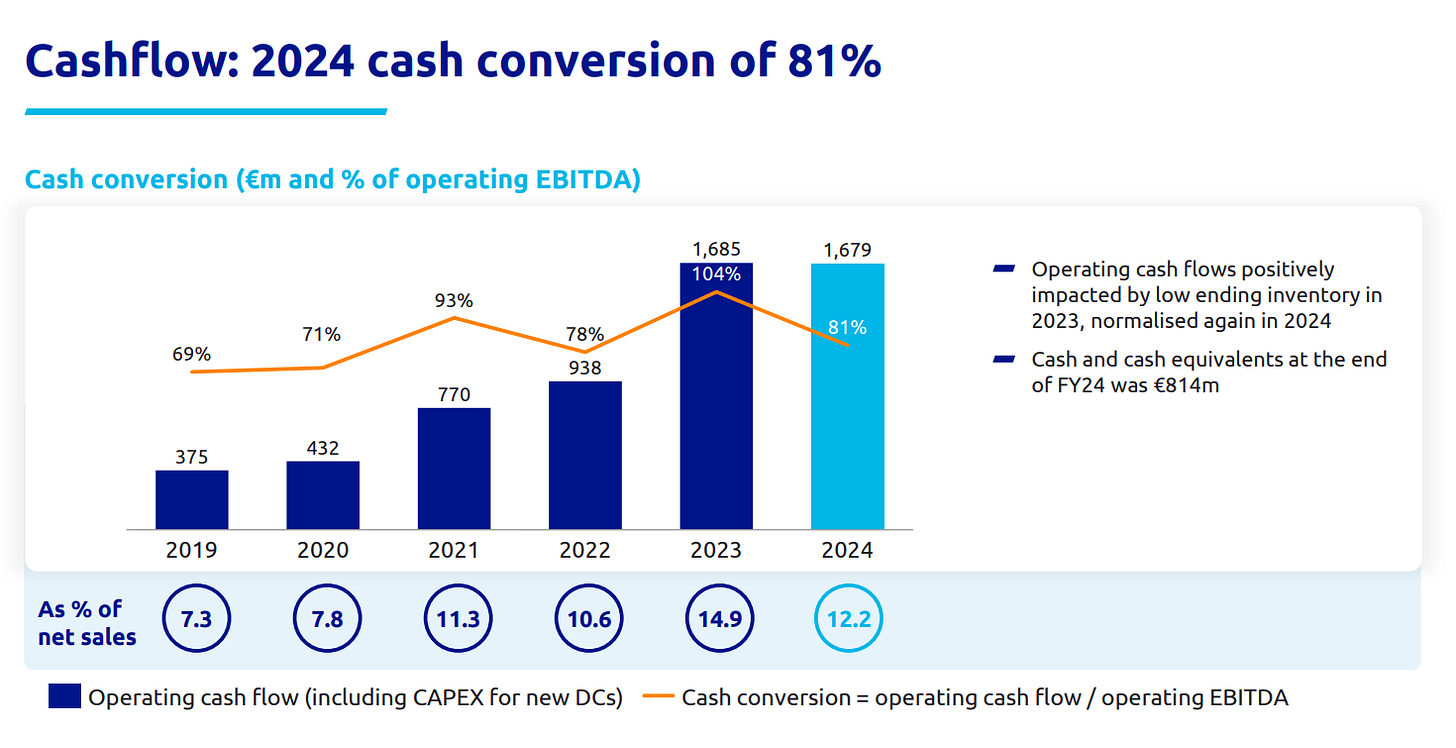

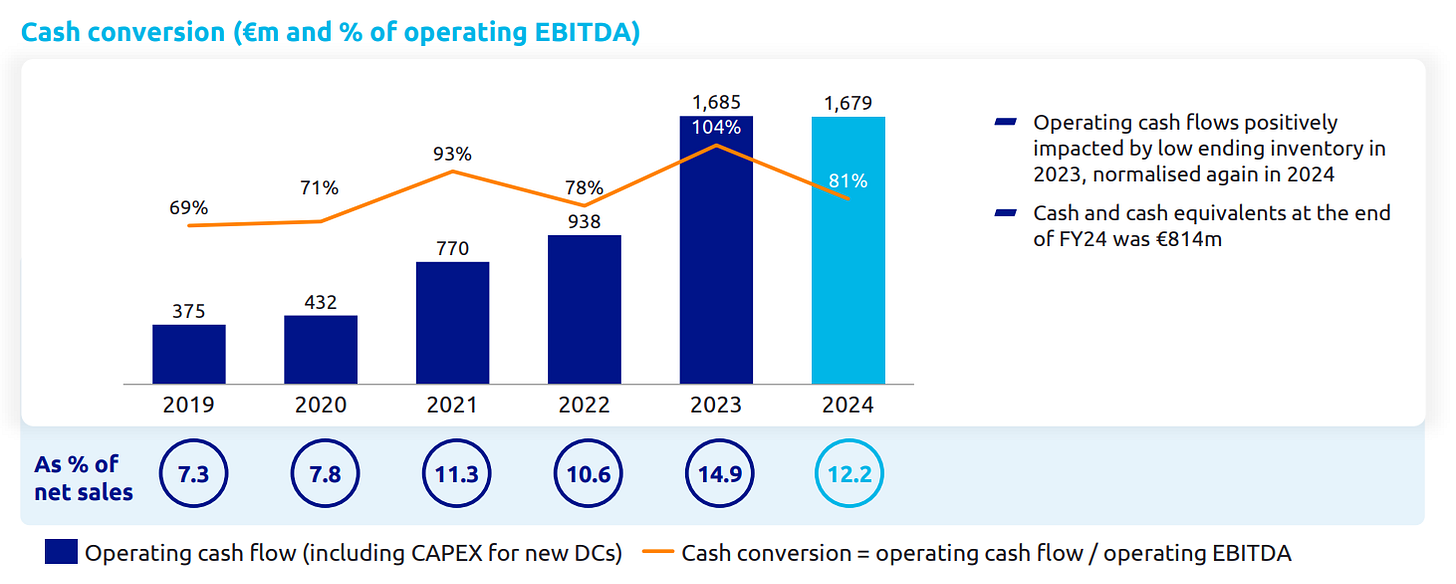

The conversion of operational EBITDA to operating cash flow in 2024 was 81%. This indicates that for every euro of operational EBITDA, Action generated €0.81 in operational cash flow (including CAPEX for new distribution centers). The decline compared to 2023 stems from a normalization of inventory levels, which in 2023 had a low year-end balance that positively contributed to that year’s cash flow conversion.

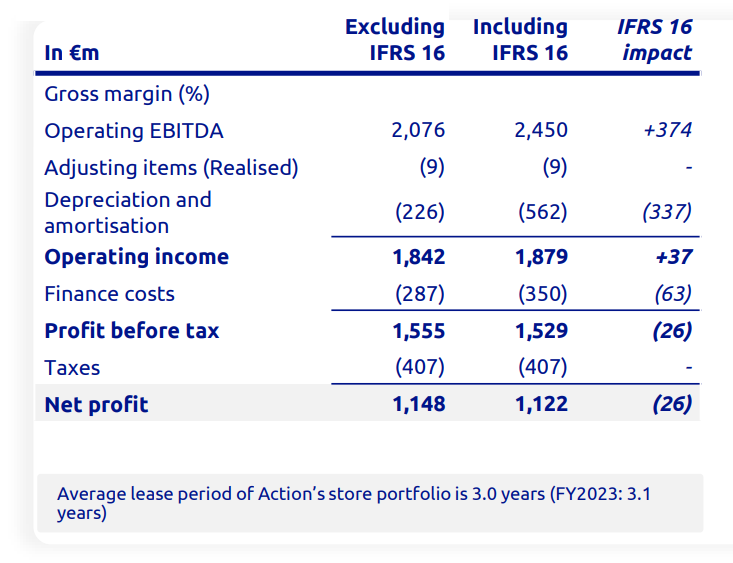

Income Statement

Below is a condensed version of Action’s income statement for the fiscal year 2024, presented starting from operating EBITDA.

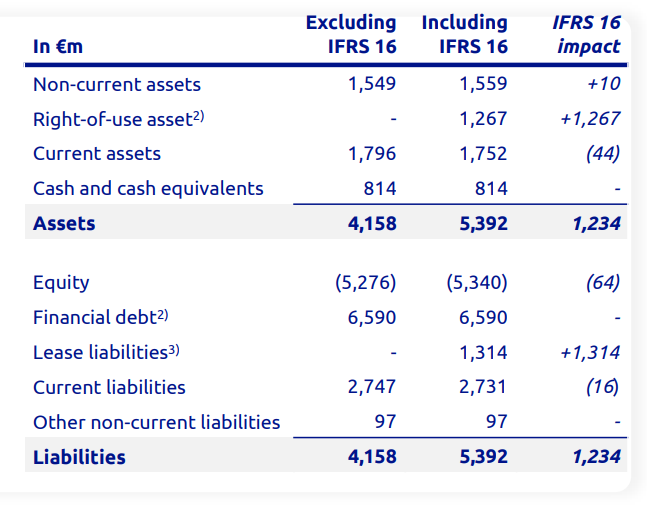

For its stores, Action enters into lease agreements with an average lease term of 3.0 years (2023: 3.1 years). Action reports financials both including and excluding IFRS 16.

IFRS 16

IFRS stands for International Financial Reporting Standard. IFRS 16 specifically addresses leases, requiring the lessee—in this case, Action—to recognize future lease obligations in its financial reporting. This is recorded as a right-of-use asset on the asset side of the balance sheet, representing the future lease benefits, and as lease liabilities on the liability side, reflecting future lease obligations.

In the income statement, under the IFRS 16 perspective, this results in a higher operating EBITDA, as lease-related costs are now classified under depreciation (D) within EBITDA (amortized from the right-of-use asset balance on the balance sheet). Additionally, the interest costs, which form part of the net lease expenses, are recorded under interest (I).

As a shareholder, it is critical to focus on metrics that incorporate the depreciation of leases and interest components in the profit figures. In my analysis, I have used operating EBITDA figures excluding IFRS 16.

Balance Sheet

Below is a simplified representation of Action’s balance sheet as of the end of December 2024.

4.8 | Management & Culture

Action’s management team consists of the following individuals:

Hajir Hajji, CEO (since January 2022);

Joost Sliepenbeek, CFO (since November 2018).

Action has a one-tier governance structure, comprising the 2 executive directors mentioned above and the following 8 non-executive directors:

Simon Borrows (Board Chair Action, 3i Group);

Menno Antal (formerly 3i Group);

Marc van Gelder;

Boris Kawohl (formerly 3i Group);

Sameer Narang;

Ulrich Wolter;

Jasi Hala (3i Group);

Rutger Vos (3i Group).

As CEO of 3i Group, Simon Borrows also serves as the Chair of Action’s Board of Directors. Below is a profile of Hajir Hajji, CEO of Action.

Hajir Hajji (CEO, Action)

Hajir Hajji (44) has been the CEO of Action since 2022, with a long-standing career within the company. She began in 1997 at the age of 17, applying for a position at Action’s 13th store at Waterlandplein in Amsterdam, where she worked as a weekend employee (SER, 2019). Her responsibilities included “stocking shelves, operating the cash register, and assisting customers. It was incredibly hard work,” Hajji noted in an NRC interview (2017). Despite the demands, she found great enjoyment:

I started my career at Action when I was 17 during a gap year in between two studies. As store employee at Action’s 13th store in Amsterdam, I learnt the ropes, quickly got more and more responsibilities, and had so much fun. I grew into new roles and bigger responsibilities quite naturally and rapidly – something that we still cherish at Action, because we look at drive and competencies and offer our colleagues internal promotion opportunities. — Hajir Hajji (LinkedIn, 2025)

In 2011, Hajji took on responsibility for Action’s international retail operations, including the opening of new stores and expansion into new markets. She became Chief Commercial Officer in 2018 before succeeding Sander van der Laan as CEO in 2022. Van der Laan served at Action from 2015 to 2022 as CEO (LinkedIn, 2025).

80,000 Employees

Action’s management oversees more than 80,000 employees representing 151 different nationalities (Action, 2025, 2025). In 2024, Action created 10,641 new jobs, compared to 8,988 in 2023. This reflects Action’s ongoing rapid growth phase. One of the challenges associated with this expansion is maintaining a healthy company culture.